Life, Liberty, Property #71: disappointing jobs report might finally get Fed’s attention, as Wall Street stocks plunge. (Commentary)

by S.T. Karnick

IN THIS ISSUE:

- Disappointing Jobs Report Might Finally Get Fed’s Attention

- Warning Signs of Downturn Have Been Abundant

- Trump Mystery Solved

- Cartoon

Disappointing Jobs Report Might Get Fed’s Attention, Finally

Disappointing Jobs Report Might Get Fed’s Attention, Finally

The Federal Reserve finally got the bad news it has been waiting for.

The U.S. jobs market is tightening distinctly, a sign of a possible economic downturn. Friday’s employment report from the Bureau of Labor Statistics showed a slowdown in the job market. Here’s the lede from Investor’s Business Daily (IBD):

The July jobs report showed that hiring badly undershot expectations, as the U.S. economy gained just 114,000 jobs. The unemployment rate jumped to the highest level since October 2021 as more people looked for work, while wage growth eased to a new three-year low. After the jobs report, the S&P 500 traded sharply lower, even as markets priced in a faster pace of Fed rate cuts to fend off a possible brush with recession.

The jobs report appeared to confirm fears of a slowdown, flashing weakness across the board, in both the employer and household surveys.

Employment was 66,000 below expectations. Of the 114,000 added jobs, 97,000 were in the private sector, undershooting expectations by 58,000 on the month. That is a shortfall of about 700,000 on an annual basis. Governments added 17,000 jobs, which are another net drag on the economy.

In addition, the May and June jobs numbers were revised down by 29,000, as has been the habit of this administration (reporting higher numbers and then telling the truth, or something more like it, a while later).

Average hourly earnings rose by 0.2 percent in July, with wage growth at its lowest since May 2021. The average work week declined slightly, however, “resulting in flat aggregate pay across the U.S. economy in July,” IBD reports.

Unemployment rose by 0.2 percentage points in July, to 4.3 percent. The number of unemployed people increased by 352,000, to 7.2 million, with adult men and whites taking the worst hit and other major demographic groups going largely unchanged. In addition, “information, which includes tech companies, lost 20,000 jobs and financial activities shed 4,000,” USA Today reports. “‘These sectors are known for creating higher-wage, higher-quality jobs,’ says Julia Pollak, chief economist of ZipRecruiter, a leading job site.”

The job losses were largely concentrated in temporary layoffs, which increased by 249,000 to 1.1 million. The labor force participation rate and employment-to-population ratio remained about the same as in June.

The data indicate that workers are becoming much less confident about the labor market. “Hiring has slipped well below pre-pandemic levels and the number of people quitting jobs—typically to take another, higher-paying position—has tumbled to the lowest mark since 2020, Labor said this week,” USA Today reports.

This is a highly important report because unemployment is a lagging indicator of overall economic conditions: when unemployment starts rising, the economy is already contracting. Using unemployment in deciding when to adjust the money supply is the equivalent of waiting until your engine seizes up before deciding to change the oil.

Accordingly, “Ian Shepherdson, chief economist of Pantheon Macroeconomics, [said] the Fed’s decision not to reduce rates this week was ‘a mistake’ and ‘leaves the Fed looking woefully behind the curve,’” USA Today reports.

The Fed seemed unconcerned about the need for a decent interest cut rate just two days ago. “In his news conference after Wednesday’s policy update, Federal Reserve Chairman Jerome Powell said rate-setting committee members hadn’t raised a possibility of a half-point rate cut,” the IBD reported on Friday.

The Fed always responds to economic conditions by tightening or loosening the money supply too late, too fast, too much, and for too long. The Fed’s actions in the Biden era have added to that dismal record.

The markets believe that the Fed will now try to play catch-up, as USA Today reported:

“The sharp slowdown in payrolls in July and sharper rise in the unemployment rate makes a September interest rate cut inevitable and will increase speculation that the Fed will kick off its loosening cycle with” a half percentage point decrease instead of a more typical quarter-point cut, Stephen Brown of Capital Economics wrote in a note to clients.

