While America’s attention has been focused on the presidential election, one of the greatest challenges facing the nation has continued to worsen.

On Friday, the gross federal debt hit $35 trillion. For perspective, that amounts to about $267,000 for every household in the country.

Unfortunately, not only has the debt soared to such an incredibly large number, but it will continue to climb by trillions of dollars per year unless officials in Washington finally take their jobs seriously.

Decades of short-term thinking and political opportunism from both parties has caused the federal budget to go completely out of whack.

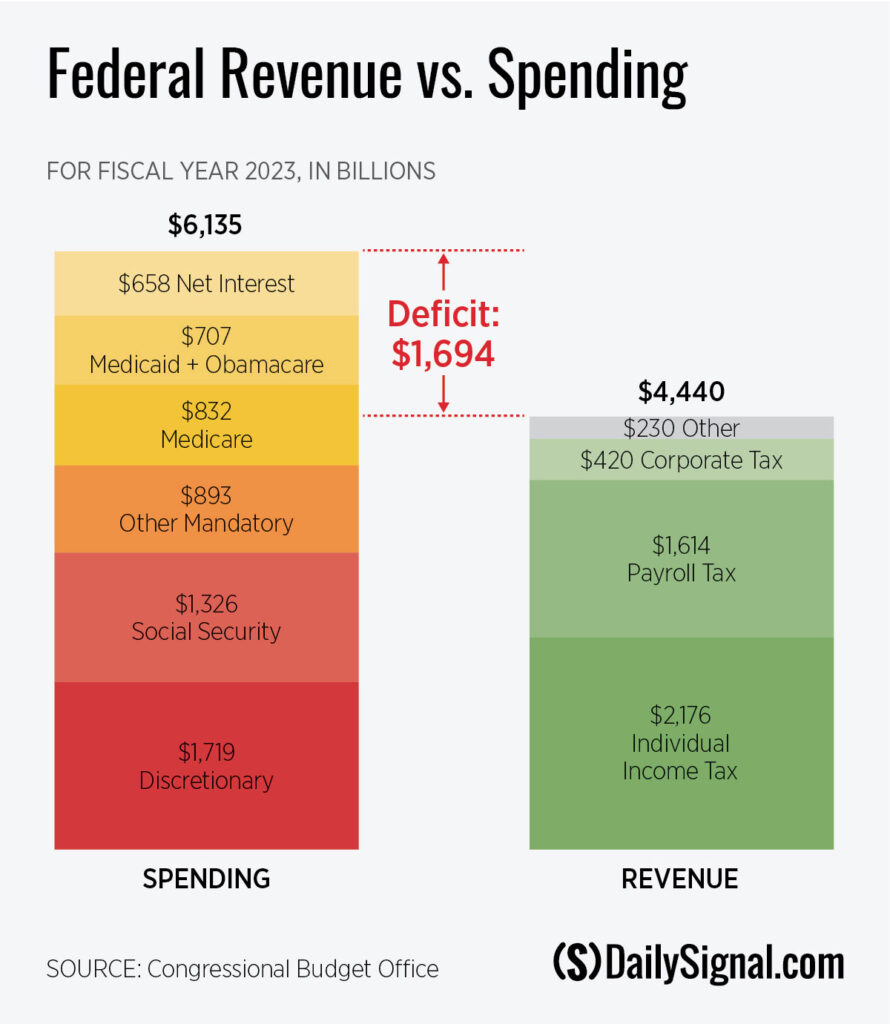

During fiscal year 2023, ending Sept. 30, 2023, the federal government raked in more than $4.4 trillion in revenue—or more than $13,500 for every man, woman, and child in the country. That was more than enough to fund core governmental functions.

However, unending bureaucratic bloat and out-of-control entitlement programs led to $6.1 trillion in spending—more than $18,000 per person.

Examples of swampy excess in 2023 include funding “diversity and inclusion” in Myanmar, corporate welfare schemes for electric vehicles and broadband internet, a trolley museum in Connecticut, doomed rail projects in California, millions of COVID-19 vaccine shots for children, student-loan write-offs that primarily benefit the wealthy, and more.

