Life, Liberty, Property #66: Governments are destroying the American Dream of owning a home, and living in a safe neighborhood.

by S.T. Karnick

IN THIS ISSUE:

- Governments Are Destroying the American Dream

- Courting Wealth Taxes

- China’s Debt Crisis a Warning to the United States

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Governments Are Destroying the American Dream

Governments Are Destroying the American Dream

An excellent new report at Moneywise asks “How much purchasing power will we have in the next 5 years?” and finds the answer is “much less than we would hope.”

The inflation of the past three years has eroded people’s purchasing power at the highest rate since the early 1980s, the study notes. Examining data from the Bureau of Labor Statistics (BLS), the Federal Housing Agency (FIFA), and Redfin, study author Nicholas Rizzo calculated “how far salaries have kept up with inflation over the last five years, and how much money we will have in our pockets in the next five years if things carry on in the same direction.”

Rizzo calculated the median salary for occupations tracked by the BLS and corrected them for inflation, and then projected salaries, inflation, and housing costs forward “to estimate future earnings and purchasing power up to 2033.”

Rizzo’s key findings are chilling (quoting here directly from the article):

- 97% of occupations’ salaries have failed to keep up with inflation over the last five years.

- Salaries have fallen by an average of 8.2% in the last five years. …

- Despite this, house prices have risen by an average of 56% in the last 5 years.

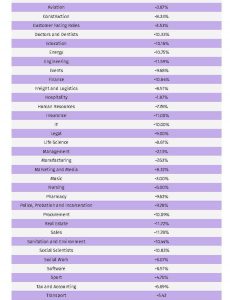

In every occupational field except management professionals, the median salary went down in the last five years:

Source: Moneywise

Americans are much worse off because of the inflation of the past three years, which was created by excessive government spending after the economy had already recovered from the Covid-19 pandemic lockdowns and did not need a “stimulus” by the Democrat-controlled Congress and President Joe Biden. People’s salaries have not kept up with price inflation.

As a result, Rizzo notes, cities are far less affordable than they were just a few years ago—and they were not very affordable then. The American Dream of owning a good house in an orderly place is increasingly out of reach for American workers.

In May, nationwide, the median price for existing homes rose to $419,300, a 5.8 percent increase from a year earlier, The Wall Street Journal reports.

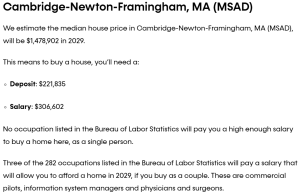

The prospects for future housing affordability look even bleaker, according to the Moneywise report. Are you working on a degree in social work from Harvard University and want to find a house nearby when you’ve graduated? Good luck with that:

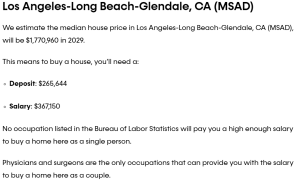

How about sunny southern California? Are you a doctor? If not, forget about it:

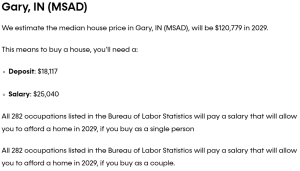

Perhaps you’re willing to set your sights a bit lower. There is one place anybody with an average-paying job can afford to live:

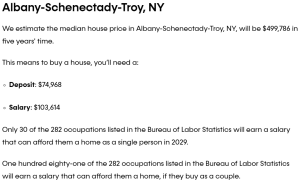

Maybe running for your life every day in Gary does not appeal to you. You might be able to make it work in upstate New York—if you’re married and both of you have jobs with salaries above the median:

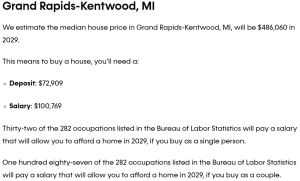

If you want to live in Grand Rapids, Michigan you’ll have to try a bit harder:

The rest of the country looks like those examples. As if that were not depressing enough, there’s an additional element to consider. People receive their individual salaries, not whatever the national median happens to be. In cities with lower housing prices, the salaries are lower. That makes it much more difficult to maintain an income that will allow you to buy the median house in those areas.

In addition, every one of these cities has numerous neighborhoods populated by low-income families. People buy individual houses, not the median house (whatever that might be). Everybody wants to live in a good neighborhood, which costs a great deal more than the less-safe areas. On top of that, young people, early in their careers, have less wealth and lower incomes than those in older age groups. They are also in their child-raising years, which means public safety and school quality are exceedingly important.

