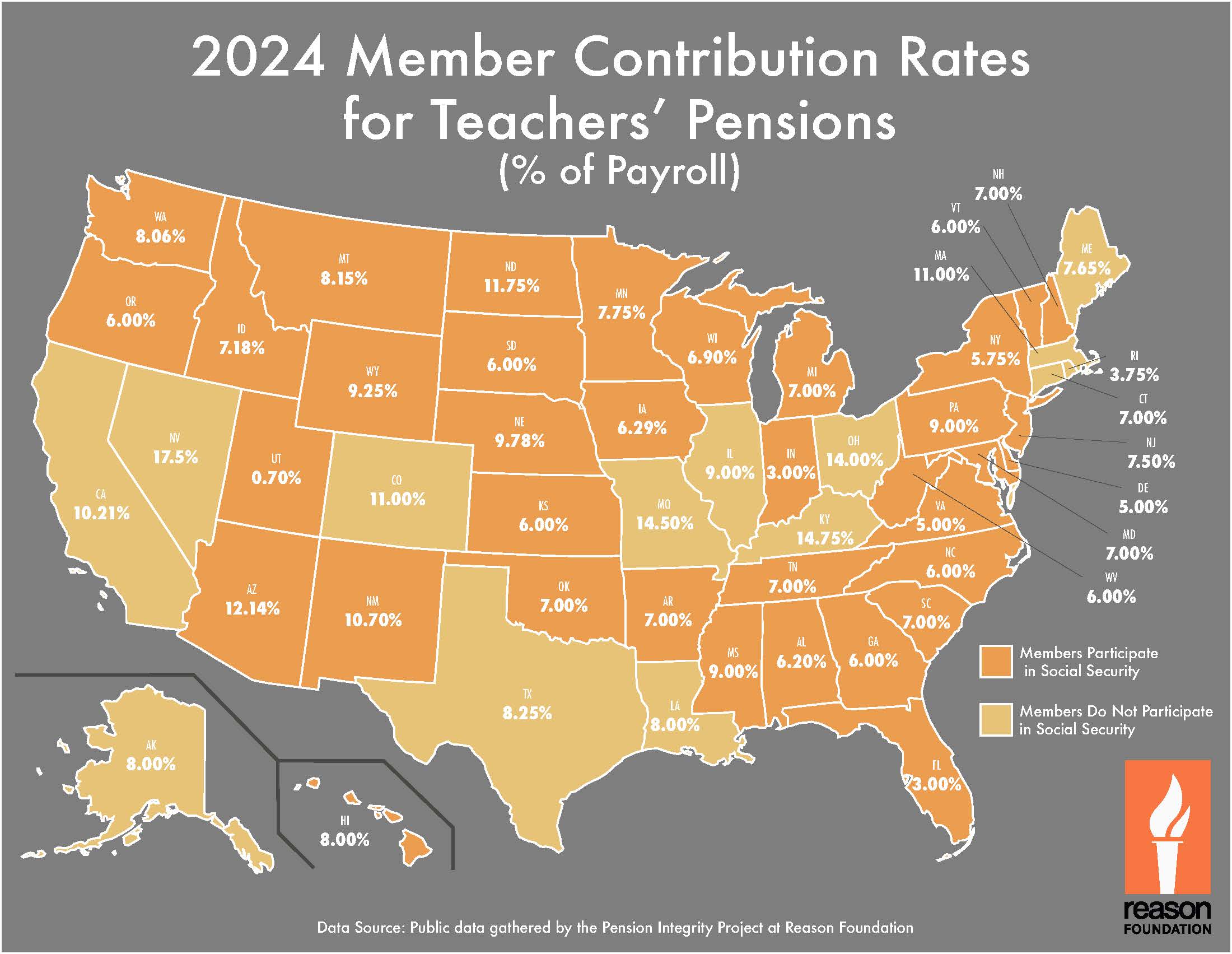

The vast majority of public school teachers are enrolled in defined-benefit pension plans, which require regular contributions from both employees and employers. These pension contributions are deducted automatically from teachers’ paychecks as a percentage of their total pay, so these contribution rates have a notable impact on their overall compensation packages.