As a result of excessive spending, the deficit was $1.7 trillion. Such high spending and yawning deficits put significant upward pressure on inflation.

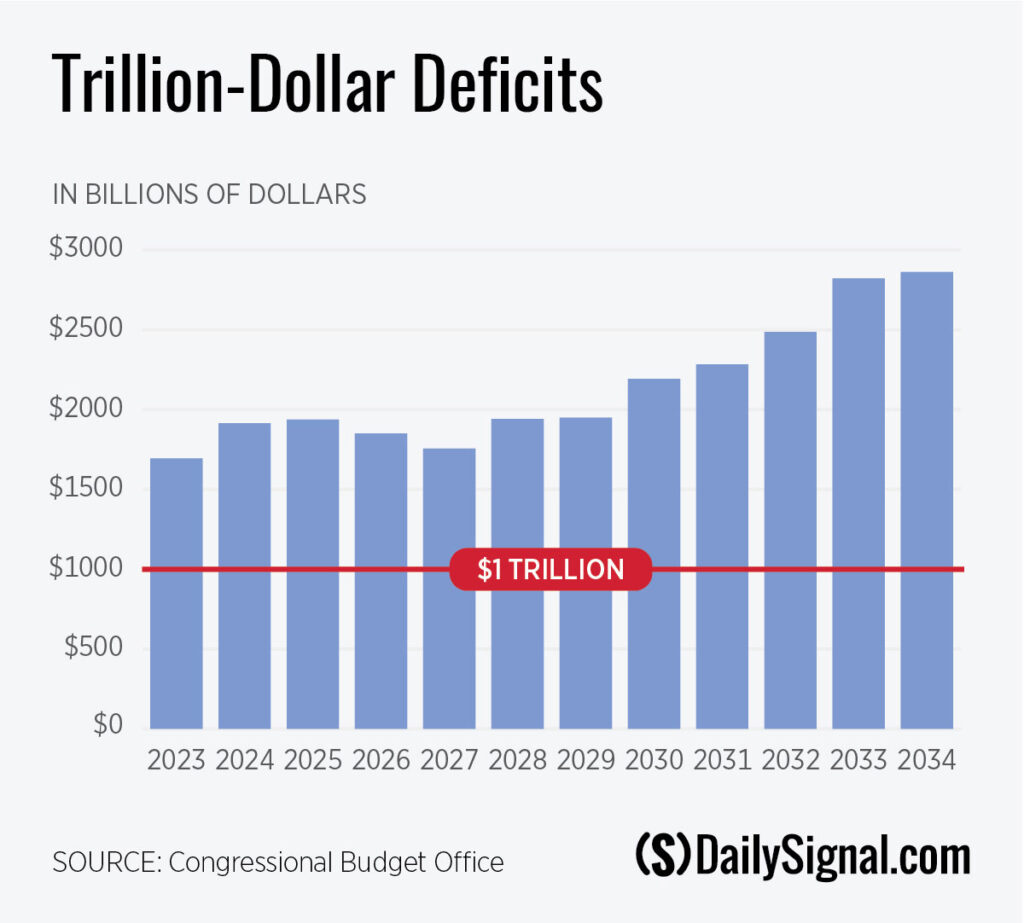

Regrettably, deficits will steadily climb in the years to come.

There are several reasons for this: Most spending grows on autopilot, interest costs are surging, and legislation coming down the pike will only make things worse.

Even if America avoids a recession or a major war, the deficit is on pace to approach $3 trillion per year by 2034. It wasn’t long ago that a $1 trillion deficit was worrisome.