With all that in mind, it is obvious that in almost all these cities few, if any, people starting out in life can afford to buy a house and yard on a safe, peaceful street. Even most people well into their 40s will struggle to find an appealing property in orderly surroundings with good public schools and social amenities. In fact, the prospects for this are rapidly heading toward zero in cities across the country.

The central problem is that the demand for housing and public order is much greater than the supply. It is really that simple.

It would be exceedingly easy for policymakers to solve this problem. Two policy changes are vital:

- Cut crime.

- Reduce legal impediments to housing construction, especially zoning and land-use laws designed to halt “urban sprawl,” which make it impossible for the housing market to meet consumer demand.

It is easy to reduce crime; it is simply a matter of political will. It is equally easy to repeal stupid, harmful laws.

Other things that would improve housing affordability and the quality of life in the nation’s cities are equally simple:

- Cutting taxes on personal and business income

- Eliminating unnecessary regulations that inhibit business formation and survival and consequent job formation, and which invite political corruption

- Allowing, but not requiring, neighborhoods to have a mix of property types, where businesses and households can settle as people prefer

- Spending taxpayer money on streets, sidewalks, streetlights, policing and criminal justice, sanitation, storm mitigation, and the like, and not on vanity projects such as entertainment complexes, convention centers, and rapid-transit boondoggles

- Reforming schools so that they teach children what they need to know and do to succeed in life and that convey values conducive to self-reliance and personal responsibility (this can best be done through school choice—which generally requires state-level action—because powerful interest groups disdain these values and continually block reform)

- Concentrating all governance efforts on making it easier for people to find work and decent housing in safe neighborhoods, not on alleviating the problems created by governance that fails to do this.

These are all simply matters of good governance that any place should have, yet few do. America will continue to decline unless governments at all levels turn to these reforms which have proven effective everywhere.

Sources: Moneywise; The Wall Street Journal

Courting Wealth Taxes

The U.S. Supreme Court has opened the door to a wealth tax in its decision in Moore v. United States—though only one of the justices was willing to admit it when supporting the decision.

In a 7-to-2 vote, the Court endorsed a provision in the Tax Cuts and Jobs Act of 2017 that imposed a one-time tax on U.S. investors’ shares of profits from overseas corporations which have not been paid to them directly via dividends or indirectly through the sale of their stock, etc. It is a tax on an increase in wealth attributed to, but not received by, the owner of the property.

The case has important implications for the future because the Court approved a tax on income the plaintiffs never received, a highly unusual decision. Only four justices went on the record as opposing taxes on these unrealized gains, known quite appropriately as wealth taxes. Thus, a majority of the justices left open the possibility of approving explicit wealth taxes—although the wording of the majority opinion suggests that some of those who approved this tax would vote to strike down others.

Justices Kavanaugh, Roberts, Sotomayor, Kagan, Jackson, Barrett, and Alito voted to uphold the tax provision, and Thomas and Gorsuch argued that it should be stricken down. Barrett and Alito, in an opinion concurring with the majority decision, stated that they oppose taxes on unrealized gains. Jackson wrote a concurring opinion saying the Constitution allows taxes on unrealized gains.

As has been common in recent decisions of the Court, the justices’ findings in Moore v. United States hinge on their widely varying interpretations of meaning of terms and phrases in the Constitution, and the laws and rulings under consideration. In the present case, it is all about the meaning of the word “income,” as noted in the syllabus of the decision:

Income, the Moores argue, requires realization, and the MRT does not tax any income that they have realized. But the MRT does tax realized income—namely, the income realized by KisanKraft, which the MRT attributes to the shareholders. This Court’s longstanding precedents, reflected in and reinforced by Congress’s longstanding practice, confirms [sic] that Congress may attribute an entity’s realized and undistributed income to the entity’s shareholders or partners and then tax the shareholders or partners on their portions of that income.

The majority opinion makes sure to state that the justices are not saying that taxes on unrealized gains are constitutional, only that this one is: “the precise and narrow question that the Court addresses today is whether Congress may attribute an entity’s realized and undistributed income to the entity’s shareholders or partners, and then tax the shareholders or partners on their portions of that income,” and “nothing in this opinion should be read to authorize any hypothetical congressional effort to tax both an entity and its shareholders or partners on the same undistributed income realized by the entity. In such a scenario, the entity would not simply be a traditional pass-through.”

