Life, Liberty, Property #48: the U.S. House of Representatives passed a very Republican tax bill that expands welfare-state spending.

by S.T. Karnick

IN THIS ISSUE:

- A Very Republican Tax Bill

- No Rate Cuts Until You Eat Your Broccoli, Says Fed

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

A Very Republican Tax Bill

A Very Republican Tax Bill

The $78 billion tax bill passed by the U.S. House of Representatives on Wednesday, the Tax Relief for American Families and Workers Act (H.R. 7024), received relatively positive news coverage in the runup to the vote. The bill was calculated to appeal to liberals and conservatives alike, passing through the House in a 357-70 landslide, with twice as many Republicans as Democrats voting no. That is interesting because the legislation is very Republican—and not in a good way.

The bill increases the child tax credit, delays the phaseout of write-offs for some business capital expenditures, renews a deduction for business research and development costs, and creates new low-income housing tax credits, disaster tax relief, and tax benefits for Taiwan.

The legislation does not increase the cap on deductibility of state and local taxes (SALT), which had threatened to undermine Republican support. Republicans established the cap in 2017, to remove what was essentially a windfall for high-income people in high-tax states. Blue-state Republicans consider the cap a burden on their election prospects, so the House GOP leadership worked on a deal to logroll their support for H.R. 7024, Roll Call reported:

One idea under consideration would be to move a second tax bill in parallel with the $78 billion family and business tax cut deal negotiated by Ways and Means Chairman Jason Smith, R-Mo., and Senate Finance Chair Ron Wyden, D-Ore.

That second bill would pair relief from the $10,000 state and local tax deduction cap with a requirement that parents collecting the child tax credit provide a Social Security number, a source familiar with the negotiations said. The new child credit requirement could offset some of the cost of expanding the current “SALT” limit, helping alleviate concerns of deficit hawks, the source said.

Blue-state Republicans have criticized the Smith-Wyden package for leaving in place the SALT cap, while the potential for undocumented immigrants to access the child credit has been a sticking point for House Freedom Caucus members.

That deal would keep the bill “revenue-neutral,” but it would bail out high-tax states once again.

By far the most highly publicized part of H.R. 7024 was the child tax credit. Everybody loves to give other people’s money away and take credit for it.

“The legislation would make it easier for more families to qualify for the child tax credit, while increasing the amount from $1,600 per child to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025,” CBS News reported. “It would also adjust the limit in future years to account for inflation. When in full effect, it could lift at least half a million children out of poverty, according to the Center on Budget and Policy Priorities.”

The tax credit is refundable, meaning that people who pay no taxes receive the payments as a gift of cash from those who do pay federal taxes.

Former House Speaker Newt Gingrich, a Republican once known for fiscal conservatism, strongly advocated the House pass the bill, writing at Real Clear Policy:

Along those lines, the bill also restores the original intent of the Republican-created child tax credit—helping families and rewarding work. The tax legislation increases the value of the child tax credit for the first time since 2017. It eliminates the penalty for larger families—and increases the refundable portion for the next few years. It provides greater flexibility by allowing taxpayers to use a prior year’s income to calculate the credit. Contrary to some criticisms, the bill preserves all the Trump-era protections against illegal immigrants accessing the credit. (No one currently crossing the border illegally would be eligible for anything in this bill.) Finally, it maintains the $2,500 minimum work requirement and cuts off monthly checks. This should be considered a real victory. And the real experts agree.

The Tax Foundation, the Center for a Free Economy, and even economists at the American Enterprise Institute have looked at the child tax credit proposal and concluded that these modest changes have little to no impact on labor force participation or work hours. Some have even concluded the changes will have a positive impact on the workforce by providing greater incentive to work for those below the poverty line by increasing the value of the next dollar earned.

The problem Gingrich refers to here is fiscal conservatives’ concern that the child tax credit expansion is an unwise move toward a guaranteed national income that would be costly and would further reduce incentives for people to work. The Committee to Unleash Prosperity (CTUP) noted,

[W]e are concerned about the expansion of the child tax credit which provides cash payments to parents of up to $2,100 for each child in the home. Those payments can exceed taxes paid—and are really a backdoor form of welfare.

There are some work requirements, but there are also loopholes that encourage parents to stay out of the workforce or to reduce hours worked.

Even more concerning to CTUP was the “greater flexibility” in getting the credit, which Gingrich likes so much. “As a result, a parent with two children could have collected over $20,000 in EITC and CTC benefits for 2020 and 2021 [on top of tens of thousands of dollars of other benefits] despite not working those years,” CTUP stated. (Brackets in original.)

This major expansion of the credit and of eligibility for it does not make sense when businesses are starving for workers, CTUP noted: “At a time when we need MORE work-aged Americans working, this higher child credit is counterproductive to ensuring healthy families and self-sufficiency through work.” (Emphasis in original.)

