Life, Liberty, Property #57: employment reports for March are another excuse for economic manipulation by the Fed.

IN THIS ISSUE:

- Another Excuse for Economic Manipulation by the Fed

- Royal Flush, Chief Disappointment in KC

- Republicans Rated on Liberty

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Another Excuse for Economic Manipulation by the Fed

Another Excuse for Economic Manipulation by the Fed

U.S. employers added 303,000 jobs in March, the Labor Department reported on Friday. That was significantly above the 200,000 that “economists expected,” as The Wall Street Journal put it.

Unexpectedly high job growth would seem to be good news for a normal person. Economic policy, however, is anything but normal.

The problem is that the Federal Reserve—the nation’s central bank and controller of the money supply—continually struggles to balance money supply growth and unemployment in response to its “dual mandate” from Congress to do that.

The Fed has long labored under the influence of the Phillips Curve, the idea that inflation reduces unemployment and high employment spurs inflation. Both of those claims are wrong, but that does not stop the Fed from assuming that they are right. Long-held illusions are difficult to discard.

As the Fed attempts to fine-tune the economy through the manipulation of interest rates, it spurs excessive spending when it reduces rates to “stimulate” the economy, and it suppresses economic activity when it raises interest rates to “cool down” an “overheated” economy. This is the familiar “boom and bust” cycle endemic in economies with manipulative central banks.

The Fed also affects the economy by directly manipulating the money supply through purchases and sales of securities and paying interest on bank reserves. This process usually has a relatively longer time horizon than the interest rate manipulation. As the Fed’s Board of Governors notes, “Over recent decades … the relationships between various measures of the money supply and variables such as GDP growth and inflation in the United States have been quite unstable. As a result, the importance of the money supply as a guide for the conduct of monetary policy in the United States has diminished over time.”

In short, the Fed looks at the money supply as more of a long-term influence and interest rates as their tool for short-term fine-tuning of the economy. As to when the Fed should stimulate and when it should suppress economic activity, it looks at inflation and unemployment, per its dual mandate.

Unfortunately, measuring inflation and unemployment is more complicated than it initially seems.

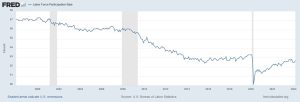

Unemployment, for example, is not a direct measure of “how well the economy is doing,” nor is it a leading indicator—it tends to follow changes in economic growth, not lead them. Measured unemployment can be low while the economy is significantly less productive than it should be, for example, if people choose not to work and voluntarily drop out of the labor force. Those dropouts are not counted in calculating unemployment. We have had a significant drop in labor force participation in recent years, down from its peak in the year 2000:

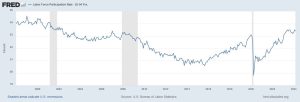

As an examination of the trend for prime-working-age people indicates much of the drop in overall labor force participation is attributable to the aging of the nation’s population:

Having many fewer people working will create a decrease in output unless productivity rises very rapidly, which it has not done. Yet unemployment will stay low—even “stubbornly low,” as avid Fed-watchers often say—despite the decrease in average output per U.S. resident.

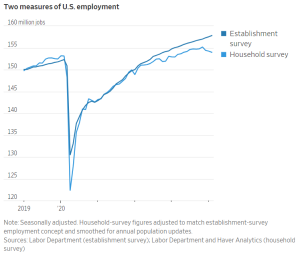

The Wall Street Journal argues that recent immigrants have made up for the shortfall. Noting a widening difference between the amount of employment that businesses report and the amount that households (the workers themselves) report (see graph below), the WSJ suggests that the population number is wrong: “The census estimates the U.S. population rose 0.5% in 2023 from a year earlier. But in January, the Congressional Budget Office estimated it rose by 0.9%. That difference was the result of the CBO’s effort to account for the millions of migrants who crossed the southwest border last year.”

Source: The Wall Street Journal

That is a plausible explanation if the CBO estimate is correct and if those migrants who “crossed the southwest border last year” went to work in U.S. jobs in large numbers. It is possible, but it remains to be proven. The WSJ story acknowledges this:

UBS economist Jonathan Pingle thinks the census immigration estimates are too low. But he also thinks that the CBO’s could be too high and that the establishment survey might be overstating job growth.

Some supporting data, such as remittances from border states, don’t entirely square with the immigration story. It also bothers him that the household employment figures haven’t just shown slowing job growth in recent months, but outright deterioration.

