How much does the federal government really owe?

According to the Treasury Department, the federal debt is about $31.4 trillion. Subtracting the amount the government owes to itself (bonds held by federal agencies), the net debt is roughly $24.5 trillion—close to the nation’s entire annual output of goods and services.

While those are eye-popping numbers, they omit another kind of debt: unfunded promises made by entitlement programs, such as Social Security and Medicare.

Beyond This Horizon

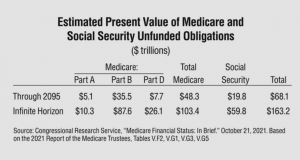

Take a look at the nearby table, which is based on estimates produced by the Social Security and Medicare Trustees. The table shows the value of the unfunded obligations (in current dollars) we have already committed to under current law—that is, without any of the new benefits Congress seems eager to add.

The first row shows the discounted value of everything we have promised between now and 2095 is almost three times our national income of $23.39 trillion. In a sound retirement system, we would have $68.1 trillion in the bank earning interest—so the funds would be there to pay the bills as they arise. In fact, we have no money in the bank for future expenses, and there is no serious proposal to change that.

The second row extends the accounting beyond 2095 and looks indefinitely into the future. The result: under current law, we have already promised future retirees an unfunded amount almost seven times the size of our economy—again, in current dollars.

People sometimes ask why we bother with the second row. Isn’t a 75-year look into the future enough? The problem with such a cutoff is this: for the person who retires in year 76, we end up counting all the payroll taxes she pays over her work life while ignoring all the benefits she expects to receive in return for those taxes. So, a 75-year cutoff makes the financial problem look better than it really is.

Are Estimates Too Optimistic?

Is it possible the Trustees are being too pessimistic in making their estimates?

If anything, they are being too optimistic. The estimates in the table assume Congress will follow the spending restrictions included in the Affordable Care Act (Obamacare)—which was supposed to be paid for by cuts in future Medicare spending. But since Congress has consistently suspended those restrictions over the past decade, the Congressional Research Service has produced a more likely spending path—again based on the Trustees’ assumptions.

In this more probable scenario, the present value of our commitments to the elderly, looking indefinitely into the future, is on the order of ten times the size of the U.S. economy!

Remember, these projections are not estimates produced by right-wing critics of entitlement programs. They come from Social Security and Medicare Trustees—answering to a Democratic Congress and a Democratic president.

Mistaken Beliefs

One reason it will be hard to change these commitments is retirees’ belief they have “paid for” their benefits by means of payroll taxes during their working years. In fact, the taxes retirees paid when they were working have already been spent—virtually the same day they were collected. Nothing was saved for the future.

There are also other obligations it would be foolish to ignore. These include Obamacare subsidies, Medicaid, the Veterans Administration, and numerous other ways in which taxpayers fund health care. As health care costs grow faster than our national income, the burden of these programs will also continue to grow. Unlike Medicare, beneficiaries in these programs did not pay for their benefits by working and paying taxes.

Even so, these programs are also politically hard to change.

‘The Longer We Wait …’

For Social Security, we need to do what 20 other countries did, or partially did, as we entered the 21st century: encourage each generation to accumulate savings in private accounts in order to fund their own retirement needs. This allows a transition to a system in which each generation pays its own way.

A similar approach could also be the answer to the unfunded liability in Medicare. With the help of former Medicare Trustee Thomas Saving and his colleague Andrew Rettenmaier, I modeled how such a reform would work. Whereas 85 percent of Medicare spending today is funded by taxpayers, 75 years from now—under our proposal—60 percent would be funded from private accounts accumulated over the work life of the beneficiaries.

Our reform also included more liberal use of Health Savings Accounts by the elderly. We know that people spending their own money gave rise to such innovative services as walk-in clinics and mail-order drug companies. So empowering patients by giving them more control over their health care dollars on the demand side of the market is likely to produce more price competition on the supply side.

With these reforms in place, we predict the share of Medicare in our economy in the future would be no larger than it is today.

Reform of our entitlement programs is possible. But the longer we wait, the harder it will get.

John C. Goodman (johngoodman@johngoodmaninstitute.org) is president of the Goodman Institute for Public Policy Research and co-publisher of Health Care News. A version of this article appeared in Forbes on February 25, 2023. Reprinted with permission.