Life, Liberty, Property #64: employment up, unemployment up, too, as more migrants are employed and economic growth slows.

by S.T. Karnick

IN THIS ISSUE:

- Employment Up, Unemployment Up Too

- Doing Violence to Statistics

- Is China Running Out of Dollars?

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Employment Up, Unemployment Up Too

Employment Up, Unemployment Up Too

Friday’s economic reports provided mostly positive news: job growth up, average hourly earnings up, but unemployment was also up, though only slightly.

“Total nonfarm U.S. jobs increased a seasonally adjusted 272,000 jobs in May, the Labor Department reported on Friday, more than in April and well above the 190,000 that economists had expected,” The Wall Street Journal reported. “Average hourly earnings also topped forecasts, rising 4.1% from a year earlier.”

On the news of greater-than-expected employment growth, we can anticipate that the Federal Reserve (Fed) will keep holding off interest rate cuts. “Interest-rate futures showed Friday morning that investors now see a greater than 40% chance that the Federal Reserve will hold rates steady past its September meeting, according to CME Group data. That was up from 31% Thursday,” the WSJ reported.

The reported employment increase was higher than expected and contradicted recent signs the economy has been weakening:

Friday’s release comes after several recent reports have hinted at some unexpected weakness in the economy. Recent data on retail sales, overall consumer spending, construction and industrial production have all come in below economists’ expectations. Demand for workers has also appeared to be ebbing. There has been a modest uptick in the number of people applying for unemployment benefits after losing a job. Listed job openings have declined faster than economists had anticipated.

That boosted expectations of further economic growth:

Most economists have remained optimistic about the near-term outlook, believing the economy is normalizing after a surprisingly hot stretch last year, rather than deteriorating in a more concerning fashion. Any anxieties on Wall Street that the economy might be cooling too fast were also mitigated earlier this week with the release of a stronger-than-expected report on the U.S. services sector.

When employment and unemployment both rise, it means more people are in the workforce and looking for jobs. That is usually good news for working Americans. Unfortunately, as “Tyler Durden” argues at ZeroHedge, the new jobs appear to be going entirely to unlawfully resident aliens: “‘strong employment growth’ for American citizens always was and remains a fabulation, and the only job growth in the US is for illegals, who will work for below minimum wage, which also explains why inflation hasn’t spiked in the past year as millions of illegals were hired.”

This means conditions for American workers may not be nearly as good as the employment and wage numbers suggest, Durden writes:

Taking a closer look, such increased labor supply—from illegals, with or without employment authorization documents (EADs)—should put downward pressure on wage growth relative to a baseline with less immigration (documented or not). In measures such as average hourly earnings, the disinflationary impact would be two-fold:

-

-

- lower wages overall from an increase of labour supply relative to labour demand and

- a composition effect because the undocumented immigrants often work in low wage industries even with EADs.

-

However, this is likely to be a gradual process, so the low wage impact may not be immediately visible. In addition, insofar as these workers’ wages reflect relatively low productivity, the composition effect on wages will be offset by a composition effect on productivity—unit labour cost growth may be unchanged.

Thus, employment conditions for people legally residing in the United States are stagnant at best, according to Durden. My conclusion from Durden’s analysis is that the Fed should take the current employment numbers as a further indication that economic growth is slowing and the central bank should lower interest rates.

The Fed, however, is expected not to lower interest rates at its meeting this week, in fear of sparking another bout of price inflation. In March, the Fed’s governors stated they expected to cut rates three times this year. That has looked increasingly unlikely in the months since. The current reports will not change the Fed’s “wait and see” stance, given the governors’ current assumptions about employment numbers.

The markets have already priced in those expected interest rate cuts, however, suggesting that a correction is in order. Economist Robert Genetski calculates that the S&P 500 is currently overvalued by 34 percent. If investors decide that the market is near its peak and start selling to take their profits before values fall, the market could drop significantly. It has not done so thus far, of course, as many trillions of dollars flowed into the economy through government action since the 2020 pandemic.

“The economy’s charge through higher interest rates is putting unprecedented sums into consumers’ pockets, pushing U.S. asset values to records and helping many high earners avoid the withering effects of inflation,” The Wall Street Journal reports.

This is the result of artificial economic stimulation by the federal government, as I noted above. The Journal reports,

Washington has pumped out trillions of dollars in recent years for pandemic relief, clean-energy projects and more, selling Treasurys to finance soaring budget deficits. The snowballing debt, coupled with the highest rates in more than two decades, pushed government interest expenses to a seasonally adjusted annual rate of nearly $1.1 trillion, according to first-quarter figures from the Commerce Department.