The majority notes that the government, in arguing for approval of the tax, “acknowledges that the constitutionality of a hypothetical unapportioned tax on appreciation may depend on, among other things, whether realization is a constitutional requirement for an income tax. … The Moores argue that realization is a constitutional requirement; the Government argues that it is not. To decide this case, we need not resolve that disagreement over realization. Those are potential issues for another day, and we do not address or resolve any of those issues here.”

Justice Jackson is ready and indeed eager to decide on whether the Constitution requires realization for a tax to be valid. To strike down the provision, Jackson writes, “First, we would need to agree with petitioners that Congress can tax income only if it is actually received or ‘realized.’ That alleged requirement appears nowhere in the text of the Sixteenth Amendment.”

Jackson recognizes that this opens the door to explicit wealth taxes, and she uses the concept of legislative supremacy to justify her approval:

I have no doubt that future Congresses will pass, and future Presidents will sign, taxes that outrage one group or another—taxes that strike some as demanding too much, others as asking too little. There may even be impositions that, as a matter of policy, all can agree are wrongheaded. However, Pollock teaches us that this Court’s role in such disputes should be limited. “[T]he remedy for such abuses is to be found at the ballot-box, and in a wholesome public opinion which the representatives of the people will not long, if at all, disregard, and not in the disregard by the judiciary of powers that have been committed to another branch of the government.” [citations removed]

Jackson is very clear in her conclusion: “income” is whatever Congress and the president say it is.

Justices Barrett and Alito broke with the majority on affirming whether realization is necessary, and they state explicitly that federal taxes on property must be apportioned among the states according to population, unlike the law in question. Barrett writes,

The question on which we granted review is “[w]hether the Sixteenth Amendment authorizes Congress to tax unrealized sums without apportionment among the states.” The answer is straightforward: No. …

The Sixteenth Amendment’s reference to income “derived” from any source encompasses a requirement that income, to be taxed without apportionment, must be realized. While the Government stresses that the Amendment did not include a “realization” requirement, Brief for United States 15–16, “realize” and “derive” have long referred to the same concept. … Many opinions use “derived” and “realized” more or less interchangeably. …

The “commonly understood meaning of the term” income when the Sixteenth Amendment was ratified requires that a gain be “realized” or “derived”—e.g., through a sale or other transaction—to be taxed without apportionment. …

Regardless of whether one uses the term “derived” or “realized,” the important point is this: The Sixteenth Amendment and the Direct Tax Clause distinguish between taxes on property, which are subject to apportionment, and taxes on income derived or realized from that property, which are not. [citations removed]

“The Moores have not realized income from their KisanKraft shares,” Barrett writes. The evidence in the case and common sense both affirm that point, Barrett argues: “Because they have not received a dividend, profit from selling their shares, or any other pecuniary benefit from their stock ownership, the Moores have not yet received a return on their original investment in the company. In short, they have not ‘derived’ income from their shares because nothing has come in.”

Barrett wants to limit the Moore decision to this tax provision only, arguing that Congress’s ability to “attribute income of a closely held foreign corporation like KisanKraft to its shareholders does not mean it has equal power to attribute the income of a publicly traded domestic corporation to anyone holding a few shares in her retirement account.” In short, Barrett wants to keep that can of worms closed while lifting the cap ever-so-slightly.

To do so, Barrett would essentially throw out the case on a technicality:

Subpart F and the MRT may or may not be constitutional, nonarbitrary attributions of closely held foreign corporations’ income to their shareholders. In this litigation, however, the Moores have conceded that subpart F is constitutional. … Taxpayers generally bear the burden to show they are entitled to a refund. Given the Moores’ concession, they have not met that burden here. For that reason, I concur in the Court’s judgment affirming the judgment below. [citations removed]

Thomas, joined by Gorsuch, eviscerates the others’ arguments in a long, detailed, and powerfully argued dissent that uses the very existence of the Sixteenth Amendment to demonstrate why the government may not tax unrealized “income”:

[The Moores] argue that a tax on unrealized investment gains is not a tax on “incomes” within the meaning of the Sixteenth Amendment, and it therefore cannot be imposed “without apportionment among the several States.”