Educators who are required to contribute higher rates to their pensions will see more drawn from their paychecks and, consequently, less in the amount of pay they are taking home.

A comparison of the required teacher pension contribution rates for each state in 2024 shows a number of issues that public teachers and government policymakers should be aware of.

Not all public pension benefits are exactly the same. Each pension plan offers a guaranteed lifetime benefit that is calculated using the employee’s final average salary, their years of service, and a unique multiplier that determines the ultimate value of the benefit. Some states offer benefits that are more generous than others, and most are gated behind vesting requirements that can vary significantly from one plan to another.

States also differ in how they balance the required contributions to pay for promised pension benefits between the teacher and the employer (usually a combination of the governing body and the school district). Some states like Arizona and Nevada balance these pension contributions 50/50, with the employer always paying the same amount as the teacher. Other states like Utah have the employer pay nearly all the costs of the pension.

Most states require teachers to pay between 5% and 12% of their pay, with the employer paying what remains to cover the benefit and whatever debt payments are needed to eliminate unfunded liabilities.

Since most state-run pensions operate with significant pension debt—aggregate state pension debt is estimated to be $1.3 trillion—nearly all employer rates greatly exceed the contribution amounts teachers are paying.

| State | Plan Name | Teacher Contribution Rate | Does Not Participate in Social Security | 2023 Funded Ratio |

| Alabama | Teachers’ Retirement System of Alabama | 6.20% | 63% | |

| Alaska | State of Alaska Teachers’ Retirement System | 8.00% | X | 76% |

| Arizona | Arizona State Retirement System | 12.14% | 74% | |

| Arkansas | Arkansas Teacher Retirement System | 7.00% | 81% | |

| California | California State Teachers’ Retirement System | 10.21% | X | 88% |

| Colorado | Colorado Public Employee Retirement Association-School Division | 11.00% | X | 64% |

| Connecticut | Connecticut State Teachers’ Retirement System | 7.00% | X | 58% |

| Delaware | Delaware State Employees’ Pension Plan | 5.00% | 86% | |

| Florida | Florida Retirement System | 3.00% | 82% | |

| Georgia | Teachers Retirement System of Georgia | 6.00% | 75% | |

| Hawaii | Employees’ Retirement System of the State of Hawaii | 8.00% | 62% | |

| Idaho | Public Employee Retirement System of Idaho | 7.18% | 84% | |

| Illinois | Teachers’ Retirement System of The State of Illinois | 9.00% | X | 45% |

| Indiana | Indiana State Teachers’ Retirement Fund | 3.00% | 72% | |

| Iowa | Iowa Public Employees’ Retirement System | 6.29% | 90% | |

| Kansas | Kansas Public Employees Retirement System | 6.00% | 72% | |

| Kentucky | Teachers’ Retirement System of the State of Kentucky | 14.75% | X | 57% |

| Louisiana | Louisiana State Teachers Retirement System | 8.00% | X | 74% |

| Maine | Maine Public Employees Retirement System – State and Teacher Retirement Program | 7.65% | X | 86% |

| Maryland | Maryland State Retirement and Pension System – Teachers Combined System | 7.00% | 75% | |

| Massachusetts | Massachusetts Teachers’ Retirement System | 11.00% | X | 59% |

| Michigan | Michigan Public School Employees’ Retirement System | 7.00% | 62% | |

| Minnesota | Teachers Retirement Association of Minnesota | 7.75% | 76% | |

| Mississippi | Public Employees’ Retirement System of Mississippi | 9.00% | 54% | |

| Missouri | Public School Retirement System of Missouri | 14.50% | X | 85% |

| Montana | Teachers’ Retirement System of Montana | 8.15% | 72% | |

| Nebraska | Nebraska Public Employees Retirement System – School Employees Plan | 9.78% | 75% | |

| Nevada | Public Employees’ Retirement System of Nevada – Regular Employees Plan | 17.50% | X | 76% |

| New Hampshire | New Hampshire Retirement System | 7.00% | 67% | |

| New Jersey | Teachers’ Pension and Annuity Fund of New Jersey | 7.50% | 37% | |