That is income for cash-rich companies or Americans who park savings in money-market funds, where 5% annual returns can turn into a surprise five figures.

Here’s what the recent surge in federal debt looks like:

The markets’ optimism is based on those “unprecedented sums” in people’s wallets and a belief the U.S. economy is about to enjoy a significant expansion because of a recent technological change, the Journal observes:

Many investors expected higher rates to weigh down companies’ share prices by eroding the present value Wall Street assigns to future corporate profits.

Instead, hype around artificial intelligence has helped push major stock indexes near records by boosting shares in tech companies, chip makers and even utilities. While the S&P 500 has ticked slightly lower over the past week, Wall Street is still betting on rate cuts this year that could propel the next leg higher.

Investors are betting that the economy is fundamentally sound, as it proved to be when the Dow fell by nearly 23 percent in October 1987 and President Ronald Reagan said that there was no need for government intervention. Reagan was right, and the markets soon stabilized while the U.S. economy continued through its nearly four decades of growth since the 1982 recession.

If the expectation of upcoming massive increases in the production of valuable goods and services via AI is correct, the stock markets are not overvalued. In the long term, that is probably true.

The markets, however, are currently still absorbing the enormous inflows of money from the federal government, which have yet to recede fully. While “the near-term outlook for stocks is mildly positive,” as Genetski notes, the government’s stimulus injection and Fed’s interest rate hikes may be waning. Regarding the latter, the Journal reports,

Andy Constan, chief executive of the investment consulting firm Damped Spring Advisors, said the higher government-bond payouts [since the Fed increased interest rates] likely boosted Americans’ overall spending. But with the Fed signaling additional rate hikes are unlikely, the growth in that income is expected to slow sharply.

Meanwhile, higher borrowing costs are hitting more small businesses that need loans, prospective home buyers who seek mortgages and lower-income Americans who pile up credit-card debt.

“At this stage, it’s much farther tilted to higher interest rates hurting the economy,” Constan said.

The question for investors is psychological at this point, Genetski says. It comes down to when investors will think it wise to take their profits and move their money to undervalued items—to the extent that such things exist today. The question for the American people is much simpler: Is the U.S. economy fundamentally sound?

Looking at the record federal debt and regulation, it is hard to believe that’s the case.

Sources: The Wall Street Journal; ZeroHedge; The Wall Street Journal

Doing Violence to Statistics

Doing Violence to Statistics

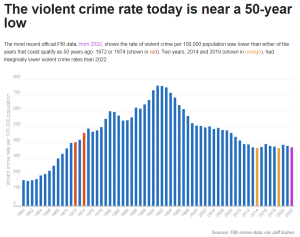

President Joe Biden recently said, “violent crime is near a record 50-year low,” speaking on May 15 at a memorial service for police officers killed in the line of duty. The supposed fact checkers at PolitiFact stated that Biden was correct, as did others in the captive media.

“We checked the FBI data and found that he’s on target,” PolitiFact concluded.

Biden and his media remoras are wrong, the Crime Prevention Research Center (CPRC) states.

The CPRC sent an email to Louis Jacobson, author of the PolitiFact piece, stating that “the most recent National Crime Victimization Survey (NCVS) data shows a 43 percent increase from the rate in 2020. So, how exactly is the current rate near a 50-year low?” The email noted that “comparing [the current rate] to only the crime rate 50 years ago doesn’t exactly justify Biden’s claim.”

The PolitiFact piece relies mainly on “a set of FBI crime data assembled by Jeff Asher, an analyst for AH Datalytics,” which was customized to eliminate the FBI’s 2013 redefinition of rape. The PolitiFact item does not mention whether Asher corrected for measurement disparities that would tend to push up the numbers after 2020, such as underreporting of crimes. I’m guessing that’s a no. “By the way, there were similar changes in the NCVS measure of property crime,” the CPRC item notes.

The CPRC email, quoted in their published factcheck, argues the NCVS data does not show a drop in crime under Biden:

The NCVS estimate of the violent crime rates in 2020 and 2021 were 16.4 and 16.5 respectively. The rate in 2022 was 23.5, thus 43.3% and 42.4% higher than the rates in those years. It seems to me that is a much higher rate in 2022 than the low rates immediately before it. There are also very low rates around 2008 and 2009. Even if you compare the average pre-COVID rate for the five years from 2015 to 2019, the rate in 2022 was still 14% higher, which also seems substantial and helps give a reason why people think violent crime has increased.

