Robert Genetski: core inflation remains, as Fed keeps selling securities in its portfolio in “move toward restricting the money supply.” (Analysis)

The Week That Was

The May CPI inflation report was slightly better than the Cleveland Fed estimates. With oil prices down sharply, the monthly annualized inflation rate was 0 percent while the core rate was 2 percent. Yearly, the total rate was up 3.25 percent and the core was up 3.4 percent.

Even with the latest low numbers, core inflation remains up 3½ percent over both the past three- and six-month periods. Our model shows this is where it should be at this stage as inflation gradually declines toward 2 percent by year-end.

As for monetary policy, the Fed reduced its portfolio of securities by $95 billion in April and $70 billion in May. After Wednesday’s meeting, Fed members decided to slow the decline in its security holdings to approximately $40 billion a month. Although the Fed claims it is maintaining its target interest rate where it should be, its ongoing sales of securities is a move toward restricting the money supply.

Things to Come

Next Tuesday, May retail sales data will reflect contradictory forces. A sharp 7 percent drop in oil prices will put downward pressure on monthly sales. This will be partially offset by a strong increase in chain-store sales, auto sales, and wages. However, retail sales numbers are notorious for erratic behavior and revisions. Hence, they are seldom much of a guide to the economy.

In contrast, Wednesday Homebuilder’s Index is one of the most informative numbers, at least for new housing activity. We expect the report for early June will remain close to 50 (breakeven), up from 45 in May.

Housing remains an important leading indicator for where the economy is heading. The Homebuilders’ report provides the most up-to-date and most accurate view of new home activity. Subsequent reports on housing starts, permits and sales all are delayed over a month and tend to provide little additional information.

Market Forces

The bulls kept running this week, spooked by the latest economic news. Financial markets liked Wednesday’s CPI report, as well as yesterday’s wholesale prices and initial unemployment claims.

The rise in unemployment claims was insignificant since the new total of 242,000 remained below the 253,000 claims from a year ago.

The inflation news was significant. The CPI report showed the monthly inflation rate at 0 percent to 2 percent (annualized). Core wholesale prices rose at only a 1 percent rate for the month and 2.3 percent over the past year.

Fed members goofed when they ran victory laps following some unusually low inflation numbers. Powell now says the Fed is encouraged by the latest numbers, but they won’t make the same mistake. The Fed is not convinced inflation is under control. In fact, since the Fed continues to reduce their portfolio of securities, monetary policy remains geared toward restraint instead of being neutral.

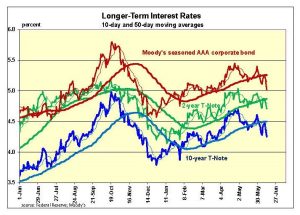

We noted two weeks ago that when the 10-day average for interest rates went below the 50-day average, it often indicates a likely shift from upward to downward pressure on rates. The same crossing level now becomes resistance to upward pressure. This is good news for stocks. The recent decline in interest rates raises our estimate of the fundamental value of the S&P500 from 4,000 to 4,050.

We noted two weeks ago that when the 10-day average for interest rates went below the 50-day average, it often indicates a likely shift from upward to downward pressure on rates. The same crossing level now becomes resistance to upward pressure. This is good news for stocks. The recent decline in interest rates raises our estimate of the fundamental value of the S&P500 from 4,000 to 4,050.

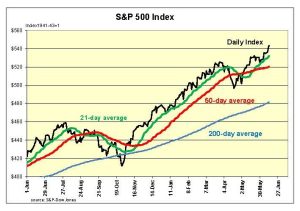

Although the S&P500 remains 34 percent overvalued, the increase in all of our technical signals raises the probability of further gains to 80 percent. For now, the rule that a force in motion will tend to remain in motion means the near-term outlook stocks remains positive.

Although the S&P500 remains 34 percent overvalued, the increase in all of our technical signals raises the probability of further gains to 80 percent. For now, the rule that a force in motion will tend to remain in motion means the near-term outlook stocks remains positive.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 34 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.