The Moores are correct. Sixteenth Amendment “incomes” include only income realized by the taxpayer. The text and history of the Amendment make clear that it requires a distinction between “income” and the “source” from which that income is “derived.” And, the only way to draw such a distinction is with a realization requirement.

Thomas examines that “text and history” in great depth to prove the amendment establishes a realization requirement. Here’s an excerpt:

With a full understanding of the context against which the Sixteenth Amendment was ratified, two conclusions become clear. First, because the Amendment abolished Pollock’s rule that an income tax must be classified as direct or indirect based on whether a tax on the source of that income would be direct or indirect, the Amendment created a constitutional distinction between income and its source. Second, because Sixteenth Amendment “income” must be distinguished from its source, the Amendment includes a realization requirement. …

… The text of the Amendment incorporates such a requirement, and the concept of realization was well understood at the time of ratification. The Constitution thus limits unapportioned income taxes to taxes on realized income. [citations removed]

Thomas’s dissent is highly critical of the premises behind the majority decision, indicating that the logic behind the ruling is extremely flawed:

Today, the Court upholds the MRT only by ignoring the question presented. It does “not address the Government’s argument that a gain need not be realized to constitute income under the Constitution.” Instead, the Court answers the question “whether Congress may attribute an entity’s realized and undistributed income to the entity’s shareholders or partners, and then tax the shareholders or partners on their portions of that income.” After changing the subject, the majority upholds the MRT by relying on unrelated precedent to derive a “clear rule” that “Congress can attribute the undistributed income of an entity to the entity’s shareholders or partners.” I respectfully dissent. The Ninth Circuit erred by concluding that realization is not a constitutional requirement for income taxes. And, the majority’s “attribution” doctrine is an unsupported invention. …

The Biden administration’s lawyers are arguing that the Sixteenth Amendment allows Congress to impose wealth taxes, Thomas observes:

[T]he Government is not shy about the fact that its definition of income includes things such as “increase in the value of a corporation’s capital assets,” “increase in the value of unsold property,” and “appreciation in the value of securities.” Those increases are “income” in a purely economic sense, but not in a sense that meaningfully distinguishes between “income” and the “source” from which it is “derived.” A tax on each, whether it be an increase in assets, unsold property, or securities, would be a tax on the value of real estate or property, and should therefore require apportionment under the Direct Tax Clause. [citations removed]

Thomas concludes that the majority strains credulity in trying to uphold the tax on unpaid profits while claiming that un-apportioned taxes on individuals’ unrealized gains in wealth are constitutional:

The majority acknowledges that the Sixteenth Amendment draws a distinction between income and its source. And, it does not dispute that realization is what distinguishes income from property. Those premises are sufficient to establish that realization is a constitutional requirement. Sixteenth Amendment “income” is only realized income. We should not have hesitated to say so in this case. I respectfully dissent.

It is evident that the justices that signed the majority decision or the Barrett concurrence tried very hard to allow the tax while somehow keeping the door closed to any obvious taxes on unrealized gains. Justice Jackson is at least clear in her opinion: yes to the tax in question, and a big yes to other taxes on unrealized gains. Thomas and Gorsuch are equally direct and are correct on the law and the Constitution: all taxes on unrealized gains violate the Constitution, and this is one.

A near-universally understood law of economics is that if you tax something you get less of it. Taxing wealth means that we will have less of it. Unfortunately, we are living in a time where unconstitutional actions with exceedingly harmful consequences are increasingly the norm.

Source: Supreme Court of the United States

China’s Debt Crisis a Warning to the United States

Back in the early 1990s, analysts in Western nations were becoming fascinated by China’s economic growth, and many were predicting that the then-liberalizing Communist country would displace the United States as the world’s largest and most-productive economy.

The international policy analyst Gen. William E. Odom, ret.—my then-colleague, for whom I was editing a book and other studies—disagreed firmly.

China, Odom said, will not catch up to the United States for at least several decades, if ever. The nation’s economy was then so small that even record-level economic growth could not raise China to the level of the United States for many decades, if ever, especially in per-capita terms. This was evident through simple math, Odom noted. The amount of investment required would be unsustainable, especially under a Communist government which showed no signs of accepting the necessarily vast reduction of economic management by the Chinese Communist Party and “letting a thousand flowers bloom,” as the catchphrase of the time idealistically forecast, that would be required for such growth.

