The Congressional Budget Office (CBO) says it will cost taxpayers more than $25 billion to “paper over” a Medicare drug premium price jump created when the Inflation Reduction Act (IRA) shifted the burden of drug price cuts to Part D insurers.

The result has been a 22 percent jump in 2025 Medicare Part D premiums expected to hit just before the election.

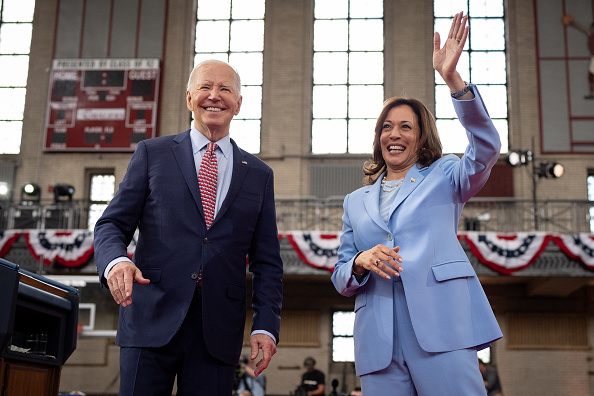

To cushion the blow, the Biden-Harris administration launched a three-year “premium stabilization demonstration” program that will subsidize those affected by the price hike by up to $35 per enrollee in 2024 and $142.70 in 2025. The program will cost $7 billion in 2025, including $2 billion in interest.

Drug Coverage Price Spike

The CBO analysis of the subsidy plan came at the request of the House Ways and Means Committee.

“The so-called Inflation Reduction Act—which is law as a result of Vice President Harris’ tie-breaking vote in the Senate—has led to a predictable spike in the cost of prescription drug coverage for America’s seniors,” said House Ways and Means Committee Chairman Jason Smith (R-MO) in an October 3 news release.

“Rather than change course, the Biden-Harris Administration is cutting taxpayer-funded blank checks to large health insurers to sweep the mess under the rug,” said Smith. “It is a shameful attempt to delay the inevitable fallout of a failed policy that leaves taxpayers footing the bill today and seniors paying the price tomorrow.”

Election-Year Cost-Shifting

The IRA signed into law on August 16, 2022, capped insulin costs under Medicare Part B at $35 a month, eliminated cost sharing for vaccines, and capped out-of-pocket drug costs to $2,000 under Part D. The law also forces drug companies to negotiate with Medicare on the prices of top-selling drugs or face stiff penalties.

To offset other costs, the IRA reduced federal subsidies on catastrophic prescription drug insurance from 80 percent to 20 percent, thus driving up Part D premiums.

“When Democrats unilaterally enacted major changes to Medicare two years ago, they set seniors up for new expenses and fewer options,” said Senate Budget Committee House Ranking Member Chuck Grassley (R-IA). “This nonpartisan CBO analysis confirms CMS’s cost-shifting plan is a dishonest election-year gimmick to cover up those consequences.”

Trump EO Scuttled

Open enrollment for Medicare plans begins in mid-October. Some 13.3 million people are enrolled in Medicare Part D, says the health care research organization KFF, and have been paying $43 a month on average for 2024.

“Medicare Part D premiums increased by over 11 percent from 2021 to 2023, costing seniors on average $52 more per year for their prescription drug coverages,” states the October 3 news release.

Seniors might have saved money if the IRA had not delayed a Trump executive order requiring pharmacists to pass on undisclosed rebates drug companies give to drug plans. The IRA delayed that action until 2032. Coinsurance payments are based on nominal prices, not discounted ones.

Flawed Changes, Cost Estimates

The IRA provision and the Biden-Harris patch will end up wasting billions of dollars, says Joel White, founder and president of Horizon Government Affairs, a health care consultancy.

“CBO has confirmed taxpayers and seniors will pay more because of the flawed IRA changes to Medicare drug coverage,” said White. “In fact, it will now cost more to paper over the law’s problems than the Biden-Harris Administration claimed they saved in ‘negotiating’ drug prices.

White House estimates of costs have been way off, says White.

“To date, the Biden-Harris administration has spent $7 billion to stabilize premiums, which is more than the $6 billion ‘saved’ from price controls,” said White. “In addition, CBO confirmed they undershot the estimate of costs in the IRA. After assessing plan bids—what plans say it will cost to deliver drug benefits to seniors—CBO says the law will cost $10 [billion] to $20 billion more than they originally estimated. I guess this is Bidenomics.”

Broken Promise

“Despite Joe Biden’s promise to never cut Medicare, that is exactly what was done in the IRA bill,” said John C. Goodman, the founder of The Goodman Institute for Public Policy Research, and co-publisher of Health Care News.

“That is the bill that Biden and the congressional Democrats brag about passing,” said Goodman. “It removed more than $300 billion from Medicare – mainly from the Medicare Part D program. Because of that withdrawal, the private sector has to make up the difference and that mainly means Part D premiums were destined to rise.”

This summer, it became clear Part D premiums would skyrocket, just before an election.

“To avert that unpleasant reality, they concocted a ‘demonstration project,’ which is another name for ‘bribery,’ under which insurers would receive billions of dollars if they promised not to raise their premiums,” said Goodman.

“Although the administration claimed the funds for the demonstration project were coming from the Medicare Trust Fund, the trust fund does not hold cash or any other marketable asset, said Goodman. “

“It is nothing more than an accounting device that keeps track of revenues and payments related to Medicare. The trust fund doesn’t even have a bank account,” said Goodman. So, where’s all the money coming from that the administration is giving to the insurance companies? The administration is running up debt that will have to be paid by the taxpayers.”

AnneMarie Schieber (amschieber@heartland.org) is the managing editor of Health Care News.