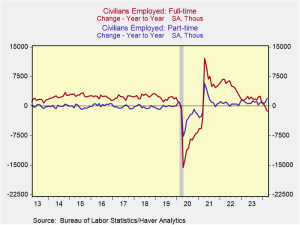

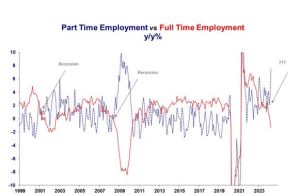

A much more straightforward explanation is available. As First Trust Portfolios economist Strider Elass notes on X, “Part-time job growth over the past year (+1,888,000) has outpaced full-time job growth over the past year (-1,347,000) for the fourth consecutive month.” Elass illustrates the point with a graph:

As Steph Pomboy notes, also on X, the numbers do not indicate an overly strong employment situation: “We’ve lost 1.8 MILLION full time jobs in just the last 4 months. 🤢 That’s (not surprisingly) the biggest such drop since Covid and the Great Recession before it.” Pomboy supplies a graph of the percentage changes in part-time and full-time employment over a longer time span and with two additional recessions for reference purposes:

The Wall Street Journal article on the jobs report discrepancy notes that “research has found that people don’t always accurately report their employment in the household survey: In a strong labor market, for example, retirees might pick up part-time work but not consider themselves ‘employed.’” What appears to be happening, then, is that the number of full-time jobs is decreasing, the number of part-time jobs is increasing, and the people answering the household survey are underreporting their “employed” status for part-time jobs reported in the establishment survey.

Elass and Pomboy both note that this is by no means good news about employment, and by implication that the Fed should not conclude that the economy is as “hot” as anyone could want it to be. Both writers, in fact use the “R” word. “Historically (as can been seen in the charts), a sustained period of such a trend has often signaled an impending recession or indicated that we were already in one,” Elass writes. “As of today we are not in a recession, but [it is] something to keep an eye on.” Pomboy writes, “Nothing about this chart suggests we have a ‘strong’ labor market. Far from it. FT jobs down -1.3% yy…PT jobs up 7.5%y/y.”

Thus, there are widely differing opinions on whether the labor market is truly strong at present. The one thing we can conclude is that the economy is sending conflicting signals, though it looks strong overall at the moment. The employment situation seems clearer: part-time employment is on the rise, full-time employment is down, and overall employment is up. Most reports characterize this mixed performance as “strong” job growth, as exemplified by The Wall Street Journal.

Meanwhile, the word “inflation” seems to be undergoing a change in meaning. As The Wall Street Journal story on the most recent employment report put it, “The Fed is mandated to keep employment as strong as possible while keeping inflation under control.” In point of fact, the Federal Reserve Act of 1977 requires the Fed to “promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates.” Inflation is not “stable prices.” At a 3 percent annual inflation rate—slightly lower than what we have experienced in the past year—prices double every 20 years.

The Fed has been talking about revising its inflation goal upward, presumably to enable it to declare success in stopping inflation. The current 2 percent inflation goal is … inflation. A higher goal would be more inflation.

However, if you remove the large factor of “fictitious Owner’s Equivalent Rent” from the Consumer Price Index, as economist John Rutledge argues we should do, inflation “has been below the Fed’s 2% target for the past three months,” and “It’s time to lower [interest] rates.” I concur with Rutledge’s correction to the inflation number. Whether one agrees that it is time to lower interest rates depends on one’s tolerance for continuous inflation.

The multiple excuses for economic manipulation by the nation’s central bank are very harmful. Money is not a commodity. It is information. The rise and fall of prices relative to one another tells us what people value the most and directs capital and spending to their most desirable uses. Inflation distorts those price signals and thereby inhibits the preferred and most efficient deployment of capital to the things people want most.

Of course, tying the money supply to something real—as has been done successfully many times in the past by implementing a gold standard and sticking to it—would solve all these problems and eliminate both the need and the excuse for the central bank to tinker with the economy. Government control over the currency tempts the central bank to manipulate the nation’s money, which will always be subject to political pressures. In our present case, federal law requires the Fed to manipulate the currency. Blame Congress and the president.

Sources: The Wall Street Journal; The Wall Street Journal; Far from Equilibrium Economics

Royal Flush, Chief Disappointment in KC

Royal Flush, Chief Disappointment in KC

The people of Kansas City, Missouri resoundingly rejected a sales tax extension to subsidize facilities for its Major League Baseball and National Football League teams last week.

More than 58 percent of KC voters rejected the plan in Tuesday’s elections. (I was going to say that KC barbecued the proposal, but I know that some people do not like wordplay, no matter how brilliant.)