If anything, the tight labor market would seem to call for a reduction of benefits for those on the margin, to encourage them to go to work—which would, in addition, improve their prospects in life by getting them into the workforce, where increases in income over time are the norm.

Gingrich, by contrast, considers the expansion to be more of a tweak, and he emphasizes the provisions preventing the lapse of the 2017 Trump business expense reforms:

In exchange for this modest expansion in the child tax credit, the American economy will be supercharged. The R&D provisions of the bill alone would mean over $70 billion in investment over the next decade, according to some estimates. Consider that China gives its companies a 200 percent “super deduction” subsidy for their R&D costs, while the U.S. is one of only two developed nations requiring businesses to spread out R&D expenses over five years. Permanent full expensing would increase investment by $400 billion. This means more orders for equipment and machines from American manufacturers.

Goodman Institute President John Goodman, writing at Forbes, notes that the tax bill is very much in line with the Republicans’ approach to tax and welfare policy for the past several decades. The U.S. federal tax system is far different from what most people think it is, and the Republicans are responsible for what the public would probably consider the most compassionate elements of it (and yes, it is disorienting to put the words “tax system” and “compassionate” in the same sentence):

[S]ome readers may be surprised to learn that more than half of all households today pay no income tax at all. That’s because every Republican tax bill—going all the way back to Ronald Reagan—threw more and more people off the income tax rolls. Through this and other provisions, Republicans have been shifting the tax burden to the rich every time they have legislated. Both private and government analyses confirm that the same is true of the 2017 (Trump) tax reform bill.

That is, of course, the opposite of the way the media and the Democrats (but I repeat myself) characterize the Republican approach to taxation on the federal level, but it is just as Goodman says.

The same is true of welfare, Goodman notes: “Not only is our tax system more progressive than other countries’, our entire welfare system is more progressive. That is, we distribute more from the top to the bottom than any other country. Other countries may have more social insurance, but we have more redistribution.”

That, too, has been a Republican initiative for decades, Goodman observes, citing the GOP’s implementation of economist Milton Friedman’s idea for a negative income tax, which Goodman describes as “[o]ne of the most important vehicles for reducing poverty”:

The legislative version, first introduced in 1975, is called the Earned Income Tax Credit. Closely related is the child tax credit, created by a Republican Congress in 1997. Because of these two measures, by 2018 it was virtually impossible for a working mother to be poor (in terms of cash income), even if she earned only the minimum wage!

The Republicans’ approach puts cash directly in the hands of the needy, whereas the Democrats’ welfare efforts are designed to enrich special-interest groups such as hospitals, landlords, housing developers, agribusiness, and school bureaucracies, Goodman notes. “Even so, congressional Democrats are apparently willing to sign on to a proposal that spends half the money on business tax cuts and the other half on what is essentially a Republican approach to poverty amelioration,” Goodman writes. “That’s a deal Republicans should seriously consider accepting.”

Blaze News Senior Editor Daniel Horowitz strongly disagrees, noting that the credit has already risen significantly over time and has had the perverse (but probably intended) effect of removing millions of people from the tax rolls:

Under current law, according to the Joint Committee on Taxation, the average tax filer in the entire bottom 50% of income earners has a net negative income tax liability thanks to the earned income tax credit and the additional child tax credit. Right now, those programs cost more than $100 billion combined. …

Rather than replacing welfare programs with refundable tax credits, we expanded both to record levels since the Obama years. This has allowed millions of Americans who don’t pay taxes to think they really do, without suffering the pain of electing socialists who are at war with our society, economy, borders, and culture.

The Republicans’ supposedly clean, no-harm alternative to the Democrats’ intrusive, special-interest-driven approach to welfare policy has in fact created huge incentives for ever-higher taxes and spending because, as Horowitz notes, tens of millions of people pay no taxes and instead receive benefits from their friends at the IRS. That creates a huge constituency of people who have no incentive to vote for candidates who offer fiscal sanity. Fiscal conservatism provides no benefit for them—at least not in the short run. If the nation runs out of money down the road, well, that’s something to worry about when it happens, apparently.

This “low-tax socialism, and even negative-tax socialism for some, … has allowed the weaponized leviathan to grow without people having to feel the pain,” Horowitz writes.

The tax bill also makes it more likely the Trump tax cuts will be allowed to expire, Horowitz argues:

By giving Democrats their most prized tax provision on refundable credits, Republicans have lost any leverage to demand an extension of the broader Trump tax cuts slated to expire at the end of 2025. Now that we have released the hostage, Democrats will have no reason to extend the other provisions or agree to a less complex, flatter tax code.