The bond markets sent that exact signal on Friday. “Interest rate futures went from implying Federal Reserve policymakers would cut their benchmark interest rate by a quarter percentage point when they next meet in September to a half-point cut,” The Wall Street Journal reported on Friday. The 10-year Treasury yield dropped to “around 3.795%, a stunning decline that highlights concerns about economic growth,” The Wall Street Journal reported in a separate story.

We saw the current unemployment trend once before in this century, and it is not a delight to contemplate. This graph from CNN illustrates the situation:

![]() Look at the shaded area designating the Great Recession, and note the shape of the unemployment curve, especially as it approaches the beginning of the economic downturn. Now look at the unemployment curve since the end of the pandemic. They are remarkably similar.

Look at the shaded area designating the Great Recession, and note the shape of the unemployment curve, especially as it approaches the beginning of the economic downturn. Now look at the unemployment curve since the end of the pandemic. They are remarkably similar.

We can only hope that the unemployment rate in coming months will not look like the rapid rise seen during the Great Recession, as illustrated by the graph. Unfortunately, there is little reason to believe it.

Sources: U.S. Bureau of Labor Statistics; Investor’s Business Daily; USA Today; The Wall Street Journal; CNN

Warning Signs of Downturn Have Been Abundant

Warning Signs of Downturn Have Been Abundant

Stock prices rather predictably fell sharply after the release of the national jobs report on Friday, after having suffered very big losses on Thursday. The Dow Jones Industrial average was down a further 1,100 points on Monday morning.

“The tech-heavy Nasdaq was hammered, falling more than 2.5% in recent trading and flirting with correction territory, down at least 10% from its recent high,” The Wall Street Journal reported on Friday. “Correction” is a euphemism for a massive slide in stock prices. (The Nasdaq ended the day down 2.43 percent.) The Dow dropped by 611 points, a 1.5 percent decline, and the S&P 500 declined by 1.8 percent.

Don’t look at this Wall Street Journal chart if you have a good deal of money in the stock markets:

Source: The Wall Street Journal

As the greater damage to the Nasdaq indicates, tech stocks took a beating, with Intel down by 26 percent and Amazon sliding 8.8 percent.

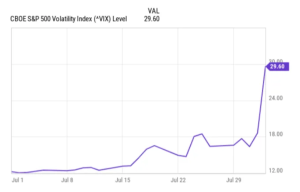

Additionally concerning is the fact that prices were so volatile during the selloff, as that is a strong predictor of an overall market decline. As Quoth the Raven noted at the Fringe Finance Substack, expected stock market volatility moved very high on Friday. “[W]e saw a massive spike in the VIX to end the week on Friday. Here’s how things looked early afternoon on Friday”:

“In my opinion,” Fringe Finance continues, “Friday’s trading session marks the beginning of a scenario that I have been predicting would unfold for the better part of the last two years”—a big stock market decline and a serious recession.

“In my opinion,” Fringe Finance continues, “Friday’s trading session marks the beginning of a scenario that I have been predicting would unfold for the better part of the last two years”—a big stock market decline and a serious recession.

There were plenty of warning signs of a weakening economy leading up to last Friday’s disappointing employment report, which I too have been writing about since the very first issue of this newsletter in November 2022. Since then, the stock markets had been reaching new highs, enjoying the crack cocaine of insane federal deficit spending and loose money. Now it appears that the inevitable “correction” is on the way.

The markets seem to have arrived at the same conclusion, albeit much later. Investor’s Business Daily reports that “the weak jobs data is being taken at face value, following a number of signals on Thursday that stoked concern of a sharp economic slowdown. Those include a jump in initial jobless claims, the Institute for Supply Management’s factory activity index sliding further into contraction territory and Amazon.com (AMZN) warning of rising consumer caution.”

Yes, yes, yes, and all of that is on top of the numerous other warning signals we have been noting since 2022. (You can find back issues of Life, Liberty, Property at this link.) Here are a few more from just Thursday and Friday of last week.

