Robert Genetski: Interest rates and price inflation was trending lower this week, and stock markets gained some optimism. (Commentary)

The Week That Was

July inflation numbers were all good news. Wholesale inflation was essentially zero and consumer prices increased at a 2 percent annual rate.

The downward year-over-year trend now shows both the total CPI (2.9 percent) and core CPI (3.2 percent) moving toward the Fed’s target. Statistically more encouraging are the annual rates for the six months ending in July, 2.5 percent for the total and 2.8 percent for the core.

The good news continued with retail sales up 1 percent in July. As noted in last week’s report, sales had been much weaker than incomes and we expected sales to catch up. They did. With the surge in sales in July, both retail sales and incomes grew at a 4 percent annualized rate for the six months ending in July,

The August Homebuilders’ survey fell to 39 despite a drop in mortgage rates to 6.7 percent in early August. Builders’ main concern was a lack of affordability among buyers. With mortgage rates dropping further to 6.4 percent, builder sentiment should improve in the months ahead.

Things to Come

At the Democrat Convention Harris will provide more details on how her agenda might differ from the Biden-Harris agenda. We expect Harris to emphasize goals and ambitions for improving economic conditions, but few details on how to accomplish those goals.

On Wednesday the Fed Minutes of its July meeting should be a nonevent.

S&P releases its advanced August business survey on Thursday. June and July surveys both show the service sector growing consistent with the Atlanta Fed estimate of real growth in the 2 percent to 3 percent vicinity. We expect S&P to continue to report similar growth for early August.

Market Forces

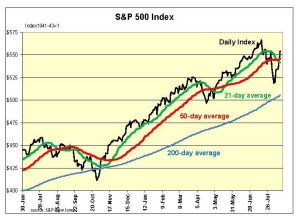

After declining by 8½ percent from its all-time high in mid-July, the S&P500 has rebounded sharply. The gains came from positive economic news on inflation and retail sales. At yesterday’s close the S&P500 was 35 percent above our estimate of its value, up from 30 percent a week ago.

The presidential betting odds have moved decisively to Harris, while polling averages show the race is a tossup. Harris began to discuss her economic policies by blaming business’ gouging for inflation. Her solution is to put price controls on businesses to get prices down.

Harris’ economic policies reflect the naivety of someone lacking any understanding of economics. Historically, price controls produce shortages. Once the shortages appear they continue until the public and politicians decide not being able to buy something is worse than paying a higher price for it. As the controls are removed, prices soar and shortages end.

With the sharp reversal in stock prices on Tuesday our momentum model shifted from 50 on Monday to 80 on Tuesday and Wednesday, and to 100 (maximum upward momentum) yesterday. Of course, after six consecutive up days, the market is overdue for at least a slight correction.

In attempting to downplay the impact of a single day, it can be effective to use the 5-day average of readings. As of yesterday’s close, the 5-day average is 72, moderately positive.

With the S&P 35 percent overvalued conservative investors should remain cautious about becoming overly invested, but look to add to stocks so long as momentum remains positive.

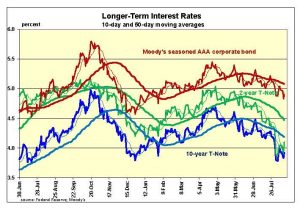

Interest rates continued to trend lower, particularly at the near end of the curve. With both the 3-year and 10-year T-Note yield at 3.9 percent the yield curve is returning to a more normal shape. As the Fed lowers its target rate, the short end of the curve also will become more normal with short-term rates below longer-term rates. We are about six months away from a return to a more normal yield curve.

Outlook

Economic Fundamentals: neutral

Stock Valuation: S&P 500 overvalued by 35 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.