In addition to all that damage, the business tax cuts will in fact backfire on the Republicans politically, because they allow big companies to continue supporting progressive initiatives with impunity, as Horowitz sees it:

The one missing component from the Democrat portfolio is taxation. If the corporations empowered Democrats on that issue, too, they couldn’t survive. Thus, Big Business backs the Republican Party line on cutting taxes, so that it is free to promote the rest of the progressive agenda.

Instead of giving Democrats another welfare-state victory for which they will claim credit and reap electoral benefits, the Republicans should be more than willing to throw woke corporations to the wolves and let them see just how much the Democrats really care about them: “conservatives should be willing to shoot our hostage (business tax cuts) instead of releasing their hostage (welfare spending),” Horowitz writes (parentheses in original).

Horowitz concludes that the tax deal is a big loss for the Republicans and that conservatives should reconsider their priorities given the GOP’s continual failure to gain victories in federal budget and tax wars: “Perhaps it’s time we change strategies. Let’s push conservatism on every other policy so we don’t suffer all the liabilities of zero taxes on many individual Americans and low taxes on corporations without reaping the benefits.”

With all due respect to Horowitz, who has the right views on the current tax deal, I think that giving up on fiscal responsibility would be disastrous. The nation is on a path to massive budget deficits that will create an upward spiral of inflation. The inflation-spike years of 2021 and 2022 will inspire nostalgia if the current spending trends continue—and in fact spending is going to worsen, if past performance is any predictor of future disasters.

Given that tax-rate increases will not raise the federal government’s revenues above 17.4 percent of GDP for any appreciable length of time, the only workable responses are spending cuts and economic growth. Real spending reform will certainly require a new Congress with a new attitude, one that is willing to consider cutting spending back to its 2019 level. That attitude will have to include a willingness to return to private life pronto, as the tens of millions of voters who benefit from the current system will pitch them right out.

Not being beheaded is probably the best these mythical future spending-cutters could hope for.

This means, of course, that such reform will not happen. Voters with no stake in the tax system will sow the wind, and we will all reap the whirlwind.

Sources: The Tax Relief for American Families and Workers Act; CBS News; Roll Call; Real Clear Policy; The Committee to Unleash Prosperity; The Goodman Institute (from Forbes); The Blaze [gated]

No Rate Cuts Until You Eat Your Broccoli, Says Fed

No Rate Cuts Until You Eat Your Broccoli, Says Fed

Wall Street investors and economic analysts have eagerly glommed on to every conceivable signal that the Federal Reserve (Fed) will soon declare inflation defeated and begin lowering interest rates. The White House, too, would like to see an interest rate cut, to boost the president’s flagging reelection prospects, even though he and his supporters continually claim that the economy is presently quite peachy as-is. Apparently, the liberal notion of perfectibility is still alive.

On Wednesday, Fed Chair Jerome Powell delivered his long-awaited verdict: no change. For now. And not soon.

Powell made no commitment to reduce interest rates at any particular time, pouring cold water on widespread hopes for a cut at the Fed’s meeting in March. “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting” to justify a rate cut, “but that’s to be seen,” The Wall Street Journal reported on Wednesday after Powell’s news conference.

Some investors are going to take a financial hit for guessing wrong on the Fed’s willingness to declare victory against inflation: “For most of January, investors in interest-rate futures markets have placed roughly 50% odds that the central bank would cut rates at its next meeting, March 19-20,” the WSJ reported.

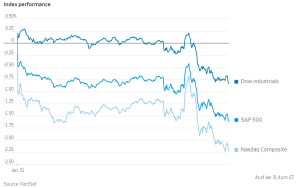

The interest rate announcement hit markets hard on Wednesday:

Stock indexes ended lower Wednesday, with the S&P 500 down 79.32 points, or 1.6%. The index, which on Monday closed at an all-time high, registered its biggest decline since September. Yields on the 10-year Treasury note declined 0.091 percentage point to close at 3.965% after New York Community Bancorp reported a loss and slashed its dividend, igniting new jitters about the health of regional lenders.

Yikes:

Source: The Wall Street Journal

Source: The Wall Street Journal

The Fed did throw a bone to the interest rate reduction hawks, ending its guidance that it was more likely to raise interest rates than lower them. It has now adopted a neutral position that “the risks to achieving its goals of healthy labor markets and low inflation ‘are moving into better balance,’” the WSJ reported. But that was a very small bone, as indicated by the markets’ quick nosedive.

The Fed has been looking for signs that the economy is slowing down, as an indication that inflation will recede with the onset of economic pain. The Fed disappointed the markets by essentially stating that economic conditions are too good right now to merit a change in interest rates and that there is no need for artificial stimulation by the central bank.

As we have noted in previous issues of this newsletter, there are many signs of imminent contraction in the economy. This may well be another case of the Fed raising interest rates too high, too late, and for too long.

Source: The Wall Street Journal

Cartoon

via Comically Incorrect