Odom was right.

China is currently laboring under massive debt and has no chance of catching up to the U.S. economy in the foreseeable future.

A new study from the American Enterprise Institute by AEI Senior Fellow Derek Scissors affirms this observation Odom made three decades ago:

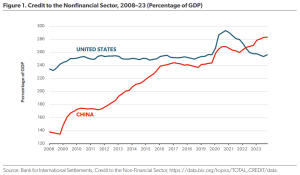

At the end of 2008, China’s outstanding credit to the nonfinancial sector—cutting out intra-financial sector transactions—was 135 percent of gross domestic product (GDP). This compared favorably to 242 percent for the US. (See Figure 1.)

But 2009 turned out to be an inflection point. PRC stimulus announced in fall 2008 in response to the global financial crisis materialized in 2009. It was not fiscal, as most still claim; it was monetary. There was a 35-point jump in outstanding credit in 2009 alone, comparable only to America and Japan in 2020, according to BIS [the Bank for International Settlements]. Two years later, the turning point was for Chinese growth, which started its premature and apparently surprising decline. … Leveraging increased more gradually through the transition from Hu Jintao to Xi Jinping in 2012 and 2013, and outstanding credit hit 243 percent of GDP in 2016.

At the beginning of 2024, China’s debt had risen above 283 percent of GDP, an increase of 143 percentage points over 15 years. That is the worst debt accumulation ever recorded by a major economy, Scissors notes.

Despite our government’s countless policy mistakes over the past couple of decades, “American outstanding credit is said to have risen less than 15 points from 2008 to 2023, passing 256 percent of GDP in 2023,” Scissors notes, although “liabilities picked up in 2023, which BIS does not yet show,” because of massive overspending instituted by Congress and President Joe Biden in 2021 and 2022.

Under Xi, China’s government borrowing increased rapidly and displaced Chinese private-sector (so-called) corporate debt, with the annual fiscal deficit rising from $20 billion in 2008 to $820 billion in 2023, with the comparable numbers for the United States being “$460 billion in 2008 and an absurd $1.7 trillion in 2023,” Scissors reports.

This borrowing has been catastrophic for China’s economy, Scissors argues: “For years (including 2023), China has engaged in the fiscal stimulus many want. Results are as seen.” Between 2008 and 2023, the “Chinese money stock soared to basically twice the size of American money stock, despite a smaller economy, reinforcing the BIS story of fast-deteriorating PRC leverage putting the country in a worse situation than the US.”

China’s unduly rapid monetary growth indicates the country will continue to accumulate debt and further undermine the Chinese economy, at least as long as Xi remains in power. “It’s not possible for the economy to adjust quickly enough to fruitfully absorb all that money; some will certainly be wasted,” Scissors notes.

Odom was right to expect that China’s economic growth would slow and that that would prevent it from catching up with the United States. “In the mid-2000s, it was reasonable to think China would ultimately surpass the US, using unbiased numbers,” Scissors writes. “By 2021, debt alone had made that highly unlikely.”

China’s debt problem should serve as a lesson to U.S. policymakers, Scissors notes. The enormous spending increases by the U.S. government in 2020 were imposed as an attempt to stimulate the economy in the face of massive lockdowns. The fact that the spending hikes were inexcusable Keynesianism and the lockdowns were counterproductive even for their stated purpose of saving lives, shows even those spending hikes were unjustifiable. The spending increases of 2020-2022 are best described as demented.

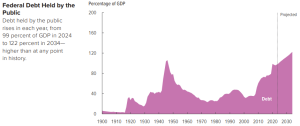

[A footnote to the previous paragraph: the right response by the U.S. government in 2020 would have been to cut federal spending and tax rates significantly, as President Warren G. Harding did, quite heroically, when faced with a brutal recession in 1920-1921 just as he took office.]Like China’s debt explosion, the post-Covid U.S. government spending spree is unjustified and will do enormous damage to the nation’s well-being:

Source: Congressional Budget Office

The United States is in a far better position than China today, yet our current government-spending trajectory is sure to land us in a plight similar to what the Chinese Communist Party has brought on in China. We have time to avert that eventuality, though our national leaders show little to no evidence of the will to do so.

Source: American Enterprise Institute

Cartoon

via Comically Incorrect

For more great content from Budget & Tax News.

For more from The Heartland Institute.