Robert Genetski: Disappointing inflation news, rise in interest rates, stocks decline this week, and Fed will likely keep buying $95 billion a month in securities.

by Robert Genetski

The Week That Was

Today’s report on March consumer spending and incomes rose at a 6 percent annual rate. Inflation measures for the month increased at a 3.6 percent rate. Hence, even the Fed’s favorite inflation measure shows inflation well above the Fed’s target.

S&P’s advance business survey for early April shows overall business activity continuing to expand, but moderating from prior months. Similarly, the April Homebuilders’ Index remained positive at 51, barely above breakeven

March new orders for durable goods were up a sharp 2.6 percent. In spite of this gain, the overall trend in new orders remains flat to down in current dollars and down after inflation.

Things to Come

On Wednesday, Chairman Powell will announce the Fed’s decision to keep the Fed’s target interest rate unchanged. The Fed had talked about possibly reducing their monthly sales of securities. However, after their faux pas in signaling three interest rate cuts, we doubt Fed members will provide another signal of easing. Look for the Fed to continue selling $95 billion a month in securities.

On Wednesday and Friday, April business surveys for manufacturing and service companies are expected to show the economy continued to expand at the beginning of the second quarter. As a guide for what to expect, S&P’’s mid-month survey also showed the growth, which was moderating.. We’re looking for the same for the month.

Weekly unemployment data show labor markets remain tight. Both unemployment claims and unemployment payments remain unchanged at low levels.

Friday’s BLS employment report is likely to show some slight moderation in job growth. We are closely watching the ADP employment report (due next Wednesday) to see if the slowdown from their previous reports has continued.

Market Forces

After falling sharply last Friday, the major stock indexes clawed their way back to eke out a slight gain of less than 1 percent.

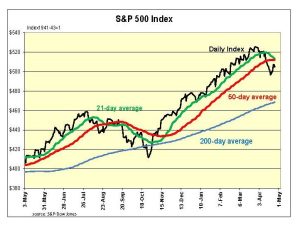

Despite this recovery, technical indicators turned negative. The Nasdaq, Dow and QQQ are the weakest. Each has their 21-day average moving below the 50-day averages. When this happens, the odds favor further declines.

So far, the market correction for the S&P has been a modest 4 percent decline from its peak. As the chart above shows, the S&P500’s 21-day average is on the verge of moving below its 50-day average. Without an explosive upturn today, it will join the other key indexes with a negative rating.

So far, the market correction for the S&P has been a modest 4 percent decline from its peak. As the chart above shows, the S&P500’s 21-day average is on the verge of moving below its 50-day average. Without an explosive upturn today, it will join the other key indexes with a negative rating.

Disappointing inflation news and the accompanying rise in interest rates are the main reason for the decline in stocks. The Fed’s favorite (and often most favorable) inflation rate reported this morning was up at a 4 percent annual rate for the past three months.

As shown above, concerns over persistent inflation pushed interest ratees to the highest levels since November. With higher interest rates, it might appear that the modest 4 percent decline in the S&P500 is a sign of a strong market.

As shown above, concerns over persistent inflation pushed interest ratees to the highest levels since November. With higher interest rates, it might appear that the modest 4 percent decline in the S&P500 is a sign of a strong market.

Unfortunately, technical indicators point to the opposite. Three weeks ago, the S&P500 broke key technical support for the first time in six months. Two weeks ago, it broke its 50-day moving average. It is now threatening a third breech, with the 21-day likely moving below the 50-day for the first time since August, 2023. While technical indicators aren’t foolproof, the odds of further weakness in stock prices increase with each new move.

Outlook

Economic Fundamentals: slightly negative

Stock Valuation: S&P 500 overvalued by 25 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.