Correct, and we don’t even have to go to the NCVS’s un-“corrected” data to show that Biden is wrong. The graph PolitiFact crafted from Asher’s data shows that the U.S. violent crime rate has been “near a 50-year low” for the past dozen years (assuming that it has not risen since 2022):

The crime rate trended steadily downward for two decades after 1992, and it has been generally stable since 2012. It’s still nowhere near what it was in 1962 and the decades before that. Biden has not improved anything, and he has certainly not approached a 50-year record low in the violent crime rate in any meaningful sense of those words.

Biden and the media are trying to gaslight the public on crime just as they have done regarding the economy, inflation, the border, Ukraine, the nation’s justice system, and everything else they have driven into a ditch full of alligators in three-and-a-half dismal years.

Source: Crime Prevention Research Center

Is China Running Out of Dollars?

Is China Running Out of Dollars?

For decades, politicians and analysts of all stripes have been declaring that other countries are about to “eat our lunch” by stealing good-paying jobs from the United States. It is true that low-wage countries have a competitive advantage in luring low-wage industries. It is also true that low-productivity people lose out when those jobs leave the country for cheaper pastures.

My belief is that U.S. government policies other than free trade are the real cause of the great majority of the outflow of manufacturing jobs in particular. Overregulation is an obvious factor, especially as tight environmental standards and NIMBY policies raise costs for these businesses far beyond those of their competitors in other nations.

Some or all of those policies may be justified as increasing the common good by forcing businesses to pay for negative externalities their activities produce. In writing laws and regulations, however, those negative effects should be balanced by acknowledgment of the positive externalities those businesses create, employment of lower-skilled Americans being just one of many such benefits. That has not been governments’ custom since the mid-1960s in the United States. This has benefited property owners of all types and harmed workers, renters, and others with less wealth.

Imagine that: government advancing the interests of the wealthy.

Meanwhile, all those countries that enviously eye our national lunch pail consistently fail to knock us off our perch despite our neglect of domestic lower-income workers’ interests. Japan, Mexico, and Korea have all failed to grab our lunch, much less eat it. Now China, the latest aspirant and economic boogeyman, appears to be getting pulled away from the lunch table as well.

China is massively in debt and running out of U.S. dollars, writes “Geovest” at ZeroHedge:

My thesis is that China has made so many bad dollar-denominated loans that their true net holdings of dollars is either negative or close to going negative. And based on watching how China operates for 30 years, I believe they may be supplementing their currency reserve account with yuan, which has technically been a reserve currency since 2016.

Under Xi, Geovest argues, China has been suffering enormous losses in its economic investments—which are, of course, all directed by the central government and hence the Chinese Communist Party:

China, collectively, has been making massive investments for the past fifteen years and suffering massive losses. These losses span from excess industrial capacity to consumer loans to massive “glamour” infrastructure projects across the nation. These projects required trillions of dollars to pay for the imported components of the investments. Everything has been capitalized with debt. Perhaps the most egregious of these losses has been Xi’s once vaunted Belt and Road Initiative. …

[H]e’s invested massively in places where nobody else would invest such as a massive port facility for Sri Lanka and a massive airport in the jungles of Cambodia. In total, Xi has spent at least $1 trillion on the BRI, most of which is valued in dollars. The result is that at least 75% of the BRI investments are already bad which implies that nearly $800 billion has vanished from the Eurodollar markets—gone. …

Making matters worse, Xi Jinping has directed state-owned enterprises (SOE’s) to “bet the ranch” on EVs and green energy right when the Western world is coming to its senses on the viability of this form of transportation and energy. Europeans are cutting back on EV purchases even as [Chinese electric-vehicle manufacturer] BYD’s cheap EV cars are piling up on the dock in Rotterdam and Bristol.

Xi’s bets have not paid off, and those financial losses have drawn a huge amount of money out of the Chinese economy, which is the real meaning of deflation (as opposed to disinflation, a general decease in prices), Geovest notes:

Deflation means losses. If a nation’s banking system makes bad loans in the collective, that nation will experience deflation because money in circulation declines when the banking system incurs losses. This is what happened in the US in 2008 which is why the Fed started quantitative easing, or QE. In effect, they injected dollars into the banking system to replace the dollars destroyed with bad investments. According to HSBC, the People’s Bank of China has “printed” 15% of currency in circulation over the past year as a means towards offsetting part of the deflation in their domestic economy. It’s not nearly enough.