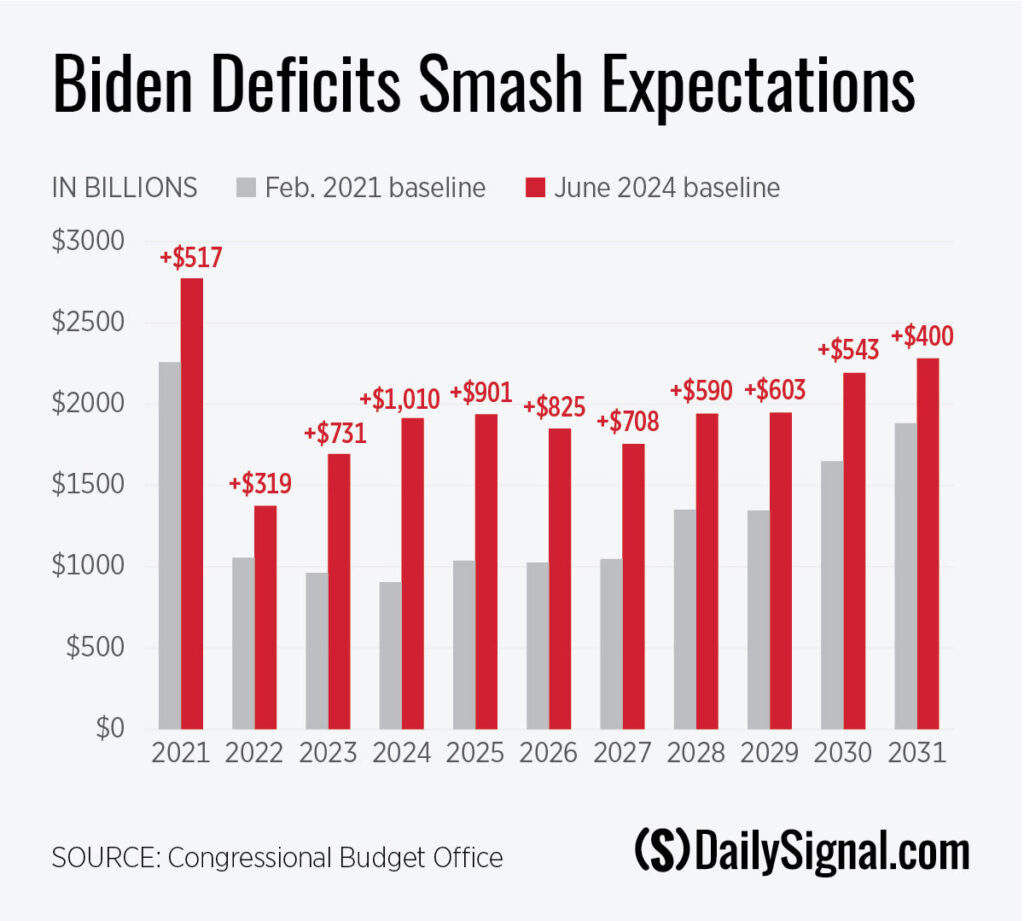

While the budget outlook has been negative for many years, the Biden-Harris administration has made things much worse.

Coming off a glut of spending in 2020 in response to the COVID-19 pandemic, there was a dire need for Washington to put Uncle Sam on a diet.

Instead, President Joe Biden pushed an enormous spending spree, helping to fuel the worst inflation in decades. This included gigantic handouts for a variety of left-wing interest groups, such as teachers unions, environmental activists, bureaucracies at all levels of government, and more.

It even extended to administrative decisions, with hundreds of billions of dollars in extra spending on welfare and a still-unknown volume of canceled student-loan debt.

As a result, the budget window that Biden inherited is now more than $7 trillion deeper in the red. While there will be opportunities to reduce the deficits starting in 2025, even bringing them back to the pre-Biden levels will be incredibly difficult.

