States cut red tape to spur economic growth, and the data show it works, as regulatory reform states outpace status quo states.

by Patrick McLaughlin

It seems self-evident that at some point you can have too many regulations. The negative effect of regulatory accumulation has been well documented. Yet most jurisdictions—countries, states, provinces and even municipalities—have a regulatory process that leads only to adding more regulations and rarely to reexamining existing regulations to see what can be removed.

Nevertheless, several U.S. states have reformed their regulatory process in some way over the past few years. The movement was arguably inspired by the Canadian province of British Columbia, which in 2001 recognized a need to cut some of the regulatory red tape that had built up over time. British Columbia’s groundbreaking red tape reduction initiative succeeded in reducing the quantity of regulations on its books by about 40% within three years. Moreover, the red tape reduction caused the province’s economic growth rate to increase by more than one percentage point, thereby converting British Columbia from economic laggard to leader in just a few years.

Now that some U.S. states have taken steps toward cutting accumulated red tape as well, we can start to answer some basic questions about these policy innovations: How well are they working in terms of cutting red tape? And are reform states seeing increased economic growth as a result, like British Columbia experienced? The positive effect of reforming the regulatory process and cutting red tape should not be ignored: Seemingly, any jurisdiction that proactively avoids unnecessary accumulation and cuts red tape might be able to boost its economy as British Columbia did.

Measuring Regulatory Reform

While British Columbia pioneered red tape reduction initiatives over 20 years ago, it was, fittingly, the Pioneer State, Kentucky, that first latched onto the idea in the United States. In the mid-2010s, policymakers in Kentucky learned about British Columbia’s policy innovation and pushed their own version of red tape reduction beginning in 2016. Several other states followed suit over the next seven years, including Idaho, Iowa, Missouri, Montana, Nebraska, Ohio, Oklahoma and Virginia.

To compare states that have effectively cut regulations against those that have not, I examined data from the State RegData project, which I launched in 2016. The project involves collecting all the regulations in effect in a given state at a specific point in time and using artificial intelligence to quantify specific dimensions of those regulations. Primary among the metrics that State RegData produces is the “regulatory restrictions” metric, which serves as a proxy for the prohibitions (e.g., you may not do this) and obligations (e.g., you must do that) contained in regulatory text. Thus, State RegData can show which states are comparatively more or less regulated.

Because State RegData now has data spanning multiple years for nearly all the states, it’s easy to see which states have managed to successfully reduce their total number of regulatory restrictions. It’s also possible to compare economic growth rates for those states against economic growth rates for states that have not attempted to cut, or succeeded in cutting, red tape.

Reform States vs. Status Quo States

In my larger analysis, I focus on those states that have reduced regulatory restrictions by at least 5% since the first year the state was included in State RegData and had made some sort of policy announcement related to its red tape reduction efforts. These reform states comprise Idaho, Kentucky, Missouri, Nebraska, Ohio and Oklahoma. Virginia and Iowa, while mentioned above, aren’t quite at a 5% reduction yet, but I expect them to achieve at least a 5% reduction in next year’s data. (The most recent data for those two states were collected in the summer of 2023, before their reforms began to take effect.)

