This week’s inflation numbers showed the CPI up, even excluding food and energy, spooking the bond market as stocks held their gains.

by Robert Genetski

The Week That Was

As we indicated in last week’s report, the March CPI rose faster than expected. Monthly inflation was reported at a 4 percent to 5 percent annual rate for both the total and core (ex-food and energy). This brought the yearly inflation to the 3½ percent to 4 percent vicinity.

Although headlines praised March wholesale inflation as below expectations, the recent uptick remains real. After declining to 1 percent – 2 percent, producer prices rose 3½ percent to 4 percent in the first three months of 2024.

Things to Come

Monday’s March retail sales report will provide the most recent view of consumer spending. We expect overall retail sales to remain weak as consumers find their personal battle with inflation more challenging. Although still at a moderate historical level, the Fed reports the highest rates of credit card delinquency rates since 2013.

Retail sales data show only a slight gain over the year, with a downtrend for the three months ending in February. Expect the overall weakness in retail to continue as consumers struggle with credit card debt.

March retail sales will get an illusory boost from soaring oil and gasoline prices, and will face downward pressure from a weakness in auto sales. Vehicle sales were reported down at a 15 percent annual rate in March and were down at an 9 percent annual rate in the first quarter.

Also on Monday, Homebuilders release their April Index for new home activity. Their Index is the most current and most reliable measure of new home activity.

We were surprised when the March Index moved to 51 (slightly above breakeven). Driving the Index higher was builder confidence that mortgage rates would be coming down and attracting new buyers. We expect the recent surge in interest rates might send the April Index below 50.

There is no other significant report scheduled for the coming week.

Market Forces

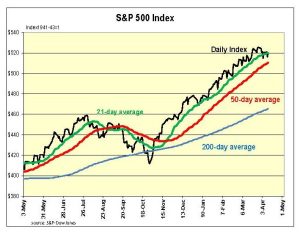

Stocks were mixed this past week. The Nasdaq registered a 2 percent gain returning to its all-time high while the S&P500 rose 1 percent. Small cap ETFs and the Dow had slight losses.

Technical indicators are mixed. The Nasdaq remains in the strongest position of all indexes while the S&P500 is indecisive at its 21-day moving average. The Dow is technically the weakest index, after falling below its 50-day moving average.

Technical indicators are mixed. The Nasdaq remains in the strongest position of all indexes while the S&P500 is indecisive at its 21-day moving average. The Dow is technically the weakest index, after falling below its 50-day moving average.

Economic news was not good. Inflation remained well above the Fed’s target sending longer-term interest rates sharply higher. Moody’s AAA corporate bond rate is at 5.3 percent, the highest in five months. Higher bond rates tend to reduce the value of stocks.

Financial markets reacted to the news by shifting their expectations of a first interest rate cut to July or September and a second cut in December. As with Fed projections, these changes are highly sensitive and subject to the latest news cycle.

One positive is how the stock market performed. When stocks hold onto gains despite setbacks it indicates most investors remain positive.

For a variety of reasons, it has taken longer than normal for the impact of the Fed’s policy to slow spending. However, the longer interest rate curves remain inverted, the more monetary restraint increases financial stress for businesses and consumers.

Outlook

Economic Fundamentals: slightly negative

Stock Valuation: S&P 500 overvalued by 29 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.