Rapidly rising automobile prices and increasing consumer debt are evident in a large increase in car repossessions and auto dealers stuck with unsellable inventory, ZeroHedge reported on Friday:

The private debt crisis is becoming apparent in America after car repossessions jumped 23% during the first half of 2024. Data shows that 1.6 million Americans will have their car repossessed by the bank before the end of the year, a slight increase from the 1.5 million autos repossessed in 2023 and a drastic upturn from the 1.1 million in 2021. …

Americans simply cannot afford new autos and car dealerships can do nothing to entice purchases. New car inventory in the US rose 36% this year, close to February 2021 levels before the supply chain crisis put a dent in imports. Yet, the average list price of a new car is $49,096 and far more than the average American can afford. The average new vehicle will sit in a dealer’s lot for 65 days, a 41% annual increase. …

The average new car costs about $735 monthly based on data from Experian, and $523 monthly on used models.

Those high monthly automobile payments are brutalizing consumers, as auto loans comprise about 9.2 percent of all consumer debt, ZeroHedge notes. The situation is likely to get worse in the coming months, the story reports: “Cox Automotive believes the trend of repossessing cars will increase into 2025 when they anticipate 1.7 million cars being repossessed.”

Note that inventory is listed as a positive item in calculation of gross domestic product. That is not an entirely reasonable claim, to say the least, as this situation indicates.

Meanwhile, shelter costs are rising, with Wisconsin representing the increasing unaffordability of housing across the country, The Wall Street Journal noted on Friday:

With median sale prices up 8% in the past year, according to Redfin, Wisconsin is the unhappy winner of the biggest price jump among the presidential battleground states. Prices are up here at double the U.S. average. …

A July Wall Street Journal poll showed that voters rank housing as their second biggest concern when it comes to high prices—behind only groceries. …

A protracted house hunt was enough to make Nahona Moore, 28 years old, plan to change her lifelong record of voting for Democrats.

Moore, a self-employed makeup artist living on the border of Milwaukee and Wauwatosa, said she blamed both Biden and Harris for “not making anything better.”

She added: “When Trump was still president, if we were making what we make now, we would be set.”

High consumer debt is causing consumers to reduce their spending on retail items, ZeroHedge reported on Friday:

For home improvement retailers such as Home Depot and Lowe’s, companywide same-store comparable sales, which compares the sales of a store open for at least a year against the previous period, have been in decline for six quarters. The same trends can be seen in the consumer electronics space, where Best Buy has posted negative same-store sales, sometimes in the double digits, for 10 consecutive quarters. Venerable Target, a traditional favorite of middle-class consumers, has also posted negative comps for a year now.

The discount stores are faring only slightly better. Dollar General, a pillar of support for low-income families, is treading water with flat sales, while Walmart has seen its comparable store sales fall from nearly 9 percent two years ago to less than 4 percent in its most recent quarter. Costco is following the same trend. For nearly all of the retailers, even those managing to grow revenue, profit margins are compressing as they are forced to discount more heavily to attract the otherwise beleaguered shopper.

The cutback in consumer goods-buying is driving companies out of business, the story notes:

For the second tier of retailers, especially those in the home products space, the pressure is too much. Furniture chain Conn’s has filed for bankruptcy and is liquidating its more than 70 stores after 134 years in operation. Big Lots, the off-price home goods retailer, is closing 150 stores and trying to raise rescue capital to avoid bankruptcy itself.

Conn’s and Big Lots aren’t alone. Over the past year, business bankruptcy filings are up 40.3 percent, and have now reached a number not seen since the second quarter of 2020, at the peak of lockdowns. American households are following along, with total bankruptcy filings up 16.2 percent in the past year, including 132,710 new filings in the second quarter of 2024 alone.

The rise in consumer bankruptcies is an important misery number. I recommend that any candidates running against the party currently holding the White House publicize this sad fact aggressively.

Big companies are feeling the pinch as well. Second-quarter sales were disappointing for chip maker Intel, The Wall Street Journal reported on Thursday:

Intel INTC -26.06% decrease; red down pointing triangle plans to lay off thousands of employees this year and pause dividend payments as part of a broad cost-saving drive more than three years into Chief Executive Pat Gelsinger’s turnaround effort.

Gelsinger laid out the plan to reduce costs by more than $10 billion next year as the chip maker reported second-quarter sales of $12.8 billion, down 1% and below analysts’ forecasts in a FactSet survey. Reaching that cost-reduction goal will require cutting jobs and lowering capital expenditures, among other moves, the company said.

