Robert Genetski: Today’s jobs report shows job gains in April as the Federal Reserve says it will cut its sales of securities in half.

by Robert Genetski

The Week That Was

Today’s jobs report continues to show a strong labor market with 175,000 payroll jobs added in April and the unemployment rate down at a low 3.9 percent.

The Fed decided to follow through on its plan to reduce its securities sales. Beginning in June the Fed plans to sell $40 billion in securities each month instead of $95 billion.

One reporter asked Powell about the inconsistency of the Fed selling securities and applying restraint while claiming short-term interest rates were at the appropriate level for current monetary conditions. Powell hesitated, then fumbled around before saying the Fed didn’t feel selling securities was restrictive. Rather, it was just a balance sheet issue. He concluded that people should look to the fed funds rate as the key to restraint.

Powell knows better, which is why he fumbled over the answer. Selling securities drives down their prices, which raises interest rates. Whether the Fed feels selling securities is restrictive is irrelevant. Economics depends on markets, not on feelings.

Despite Powell’s comments, it is encouraging that the Fed is moving toward a position of no longer selling securities. The sooner they stop, the better off the economy will be. An even more encouraging step would be to allow markets to dictate short-term interest rates. Doing so would help to determine if short-term interest rates should be higher or lower than the Fed’s current target.

April business surveys show the economy continues to grow, albeit at a slightly slower pace than March. Inflation remains a problem.

Things to Come

There are no significant economic reports scheduled for the week ahead.

Market Forces

Stocks moved slightly higher this past week with gains ranging from ½ percent to 1½ percent. They continued to slowly claw back gains following losses in early April.

Stockholders appeared to get a slight lift from Chairman Powell’s upbeat press conference. In addition to his reassurance that interest rates would not be going up, he said the Fed would be reducing their monthly security sales in June.

Despite the latest upward trend, technical stock market indicators turned negative. As with the S&P500, all major indexes have had their 21-day averages move below their 50-day averages. In addition, S&P500 trading volume was higher on down days and lower on days with gains. This is the opposite of what happens in a healthy market.

Despite the latest upward trend, technical stock market indicators turned negative. As with the S&P500, all major indexes have had their 21-day averages move below their 50-day averages. In addition, S&P500 trading volume was higher on down days and lower on days with gains. This is the opposite of what happens in a healthy market.

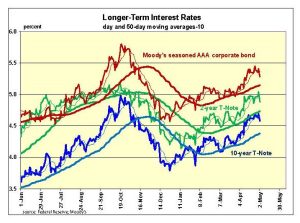

The good news this past week came in the form of a downward move in longer-term interest rates. Chairman Powell said he was confident inflation was on a downtrend. The market responded by sending interest rates back down.

With the S&P500 25 percent above our estimate of fundamental value and with technical indicators turning negative, stocks remain vulnerable.

With the S&P500 25 percent above our estimate of fundamental value and with technical indicators turning negative, stocks remain vulnerable.

Most of the stock indexes currently face resistance at their 21-day moving averages. If markets can move break through this resistance level and interest rates continue to fall, stocks could still considerably higher.

Market psychology can be a powerful force. Extreme bullishness in the dot-com boom of 2000 sent the S&P500 to twice its fundamental value. If this were to happened again, the S&P500 would gain another 30 percent from its current level. This potential is why we never want to be completely out of stocks.

Outlook

Economic Fundamentals: negative

Stock Valuation: S&P 500 overvalued by 25 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.