Robert Genetski: Economy slowing and inflation trending lower, as political sentiments affect stocks. (Commentary)

The Week That Was

Last Friday’s economic news will help justify the expected September interest rate cut. The report shows June inflation rate was close to zero, while incomes grew at a slower rate.

Last Thursday’s GDP report was also in line with expectations. Current dollar spending rose at a 5 percent annual rate, similar to the two prior quarters. Real growth and inflation were also similar to the two previous quarters with increases of 2.8 percent and 2.3 percent, respectively.

Other data remain mixed. June durable orders, which had been flat to down this past year, fell by 6 percent. In contrast, S&P’s advanced business survey for early July shows business activity up at the fastest pace in over two years.

Housing data show both new and existing home sales remain depressed while house prices remain elevated.

Things to Come

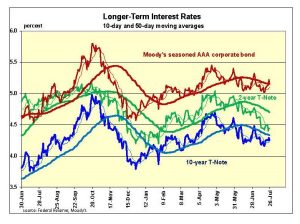

Wednesday’s Fed announcement should reaffirm the current interest rate target. However, the Fed likely will signal its intent to move interest rates down on September 18th, if upcoming inflation numbers remain subdued.

We also expect the Fed will announce its intent to stop selling securities. This would provide another sign that the Fed is comfortable it has reached its objective in stabilizing the economy and inflation.

We expect Thursday’s July ISM survey of manufacturing businesses to continue to show a weakness in manufacturing. The more important survey for service companies won’t be available until the following week.

Friday’s jobs report likely will continue to show a slowdown in private jobs. Recent growth has been in the vicinity of 150,000 a month. However, the Labor Department’s survey of participants continues to show no job growth for the past year. It’s difficult to take any of the job numbers too seriously.

Market Forces

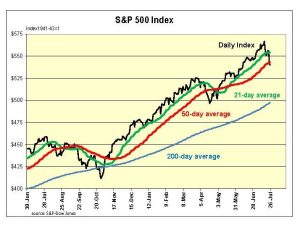

After hitting all-time highs the week before last, the S&P500 was down 4.7 percent seven days later. Without any significant changes in economic news, the decline is most likely related to political developments.

By replacing Biden with Kamala Harris, Democrats believe they have a better chance of beating Trump. Although the top of the ticket has changed Democrat policies have not.

By replacing Biden with Kamala Harris, Democrats believe they have a better chance of beating Trump. Although the top of the ticket has changed Democrat policies have not.

Under a Harris presidency the United States would face major tax increases coupled with further increases in federal control. The result: lower living standards and higher inflation. As the implications of a Harris presidency become apparent, the current optimism surrounding her chances will subside.

The abrupt shift in market psychology sent our momentum model back to a 50 percent probability of further gains in stock prices. This is similar to what occurred back three months ago when the S&P fell 5½ percent in three weeks before reversing direction.

One difference between now and April is stocks were 38 percent overvalued seven days ago compared to 28 percent overvalued at their peak on March 28. The greater the overvaluation, the greater the potential decline. The latest decline also was on higher trading volume, which is not encouraging.

Interest rates remain on a downtrend with futures markets placing the odds at 90 percent the Fed will cut its target rate by ¼ percent in September.

Without any significant change in economic news, political developments should continue to weigh heavily on stocks. With the market now 32 percent overvalued, conservative investors should consider cutting back on their holdings so long as the S&P500 remains below its 50-day average.

Without any significant change in economic news, political developments should continue to weigh heavily on stocks. With the market now 32 percent overvalued, conservative investors should consider cutting back on their holdings so long as the S&P500 remains below its 50-day average.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 32 percent

Monetary Policy: less restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.