Now China is apparently selling off assets to raise money to offset these losses and obtain dollars to pay the interest and principal on its loans:

In 2023, China represented 50% of global steel output by tonnage but only 30% of steel output by value. For all of 2023, Chinese steel exports rose by 36% based on tonnage but declined by 8.3% by value. That, my friends, is dumping. We can observe similar behavior in electric vehicles, solar panels, and lithium batteries.

That lends credence to the belief that China has too few U.S. dollars in its portfolio, Geovest argues. The number of dollars in China’s Reserve Account is a state secret, which makes it possible for the CCP to pretend that it has sufficient dollars to pay its debts:

Despite all of these red flags, the prevailing narrative holds that China is flush with dollars in their currency reserve account. My thesis is that China is holding renminbi in that account and bluffing on their financial strength. If I’m right, the global economy is facing the biggest “beating” since WWII and possibly bigger than anything faced in the 20th Century.

Geovest says the math indicates that China has far fewer dollars than the rest of the world thinks it has:

We know that the US dollar represented 79% of the reserve account in 2005 and that dollar holdings fell to 58% of the reserve account by 2014. 2014 was the high-water mark for China’s foreign currency reserves which declined by $1 trillion from late 2014 until the start of 2017. Over the past seven years, reserves have stabilized around $3.2 trillion.

We also know that trade with the US has NOT grown since 2014 indicating that China has had limited opportunities to re-build their dollar positions. Here’s a chart of China’s trade surplus with the US. Keep in mind that China needs to generate significant dollar levels in trade to pay for imports of food (20%+), energy (80%), and high-end technology that they can’t produce domestically. Apart from Russia and Iran, these markets don’t accept yuan.

In a follow-up article, Geovest notes that China’s accumulation of large amounts of gold in recent years, while a positive action, will not save the country from its economic problems and “turn the world into a Communist state with China at the top. It’s not going to happen. It takes more than gold and low-end manufacturing to be the Global Alpha.”

The CCP is just the latest regime to demonstrate the vanity of belief in government control over economic activity, Geovest argues:

China is going to decline because they never developed the necessary competitive advantages to move up the value-added spectrum. Additionally, the extraordinary corruption of the Marxist system represents both a frictional cost and a deterrence against merit such that their best and brightest are stunted in favor of CCP cronies. Just look at what they’ve done to Alibaba.

Geovest makes a distinction between the dollar and what he calls the Eurodallar, his name for dollars that have left the United States “through trade, transfer, or investment” and which are therefore not “subject to our domestic banking laws and leverage limitations plus the impact of Federal Deposit Insurance premiums.” The Eurodollar market is roughly about as large as the U.S. domestic money supply, Geovest estimates.

Since Eurodollar deposits are lightly regulated, banks and funds have been able to invest those dollars aggressively into emerging economies. The bald truth is that the Eurodollar market built China and now China is in the process of destroying the Eurodollar thanks to ridiculously bad investing. Once a bad investment is written down to salvage value, the difference between the face value of the loan and the salvage value deflates bank assets.

I believe the combination of the US’s energy self-reliance and China’s abysmal investment decisions have made the Eurodollar scarce and that is why the US dollar has been strong since 2014 despite domestic profligacy.

These abundant and lightly regulated Eurodollars flowed rapidly into foolish projects toward which people with domestic U.S. dollars may have been more wary:

The Eurodollar system is broken thanks to China and the rest of the emerging markets who borrowed heavily in dollars following the start of quantitative easing. The projects that were meant to generate the returns to service the dollar-denominated debt are largely worthless whether it’s China’s BRI, Egypt’s new Cairo, Dubai’s islands, or even infrastructure for electric vehicles.

The globalist dream of the wealthy West using the rest of the world to supply it with cheap goods was clearly unsustainable in addition to being greedy, cynical, and callous toward lower-income workers. We will all pay for that vanity, Geovest writes,

For the past twenty years, I have fervently believed that turning China into a leading cog in the global economic machinery would prove to be a fatal mistake. By centralizing low-end manufacturing in China, we have distorted the supply/demand balance of the entire global economy such that a declining China will export disinflation in some product categories and dramatically higher prices in others. Ultimately, it’s going to take a long time for asset markets to stabilize. This will prove to be a global problem and possibly the end of the Eurodollar.

Maybe this will return manufacturing jobs to the United States. It certainly seems to have been an incredibly stupid way to get nowhere.

Cartoon

via Comically Incorrect

For more great content from Budget & Tax News.

For more from The Heartland Institute.