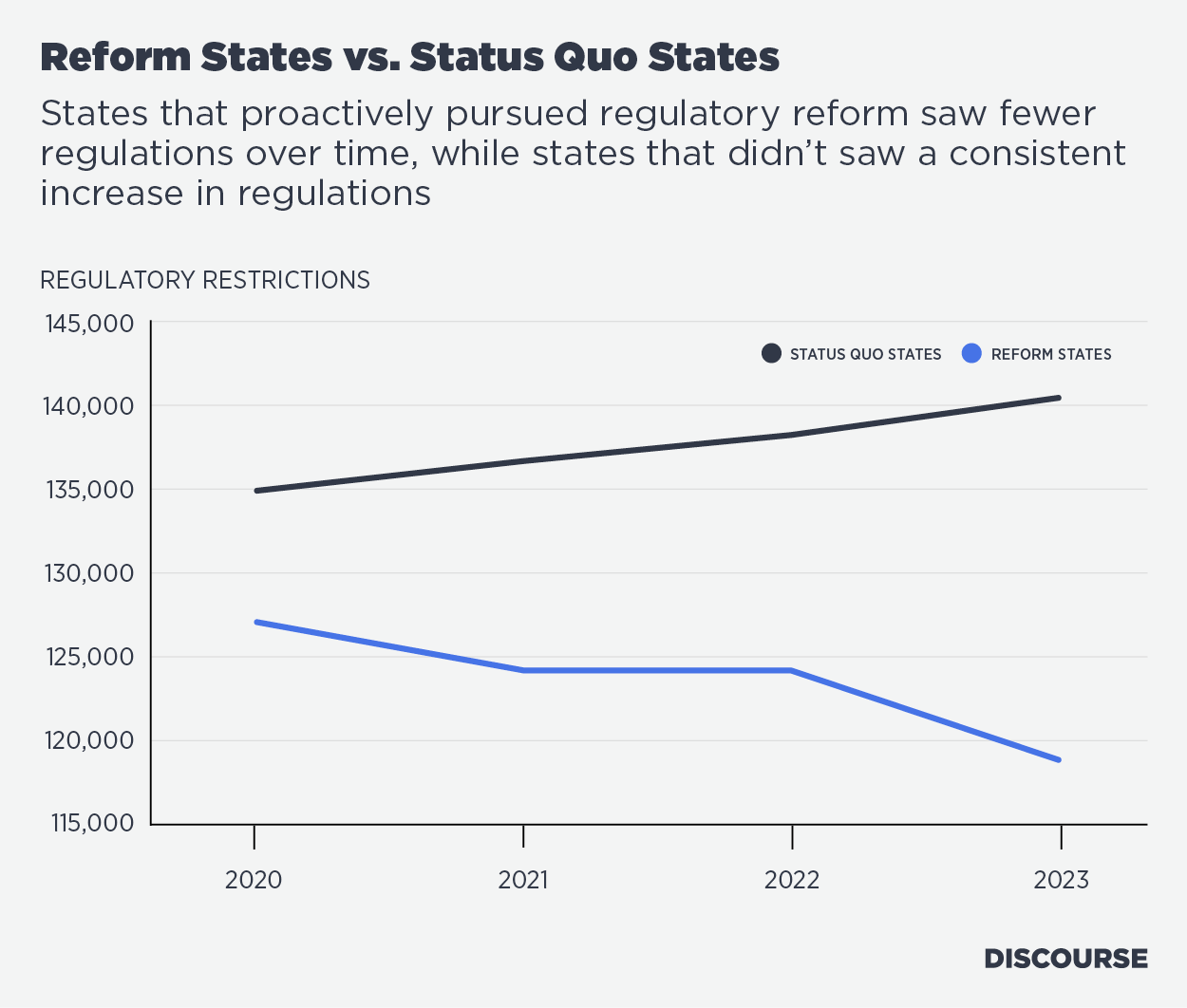

I group the remaining states into a nonreform category that I call the status quo states. Those states have not achieved meaningful (i.e., more than 5%) red tape reduction in the years for which State RegData covers them. The figure below compares the mean of regulatory restrictions in reform states with that of status quo states for the period 2020 through 2023. (Earlier years are not included because the data were insufficient.) This figure demonstrates that the status quo states experience consistent regulatory accumulation, but that trend can be reversed by proactive regulatory reforms that aim to cut red tape.

Implications for Economic Growth

The economics literature is clear on the implications of regulations on economic growth. Those jurisdictions that allow regulations to continually accumulate can expect to experience slower growth as a result. Conversely, cutting red tape should offer better economic performance.

As a test of this theory, how do these two groups of states—the reform states and the status quo states—compare in terms of economic growth? Over the period covered by State RegData, the reform states did substantially better than the status quo states. Reform states experienced average annual growth of 2.09%, whereas status quo states grew at 1.87% on average. For growth rates, a difference of 0.22 percentage points is significant. If that difference were maintained for a 20-year period, the faster-growing group would grow 5.25% more than the slower group—essentially gaining nearly three entire years of economic growth.

Although this quick analysis is by no means dispositive, it certainly suggests that the findings in existing research on the effects of regulatory accumulation and regulatory budgeting are being repeated in the states that have begun cutting red tape. Because British Columbia gained a full percentage point of economic growth only after cutting nearly 40% of its regulations, it seems reasonable to predict that further cutting of red tape in the reform states should further increase the difference in growth rates between them and the status quo states. Therefore, U.S. states that haven’t yet implemented anti-red tape initiatives should consider doing so; otherwise, they could lose out to their less-regulated rivals.

Originally published by the Mecatus Center. Republished with permission.

For more Budget & Tax News.