Private sector production is headed into a downturn that could paradoxically benefit the economy by keeping the Fed from raising interest rates too far and too fast.

Stock prices are regaining some lost ground following their steep sell-off. The gains are occurring amid signs the economy is on the verge of a recession. Look for more signs of weakness from upcoming economic reports.

The Week That Was

The June Markit business survey shows the U.S. economy close to a downturn. Both the United States and the Euro area had overall readings of 51. With 50 being the break-even mark for growth, the indication is the economies were growing at a rate of less than 1 percent earlier this month.

The survey showed a decline in manufacturing for the first time since the spring of 2020. Moreover, new orders for both manufacturing and service companies also registered their first decline since the spring of 2020. This survey indicates the economy is slowing rapidly at mid-year and is poised for a downturn in the second half.

The upward drift in initial weekly unemployment claims continued into the first three weeks in June. Initial unemployment claims are at 230,000, up from 209,000 in May, 188,000 in April, and 175,000 in March.

Things to Come

The most significant economic news due this coming week is next Thursday’s report on May personal incomes and spending. This is the most comprehensive look at the economy in the middle of the second quarter and will confirm the degree to which the economy slowed.

On Friday, the June ISM manufacturing survey is likely to show manufacturing close to 50, meaning no growth. The advance Market survey put the number at 49. If the ISM survey also shows new orders in negative territory, it will further confirm weakness in the economy.

Money, Money, Money

Fed Chairman Jerome Powell endured the wrath of both Republicans and Democrats during congressional hearings this week. His crime? He and the Fed generously purchased Treasury securities to accommodate Congress’ profligate spending. Senator Elizabeth Warren (D-MA) blasted Powell for raising interest rates and likely helping to push the economy into a recession.

To Market, to Market

Stock prices rebounded this week, with the major indexes rising 2 percent to 5 percent on the week. The gains came despite signs the economy is entering a recession.

This recession is unique. Most recessions are caused by monetary policy errors producing a lack of spending. This one, as in 2020, is a direct consequence of government policies. The Biden administration’s onslaught of regulatory burdens has created significant problems for businesses. The end result is widespread shortages. Shortages are characteristic of countries where government regulations dominate the allocation of resources.

As the economy heads toward the most anticipated recession in history, the challenge becomes the advance measuring of the length and depth of the downturn. This will depend upon the strength of demand. The latest business survey indicates that demand is slowing rapidly. If true, that would reduce some of the pressure on inflation and interest rates in the latter half of this year.

Any relief rom recent inflation, in turn, is likely to moderate the Fed’s inclination to raise interest rates and sell securities. Hence, we are entering a period in which bad news on the economy, in terms of less spending, can be positive news for financial markets and therefore investment in private sector production, the basis for economic growth.

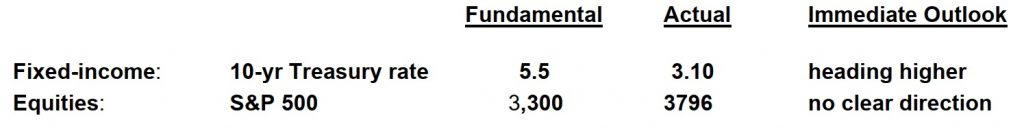

Our analysis shows the S&P500 remains about 15 percent above fundamental value. This valuation assumes further increases in longer-term interest rates. An alternative measure of valuing stocks, using current interest rates, shows stocks are now close to fair value.

Outlook

Outlook

Economic Fundamentals: weakening

Stock Valuation: S&P 500 overvalued by 15 percent

Monetary Policy: changing

For more from Robert Genetski.

More on inflation and unemployment.

For more Budget & Tax News articles.

For more from The Heartland Institute.