Higher inflation news over the past two months has sent interest rates sharply higher and led to at least a pause in rising stock prices.

by Robert Genetski

The Week That Was

February’s CPI report shows inflation remain well above the Fed’s target. Monthly annualized rates were 5.4 percent for the total and 4.4 percent for core. The past six-month rates were 3.2 percent for the total and 3.8 percent for core.

Not only was the CPI news disappointing, but February wholesale prices also were up. With prominent inflation measures at least a full percentage point above the Fed’s target, the Fed will be forced to quiet its talk about cutting interest rates or risk undermining their credibility.

February retail sales increased at a 7 percent annual rate. Despite this seemingly large gain, sales were still down for the past three and six-month periods and are up only 1 percent over the past year.

More comprehensive sales data for February won’t be available until the end of this month. However, comprehensive sales data for January show spending rising at a 5 percent annual rate for the last three- to six-months. We suspect the February release will show sales slowed, but not as much as retail sales alone would indicate.

Weekly data on unemployment continue to show no significant signs of layoffs.

Things to Come

February’s CPI report shows inflation remain well above the Fed’s target. Monthly annualized rates were 5.4 percent for the total and 4.4 percent for core. The past six-month rates were 3.2 percent for the total and 3.8 percent for core.

Not only was the CPI news disappointing, but February wholesale prices also were up. With prominent inflation measures at least a full percentage point above the Fed’s target, the Fed will be forced to quiet its talk about cutting interest rates or risk undermining their credibility.

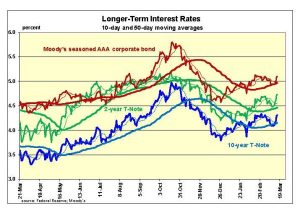

The increases in inflation and longer-term interest rates will make it difficult for the Fed even to talk about easing monetary policy or cutting interest rates.

Previously, Fed members had hinted at reducing its sales of securities. This could have been a first signal of a less restrictive policy. Recent inflation numbers make it difficult for the Fed to do so. We suspect the Fed will continue targeting monthly sales of $95 billion, taking more money from the economy.

Although we continue to expect signs of a weakening in business activity in the months ahead, signs of strength remain.

One potential sign of weakness has been housing. On Monday, the key Homebuilders Index for early March will provide a guide to whether Homebuilders’ confidence continued to improve. Since its November low of 34, the Homebuilders’ Index has risen to 48 (50 is breakeven). With mortgage rates again on the rise, we expect the Index to remain below 50.

Next Thursday’s S&P’s advanced business survey for early March will provide the first hint of any potential change in the business climate. Prior surveys have shown the economy growing moderately with rising inflationary pressures.

Market Forces

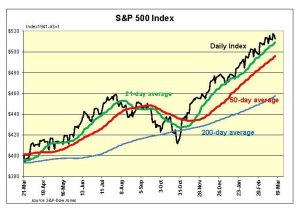

Stock prices have leveled off and are facing resistance to the seemingly endless upward trend. The Nasdaq and Dow had leveled off over the past two week and small cap ETFs (IWM, IJR) fell 2 percent this past week. The S&P500 also shows signs of a pause.

Inflation news has been the main force driving both stocks and interest rates. As we wrote last week, both wholesale and consumer prices were expected to jump for the second consecutive month. They did. Interest rates, which are hostage to inflation news, moved sharply higher.

Inflation reports are the Fed’s members major concern as they prepare for next Wednesday’s policy announcement. Estimates of the economy from two Fed Regional Banks see a moderately strong economy with inflation in the 3 percent – 4 percent vicinity.

The Fed’s main task at its upcoming meeting will be to reassure financial markets that inflation will be contained. Expect Fed members to reiterate their willingness to raise interest rates if necessary to achieve their inflation target.

With the S&P500 close to 30 percent above value, it is normal for stock prices to run into resistance. So far, any weakness in stocks has come on lower volume. So long as the indexes remain above their 50-day moving averages, there continues to be a near-term upward bias to for stocks. As for interest rates, they rebounded sharply at a key level of support. The near-term upward bias for interest rates also remains in effect.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 29 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.