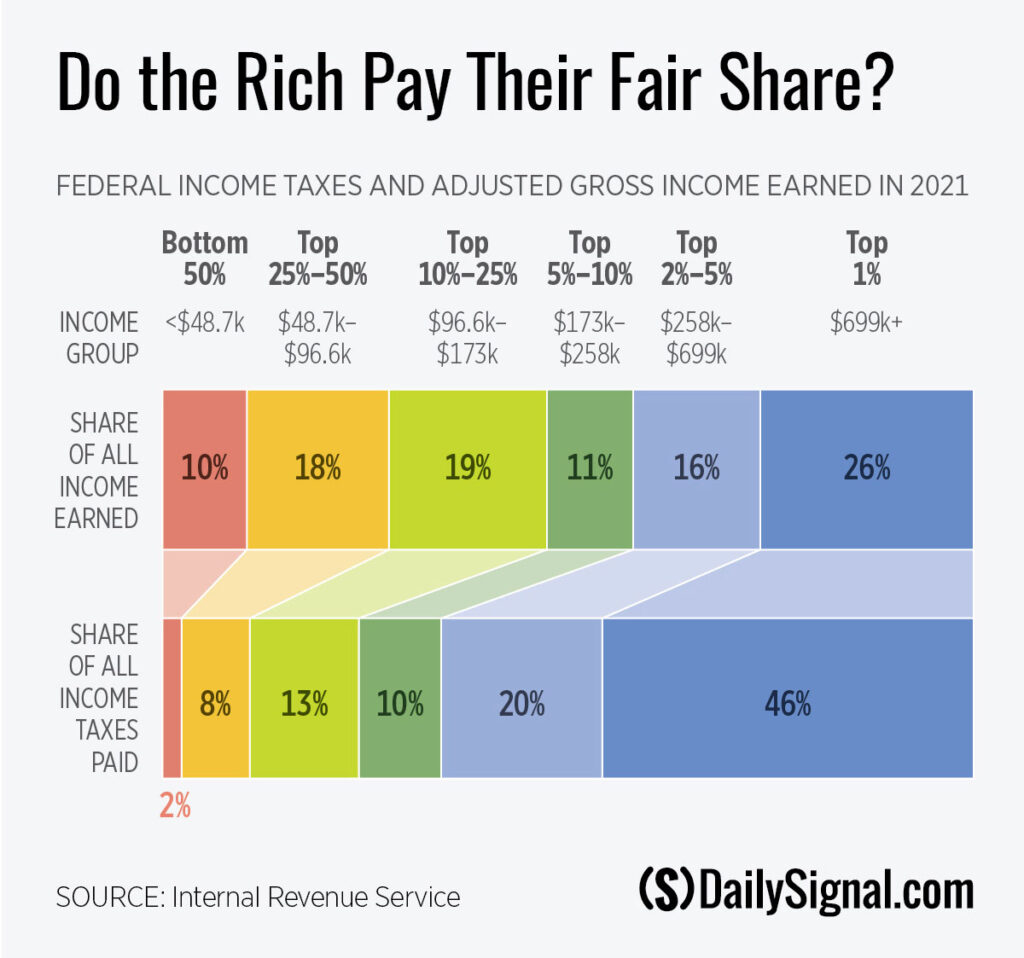

Despite the $4.4 trillion tax haul in 2023, the Left thinks the main budget problem is Washington not shaking Americans down hard enough.

The narrative pushed by the likes of Vice President Kamala Harris is that tax rates on individuals and businesses should go up because those at the top supposedly aren’t paying their “fair share.”

That’s malarkey.

In calendar year 2021, the most recent year for which there is complete data, the top 1% of households paid 46% of income taxes. In contrast, the bottom 95% of households paid a combined 31% of income taxes.

Contrary to claims from the Left, America’s federal tax system is far more progressive than most other developed nations. What separates the U.S. and Europe is the punishingly high taxes that European states impose on lower- and middle-class families.

Rather than throwing more hard-earned money into the gaping maw of the federal behemoth, policymakers should focus on reducing spending.

Top targets for cuts and reforms should include:

- Eliminating expensive and ineffective “green” subsidies passed by Democrats in 2022.

- Ending loopholes that plow enormous amounts of public resources to health care providers without benefiting patients.

- Reining in the increasingly radical institutions of academia and federal science agencies.

- Stopping handouts to state and local governments and corporations.

The $35 trillion national debt is a grim milestone, but there’s still time to avoid the greatest bankruptcy in human history if the nation’s leaders are willing to stand up to special interests.

Originally published by The Daily Signal. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.