The proposal would have extended for an additional 33 years the city’s current 3/8 cent stadium sales tax, which is scheduled to end in seven years. The extended tax was intended to raise about $2 billion over the next 40 years. The Royals had pledged to commit at least $1 billion to the project, and the Chiefs promised to kick in $300 million.

The plan was to fund a new, downtown stadium for the Royals baseball team, surrounded by an entertainment district (the new fad among subsidy seekers), to cost $2 billion, plus extensive renovations to Arrowhead Stadium, where the Chiefs play (at present, haha), at a cost of $800 million. In addition, the proposal was to pay off $200 million in debt for prior upgrades to the two teams’ current stadiums.

Add the inevitable cost overruns to that, and the price could easily run to significantly more than that $3 billion total. On top of all that, further costs for additional infrastructure and personnel would surely arise.

As of last fall, the Chiefs were worth $4.3 billion, according to Forbes, and the Royals were reportedly worth $1.2 billion going into last season.

The Royals’ and Chiefs’ leases both run out in 2031. The two teams had made it clear they would not stay in their current homes as-is. “Prior to the decisive vote, the Chiefs and Royals openly said that they would ‘explore all options for where we will play come 2031,’ when the teams’ current stadium leases expire, should a ‘No’ vote prevail. Chiefs president Mark Donovan then doubled down on that notion,” Front Office Sports reported.

The Royals’ owner and Chiefs’ president both expressed disappointment after the vote and said they will consider their options and do what is best for both their fans and their team organizations. That means they will do what is best for themselves. That is exactly what they should do, and it is what the Kansas City voters did.

On that same day, the Washington, D.C. Council approved a deal between Mayor Murial Bowser and Wizards (NBA) and Capitals (NHL) owner Ted Leonsis to spend $515 million in taxpayer money on improvements to Capital One Arena, where the two teams play. Meanwhile, The Washington Post recently asked, “Can anything stop the D.C. crime wave?” noting that the number of officers in the D.C. police force is at its lowest point in half a century.

Conclusion: many Kansas City residents may have literally dodged a bullet thanks to last week’s vote.

Sources: AP; Front Office Sports; DC News Now

Republicans Rated on Liberty

Republicans Rated on Liberty

The Republican Liberty Caucus has published its 2023 scorecard for the U.S. Senate, rating senators on their commitment to individual freedom, as measured by “20 pivotal bills/votes from 2023 that either advance liberty or diminish liberty,” the group reports.

The overall winner was Sen. Rand Paul of Kentucky, who had a perfect score of 100, voting with the RLC every time.

That is no surprise, given that Paul has consistently been the best man in the U.S. Senate, by far. Paul introduced at least four of the items used in the scorecard. All of that sets him as a model for the promotion of liberty.

Other “Top Defenders of Liberty” in the upper chamber were Mike Braun of Indiana, who scored a 95, and Mike Lee of Utah, who earned a 90. Interestingly, J. D. Vance of Ohio came in fourth at 85. Kudos to all of them.

Braun is running for the Republican nomination for governor of Indiana. Based on his liberty score, it seems likely that he would be a significant improvement over the two most recent Hoosier governors, both Republicans: Mike Pence and Eric Holcomb. Those two both talked very conservatively but folded on the biggest issues of their tenures: Medicaid expansion for Pence, and lockdowns for Holcomb.

(If you place a higher value on Indiana’s Religious Freedom Restoration Act, which Pence signed in 2015, note that he signed legislation a couple weeks later watering down the law. When the business community and social activists applied pressure, Pence folded immediately.)

Vance, a former venture capitalist and the author of Hillbilly Elegy, has been known as something of a bleeding-heart conservative, unusually attentive to the plight of blue-collar Americans. It is interesting and instructive to see Vance score so high on the liberty scale, as it demonstrates that concerns for freedom and for the welfare of the less fortunate are by no means mutually exclusive.

Not that the press would ever acknowledge that.

On the opposite end of the scale, the lowest-scoring Republican was Mitt Romney (UT), with a meager 20. Just above Romney, at 25, were Susan Collins (ME), Mitch McConnell (KY), Mike Rounds (SD), Tim Scott (SC), and Thom Tillis (NC). Scott had a moment in the sun as an aspirant for the Republican presidential nomination last fall. Apparently, some Republicans were feeling nostalgic for Romney 2012.

The report is full of useful information and is well worth reading.

Source: Republican Liberty Caucus

Cartoon

via Comically Incorrect

For more great content from Budget & Tax News. For more Rights, Justice, and Culture News.

For more from The Heartland Institute.