A report examining misstatements of income by individuals applying for Obamacare to qualify for bigger federal subsidies has garnered congressional interest.

The report, “The Great Obamacare Enrollment Fraud,” by Brian Blase and Drew Gonshorowski, published by the Paragon Health Institute, traces the problem to the Inflation Reduction Act (IRA), which increased payments to Affordable Care Act (ACA) plans through 2025, fully subsidizing the premiums of enrollees with incomes between 100 percent and 150 percent of the federal poverty level (FPL).

The effect on ACA signups of individuals claiming they are in that income range has been dramatic, according to the report.

“In nine states (Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, Tennessee, Texas, and Utah), the number of sign-ups reporting income between 100 percent and 150 percent of FPL exceeds the number of potential enrollees,” states the report.

‘Astonishing … Behavior’

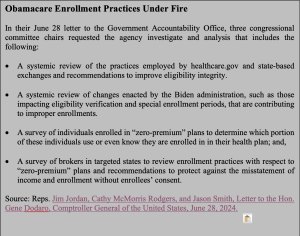

In response to the Paragon report, the chairmen of three House committees—Energy and Commerce, Ways and Means, and Judiciary—sent letters to the Government Accountability Office (GAO) and the Office of Inspector General (OIG) at the U.S. Department of Health and Human Services (HHS) requesting information on the “astonishing level of improper, and possibility fraudulent, behavior, in Obamacare markets.”

In another letter, the committee chairmen asked the OIG to “conduct a systemic review of enrollment in ‘zero-premium’ plans to estimate the scope of improper enrollment in such plans as well as improperly paid federal subsidies paid to insurance companies on behalf of such individuals.”

Brokers Paid for Enrolling People

The cost to taxpayers of people understating their income to qualify for subsidized plans is $15 billion to $20 billion in 2024, the Paragon report estimates.

“In all states, there is an incentive for all people who have an income between 200 and 400 percent of the FPL to report an income of 100 to 150 percent of FPL,” states the report. “They qualify for a larger advanced subsidy and a plan with much lower cost-sharing, and the Internal Revenue Service only recaptures a portion of the excess subsidy when they file their taxes.”

ACA premium subsidies are paid directly to insurers, but individuals sign up for plans through the marketplace, often with the aid of independent brokers.

During the COVID-19 emergency, HealthCare.gov inadequately policed fraudulent sign-ups on the Obamacare exchanges by people who were eligible for Medicaid says the report.

“Unscrupulous brokers are certainly contributing to fraudulent enrollment and the enhanced direct enrollment feature of HealthCare.gov appears to be a problem,” states the report. “Brokers just need a person’s name, date of birth, and address to enroll them in coverage, and reports indicate that many people have been recently removed from their plan and enrolled in another plan by brokers who earn commissions for doing so.”

Dual Medicaid-Obamacare Enrollees

In addition to the issue of understating income, in North Carolina, Medicaid-eligible individuals, including current enrollees, are also signed up for ACA plans, says the report.

“The data indicate that many North Carolinians were (and still are) simultaneously enrolled in Medicaid and the exchanges,” states the report. “Because North Carolina transitioned its Medicaid program to managed care in 2021, this suggests that insurers are potentially reaping windfall profits from dual enrollment.”

The fraud plaguing Obamacare is not surprising says Devon Herrick, Ph.D., a health economist.

“Government programs that rely on self-reported data certainly run the risk of fraud,” said Herrick. “The Biden administration wants to make Obamacare appear to be to be a success. That makes me wonder if the administration will ever try to track down those who intentionally underestimated their income to boost subsidies.”

Is Fraud a ‘Tactic’?

Jeff Stier, a senior fellow at the Consumer Choice Center, says the lack of accountability for government officials supervising the ACA program is the principal reason for enrollment crime.

“The question I’d like to have answered, given the widespread and systemic fraud, has less to do with dishonest applicants and shady brokers, and has more to do with those charged with overseeing Obamacare,” said Stier.

“[I]nvestigators should be asking whether bureaucrats are knowingly looking the other way in the face of rampant fraud, as a tactic to expand ‘free healthcare for all’ (who are willing to lie about their income),” said Stier.

Bonner Russell Cohen, Ph.D. (bcohen@nationalcenter.org) is a senior fellow at the National Center for Public Policy Research.

For related articles, click here.