Stocks are becoming increasingly overvalued, and some downward move is overdue. Even so, there are reasons to believe they could become even more overvalued. A rapid decline in COVID cases and deaths bodes well for the economy.

The Week That Was

Consumer prices rose at a 3 percent annualized rate in January, caused primarily by the soaring price of oil. Excepting the increase in oil costs, prices were stable.

Initial unemployment claims have been stable since October, with the number of people applying for unemployment 850,000 above new hires. Even so, the number of people receiving unemployment insurance payments continues to move lower. Payments were made to 4.5 million at the end of January, down from five million a month ago.

Things to Come

The economic reports next week should continue to provide good news. Wednesday’s report on retail sales should show a sharp increase after December’s unusual decline. The Fed’s measure of manufacturing output in January and the Homebuilders’ Survey for February should also reflect strong activity.

COVID-19 Developments

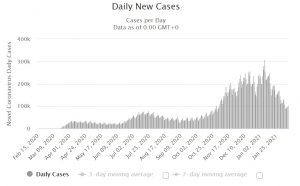

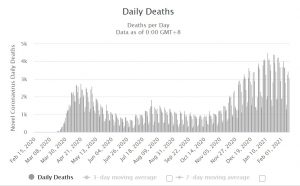

The numbers of U.S. COVID cases and deaths continue to decline rapidly. Deaths tend to follow cases with a lag of about four weeks. Hence, we are on the verge of a steep reduction in daily deaths. The combination of this sharp decline along with ongoing vaccinations should continue to help bring economic activity back to normal.

Market Outlook

The continuation of good economic news this past week sent stock indexes to new all-time highs. Small caps led, with increases in the vicinity of 4 percent. The Nasdaq, S&P, and Dow trailed with gains of 1 percent2 percent.

This week’s good news revolved around earnings. With more than two-thirds of S&P500 companies reporting, fourth quarter earnings are up more than 5 percent from a year ago. This puts earnings 13 percent above the S&P’s long-term earnings trend. However, due to the collapse in earnings earlier in the year, earnings for all of 2020 were 30 percent below the year’s longer-term trend.

According to Zach’s, analysts forecast earnings for 2021 will be 27 percent above 2020. That would place this year’s earnings well below their longer-term trend. With fourth quarter earnings have been above this long-term trend, analysts appear to be substantially underestimating the rebound in profits for this year.

The latest upward move in stock prices brings the S&P500 18 percent above its fundamental value. Stocks are clearly overvalued. Despite this overvaluation, there are two reasons to believe stocks can still move higher.

First, the Fed’s unprecedented monetary stimulus provides a tailwind for stocks. Second, analysts are likely to continue to adjust their earnings estimates upward.

Although there are few signs of higher inflation at present, the upward drift in longer-term interest rates provides the first hint of concern among bondholders. This concern is justified.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P500 over-valued 18 percent

Monetary Policy: highly expansive