| New Mexico | Educational Retirement Board of New Mexico | 10.70% | 63% | |

| New York | New York State Teachers’ Retirement System | 5.75% | 99% | |

| North Carolina | Teachers’ and State Employees’ Retirement System of North Carolina | 6.00% | 84% | |

| North Dakota | North Dakota Teachers’ Fund for Retirement | 11.75% | 69% | |

| Ohio | Ohio State Teachers Retirement System | 14.00% | X | 78% |

| Oklahoma | Teachers’ Retirement System of Oklahoma | 7.00% | 73% | |

| Oregon | Oregon Public Employees Retirement System | 6.00% | 82% | |

| Pennsylvania | Public School Employees’ Retirement System of Pennsylvania | 9.00% | 62% | |

| Rhode Island | Rhode Island Employees’ Retirement System Plan | 3.75% | X | 64% |

| South Carolina | South Carolina Retirement System | 7.00% | 58% | |

| South Dakota | South Dakota Retirement System | 6.00% | 100% | |

| Tennessee | Tennesee State and Teachers’ Retirement Plan | 7.00% | 107% | |

| Texas | Teacher Retirement System of Texas | 8.25% | X | 73% |

| Utah | Utah Public Employees Noncontributory Retirement System | 0.70% | 98% | |

| Vermont | State Teachers’ Retirement System of Vermont | 6.00% | 57% | |

| Virginia | Virginia Retirement System | 5.00% | 83% | |

| Washington | Washington Teachers Plan 2 | 8.06% | 101% | |

| West Virginia | West Virginia Teachers’ Retirement System | 6.00% | 80% | |

| Wisconsin | Wisconsin Retirement System | 6.90% | 103% | |

| Wyoming | Wyoming Public Employees Pension Plan | 9.25% | 82% |

Whether teachers in a particular state participate in Social Security also warrants attention. Some states have declined to have their employees in the federal program and are therefore expected to adopt higher pension benefits and, consequently, higher contributions to make up the difference.

While the percentage of pay that teachers contribute to their pensions is merely a part of a bigger retirement plan structure, it is useful for teachers to examine and compare the deductions they will see on their paychecks.

It is also useful for policymakers to see what states around the country are requiring of their educators as they cooperate to tackle adequate funding and the growing struggles with public pension debt.

Notes on the data

The 2024 pension contribution rates were gathered from financial documents, educational materials, and the websites of state-run retirement plans for teachers.

Many states have several tiers of benefits based on a teacher’s hire date or other factors. This analysis only presents the contribution rates of the latest tier, or the tier in which new hires will be members. It does not include contribution rates from tiers that are still active but no longer available to new hires.

The funded ratios display the pension system’s ratio of assets to the estimated pension liability. These figures come from 2023 financial reports. Since 2023 figures were not available, the figures were estimated for Michigan, Nebraska, Oregon, and Wisconsin.

Additional notes on specific states:

- Indiana: Teachers are offered a hybrid plan in which employees contribute to the defined contribution (DC) portion and the employer pays into the pension portion. This analysis displays the DC contribution obligation for teachers.

- Kansas: Teachers are enrolled in a cash balance plan, which guarantees defined returns but is different from a defined benefit plan.

- Tennessee: Teachers have a hybrid plan in which 5% of their contributions go to the defined benefit (DB) portion and 2% goes to a DC.

- Utah: The tier 2 pension benefit offered to Utah teachers has the employer pay 10% pay into the DB fund, with employees covering any necessary costs that exceed that amount. Up until 2024, this has resulted in no required contributions from teachers. With pension costs continuing to grow, teachers are now seeing deductions from their paychecks for the first time.

- Vermont: Teacher contributions are set on a progressive scale based on salary. This analysis uses the lowest contribution requirement (6%) for any salary below $40 thousand.

- Washington: Employers offer a defined benefit or hybrid plan. There is 50/50 cost-sharing in the DB plan. In the hybrid, the employer pays all DB costs, and teachers cover all DC contributions, ranging from 5-15% of pay.

- Wyoming: While teachers are required to contribute 9.25% of their pay, the employer has agreed to pick up 5.57%, meaning educators are only obligated to pay 3.68% of their salary for their pension.

Originally published by the Reason Foundation. Republished with permission.

For more School Reform News.