The company’s stock fell 20% in after-hours trading. …

Intel reported a loss of $1.6 billion for the second quarter, compared with a $1.5 billion profit a year earlier. It said it expected sales of roughly $13 billion in the third quarter, below analyst forecasts.

The pause in the company’s dividend follows a 66% reduction of the payouts last February.

Things got even worse for Intel on Friday, as noted above.

Apple is floundering in its efforts to benefit from the rising interest in AI, The Wall Street Journal reported on Thursday:

Apple’s AAPL 1.84% increase; green up pointing triangle iPhone revenue fell for a second consecutive quarter, a soft demand signal investors hope will turn around once the company releases new AI features in the fall.

For its quarter ended in June, iPhone sales declined nearly 1% from the prior year to about $39.3 billion and overall Apple revenue increased about 5% to $85.8 billion.

Amazon’s stock was hit hard after the announcement that the retailer’s sales growth was less than expected in the second quarter, though the company is still enjoying rising sales, The Wall Street Journal reported on Thursday:

Amazon.com (AMZN -9.12% decrease) shares slipped Thursday after it projected weaker-than-expected revenue growth and said it would continue to ratchet up spending to meet anticipated demand for artificial-intelligence services. …

Shares of Amazon—which had risen more than 20% so far this year—fell more than 7% in after-hours trading Thursday.

Warren Buffett’s Berkshire Hathaway has sold 90 million shares of Bank of America because the billionaire investor’s company cannot “find deals in today’s overvalued and weak economic environment” and is saving up for when stock prices reach bottom, ZeroHedge reports:

The exact reason for Berkshire’s BofA dump has yet to be disclosed. But raising cash could be a sign that Buffett and his team understand deals are ahead. This means valuations in overall markets must go lower.

All this desolation, and much more, was reported by just two outlets over just two days.

Sources: The Wall Street Journal; Fringe Finance; Investor’s Business Daily

Trump Mystery Solved

Trump Mystery Solved

American voters believe, by a wide margin, that the extraordinarily harsh and terrifying rhetoric President Joe Biden and his supporters have directed against Donald Trump “led to” the assassination attempt against the former president in Pennsylvania in mid-July, according to a national public opinion poll.

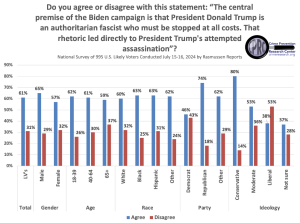

By almost two to one, likely voters surveyed by the Rasmussen polling group said they agree with the following statement: “The central premise of the Biden campaign is that President Donald Trump is an authoritarian fascist who must be stopped at all costs. That rhetoric led directly to President Trump’s attempted assassination,” the Crime Prevention Research Center reports:

Except for liberals, likely American voters of all categories think the rhetoric of Biden’s campaign that Trump is “an authoritarian fascist who must be stopped at all costs” led to Trump’s attempted assassination. In fact, overall likely voters by an almost 2-to-1 margin (61%-to-31%) agree. Even Democrats believe by a 46%-to-43% margin that this rhetoric led to the attempted assassination. Generally, those with lower incomes and less education were more likely to agree that the rhetoric caused the attack.

Here is a graphic from the Crime Prevention Research Center illustrating the results of the poll:

It is worth noting that these heightened denunciations of Trump arrived after five years of similar attacks. The Biden-era Democrats, however, crossed the line into implicit advocacy of assassination by the repetitive use of the word existential to convey the thought of Trump as murderous while maintaining deniability on their part.

That campaign of homicidal hatred was outrageous, dishonorable, and utterly unjustifiable. It is neither happenstance nor coincidence that this years-long torrent of abuse culminated in an assassination attempt.

The Biden-era description of Trump as an “existential threat” should go down in history as the most vicious, brutal, irresponsible, and contemptible political attack in American history.

Source: Crime Prevention Research Center

Cartoon

via Comically Incorrect

For more Rights, Justice, and Culture News.

For more Budget & Tax News.

For more from The Heartland Institute.