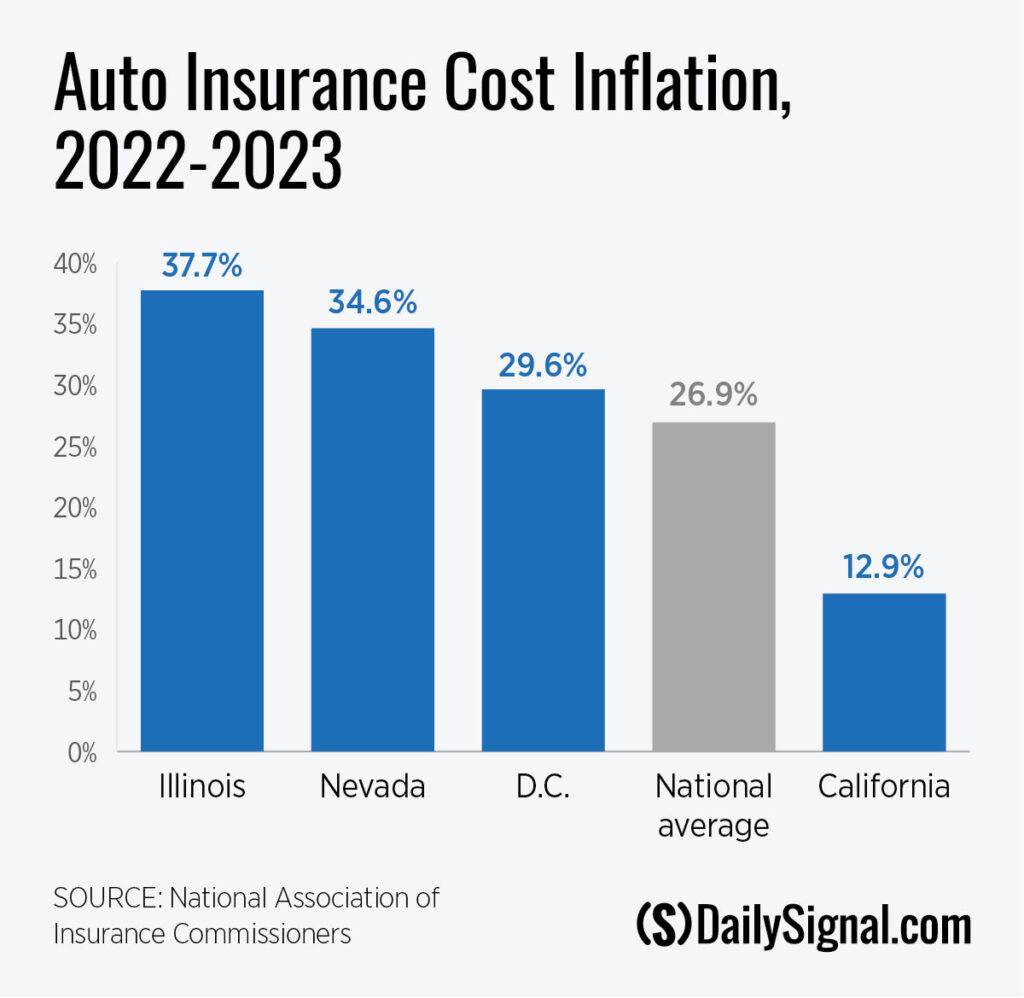

Over the past two years, auto insurance prices have surged by an average of 27% nationally. That’s an increase from $127 a month in 2022 to $161 a month by the end of 2023.

The increase in insurance premiums far outpaces the overall average inflation rate of 12% over the same time period.

These price hikes strain the budgets of all American motorists, especially those who depend on their cars for work, grocery shopping, or picking up their kids from school.

Four main factors are driving up auto insurance rates: increasing vehicle thefts, soft-on-crime district attorneys, burdensome regulatory policies, and the broader impact of inflation on the car industry.

In 2023, the National Insurance Crime Bureau reported more than 1 million auto thefts in America, levels not seen since 2007. For example, Washington, D.C., saw a staggering 64% increase in vehicle thefts in 2023. Consequently, insurance rates in the nation’s capital rose by 30% between 2022 to 2023. Nevada endured an 18% increase in motor vehicle theft, and insurance rates climbed 35% in the Silver State.

The increase in vehicle thefts force companies to raise prices for consumers to cover their growing losses.

Unfortunately, many district attorneys are increasingly lenient on crime. For example, the District of Columbia’s Attorney General, Brian Schwalb, has stated that the District cannot “prosecute or arrest our way” out of surging crime. Meanwhile, Schwalb has declined to prosecute minors arrested for carjacking.

Instead, he has decided to focus his efforts on cracking down on the supposed “health hazards” of gas stoves.

However, auto insurance rates in California seem to be an outlier from this national trend. Auto insurance prices have increased only 13% since 2022, despite cities like Los Angeles and San Francisco leading the nation with more than 70,000 and 40,000 automobile thefts annually, respectively.

The truth is, the Golden State’s regulations prevent insurers from raising rates adequately, causing insurance companies to leave the state. Since October 2023, Californians have lost at least six insurance companies. The largest company to leave is Tokio Marine Co., which wrote nearly a trillion dollars in auto insurance premiums across the U.S. last year.

Big insurance brands are scaling back their efforts as well. In 2022, Geico closed all of its offices in California. Progressive has stopped advertising there, and State Farm now only offers quotes in person.

Since these insurance companies recoup their financial losses by charging higher prices in safer areas, customers in other states are forced to subsidize companies still operating in California.

Instead of stabilizing the auto insurance market by keeping car prices down, the Biden administration has introduced new regulations that will increase vehicle prices and, thereby, exacerbate insurance issues.

The Department of Transportation announced new vehicle efficiency requirements that will jack up future car prices. Additionally, the Environmental Protection Agency mandated that 70% of all passenger cars sold by 2032 must effectively be all-electric or plug-in hybrid. Because more expensive cars have higher premiums, these regulations will only further inflate premiums.

From 2021 to 2022, new vehicle prices rose 13%, while used car prices soared 40%. Although the prices of new and used vehicles have cooled from all-time highs in recent months, consumers still feel the pain of lagging insurance adjustments. Moreover, the price of manufacturing materials for automobiles has increased, leading to inflating vehicle prices. As vehicle prices, repair costs, and insurance claim costs skyrocket, premiums will inevitably catch up to cover those expenses.

These additional costs intensify the financial burden on middle- and working-class Americans. To cool the auto insurance market and bring prices down, policymakers must enforce the rule of law and remove price control measures that cause market instability. By enacting these crime and regulatory policy reforms, Americans can worry less about their cars being stolen and about affording their next auto insurance payment.

Originally published by The Daily Signal. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.

EV Dangers Daily Becoming More Evident...

EV Dangers Daily Becoming More Evident...