Robert Genetski: Signs the economy is slowing, as a key measure of inflation remains in the vicinity of 2 percent. (Commentary)

The Week That Was

Today’s April report on consumer spending, incomes and inflation was mostly good news. The key inflation measure was up only 0.2 percent keeping year over year inflation in the 2 percent vicinity. Real disposable income was down slightly for the month and essentially unchanged for the past four months.

Yesterday’s first quarter gross domestic product (GDP) report shows the economy increased at only a 4½ percent annual rate as measured by spending and income. With inflation at a 3 percent rate, real growth had slowed to 1½ percent.

The Elephant in the Room: Yesterday, for the first in American history, a former President and current front-running candidate is now a convicted felon. Regardless of our opinions of President Trump, what happened yesterday was a stunning rebuke of the fairness of our legal system and the people currently running it.

In America, everything economic, political and personal is based on the “good faith and credit” of the government—and that is based on the worldwide belief that our country is a social system based on the rule of law. The unprecedented conviction of the leading Presidential candidate on frivolous charges undermines the rule of law. Without a reversal of this travesty, the United States can no longer be considered a free country governed by the rule of law.

Things to Come

Next week’s data includes ISM and S&P business surveys for manufacturing activity (on Monday) and service companies (on Wednesday). April surveys showed the economy weakening in both areas. However, S&P’s advance business survey showed a very strong economy in early May. As a result, the market expects the upcoming surveys to show the business activity rebounded in May. If so, interest rates will stay elevated.

On Friday, the closely watched jobs report is likely to continue to raise questions. The Household survey shows no growth in jobs over the past year. In contrast, payroll data from both ADP and the government show job growth continuing at a 1½ percent to 2 percent rate.

We believe the ADP data are the most reliable since they are based on actual payroll numbers. If the date show payroll growth continuing, it will compound any upward pressure on interest rates.

Market Forces

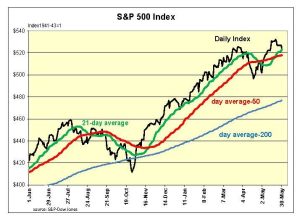

After six consecutive weekly gains, stock prices have moved lower. The S&P500 closed yesterday where it was three months ago.

The modest decline in the S&P500 and the Nasdaq has been on below-average trading volume. This is all normal. Unfortunately, the decline in the Dow has sent it below its 50-day average and where its 10-day average about to fall below its 50-day average. This represents an initial warning of a shift in investor sentiment.

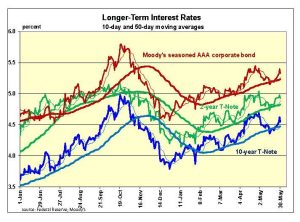

There was little in the way of economic news to drive markets. Fed officials continue to suggest they are not convinced that inflation is down and are postponing any rate cuts.

This shift in sentiment on cutting interest rates was enough to send the yield on 10-year T-Notes back up to 4.6 percent, before retreating slightly. The retreat was due to signs that current dollar spending and incomes are slowing, and also that the Fed’s favorite inflation indicator remains close to the 2 percent vicinity.

This shift in sentiment on cutting interest rates was enough to send the yield on 10-year T-Notes back up to 4.6 percent, before retreating slightly. The retreat was due to signs that current dollar spending and incomes are slowing, and also that the Fed’s favorite inflation indicator remains close to the 2 percent vicinity.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 31 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.