Life, Liberty, Property #28: temp-job downturn is bad news, as a leading indicator of a recession.

IN THIS ISSUE:

-

-

- Temp-Job Downturn Is Bad News

- Credit Card Debt Hits New Record

- San Antonio Give-and-Go

- Cartoon

-

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Temp-Job Downturn Is Bad News

Signs of an economic retrenchment in the United States are multiplying. Personally, I have refrained from putting a date on when a recession will arrive, though I have regularly observed that the federal government and Federal Reserve are suppressing the production of goods and services by the private sector, which will surely lower economic output and the national quality of life as measured in economic terms.

Signs of an economic retrenchment in the United States are multiplying. Personally, I have refrained from putting a date on when a recession will arrive, though I have regularly observed that the federal government and Federal Reserve are suppressing the production of goods and services by the private sector, which will surely lower economic output and the national quality of life as measured in economic terms.

The latest sign of an impending downturn is an ongoing reduction in the number of temporary jobs, writes Mises Institute Executive Editor Ryan McMaken at the organization’s (excellent) website.

As I’ve noted several times in previous editions of this newsletter (most recently last week: “Is Unemployment Really Too Low?”), the unemployment rate is not a good measure of the overall trend in the production of goods and services. It is in fact a lagging indicator, not a leading one. The number of jobs for temporary workers is a different story. McMaken notes that the Bureau of Labor Statistics says “falling temp jobs have been closely connected to trends in the business cycle,” meaning they signal an upcoming recession.

The nlumber of jobs filled by temporary help services (THS) has been decreasing throughout this year, McMaken writes:

THS growth turned negative in December 2022 and as of July has been negative for seven months in a row. In fact, THS jobs in July were down 4.7 percent, which is the lowest since 2020 and is comparable to what we saw in the months before the beginnings of recessions in 1990, 2001, and 2007. Temp jobs growth also fell below zero in 2019, reminding us that the US economy was headed for a 2020 recession even without the Covid Panic.

This isn’t just a year-over-year measure either. THS jobs have fallen, month-to-month, for seven months in a row. There is good reason to believe employers are at that part of the cycle in which, as the BLS puts it, “flexible labor arrangements provided by temp agencies allow firms to scale down their operations readily and without the added expense of separation pay or having to let go of their best workers.” There is no longer a need to use THS workers as a means of screening potential new workers or adding work hours to supplement the full-time work force. The need for new workers is fading fast and dropping temp workers is a cheap way to cut costs.

It is clear employers are cutting back on employees’ work hours as well, McMaken notes:

[A]verage weekly hours of all employees have been declining also. This gives us even more reason to believe that employers are trying to find ways to scale back employment without actually getting rid of any trained employees. After all, training employees is costly, as is severance pay. There is good reason to believe that, at least in the short term, employers really are “hoarding workers,” even while total work hours is falling.That is no sign of an overheating economy. The reported unemployment number is low because the federal and state governments are increasingly paying people not to work:

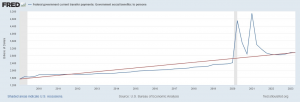

Source: FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/B087RC1Q027SBEA, August 11, 2023

Source: FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/B087RC1Q027SBEA, August 11, 2023

As you can see in the graph, the trendline in federal transfer payments is now well above what it was at the beginning of 2020. The situation is even more severe when you add in state transfer payments:

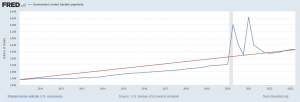

Source: FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A084RC1Q027SBEA, August 11, 2023

Source: FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/A084RC1Q027SBEA, August 11, 2023

Here’s the state and local component broken out:

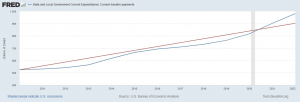

Source: U.S. Bureau of Economic Analysis, State and Local Government Current Expenditures: Current transfer payments [LA0000171A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LA0000171A027NBEA, August 11, 2023

Source: U.S. Bureau of Economic Analysis, State and Local Government Current Expenditures: Current transfer payments [LA0000171A027NBEA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/LA0000171A027NBEA, August 11, 2023

Businesses don’t need as many workers as they did previously—a sign of economic decline—but they are reluctant to lay people off, because they know it is difficult to get new employees to sign on. Hence, they are carrying workers they don’t really need and are cutting their hours to avoid having to find new people down the road.

As noted above, this is another sign of an unhealthy economy made sick by government.

Source: Mises Institute

Credit Card Debt Hits New Record

U.S. households are getting squeezed financially.

U.S. households are getting squeezed financially.

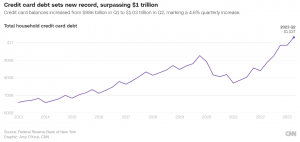

Credit card debt for American households reached an all-time high during the second quarter of the year, surpassing $1 trillion for the first time ever, with a $45 billion quarterly increase, the Federal Reserve Bank of New York reports.

The increase in credit card debt is a return to pre-pandemic rates, the NY Fed reports, though the second quarter debt hike amounts to “a brisk 16.2 percent increase from the previous year,” the institution notes.

Here CNN’s handy graph of the past decade’s changes in credit card balances:

Overall consumer debt remained steady, rising by 0.1 percent, to $17.06 trillion, because the slow housing market kept household mortgage debt from increasing. That is not good news.

Overall consumer debt remained steady, rising by 0.1 percent, to $17.06 trillion, because the slow housing market kept household mortgage debt from increasing. That is not good news.

The family car is also proving more expensive, in addition to the rising price of gasoline, as Reuters reports:

Auto loan balances continued their long-term increase, rising by $20 billion to $1.58 trillion in the second quarter, the data showed. Originations rose about 11% to $179 billion, reflecting the sharp rise in car prices; the number of newly opened loans remains below pre-pandemic levels, the report said.

Consumers are opening more credit card accounts, the New York Fed’s Liberty Street Economics blog notes:

Credit cards are the most prevalent form of household debt and continue to become even more widespread. Consider that there are 70 million more credit card accounts open now than there were in 2019, before the pandemic. What’s more, about 69 percent of Americans had a credit card account in the second quarter of 2023, up from 65 percent in December of 2019 and only 59 percent in December of 2013. And while lending did take a dip during the first year of the pandemic, credit card issuances have been at somewhat elevated levels since.

Credit cards generally have high interest rates, so the increase in credit card debt hits consumers especially hard. Interest rates overall are at a 22-year high.

Nonetheless, the NY Fed economists take an optimistic stance:

Despite the many headwinds American consumers have faced over the last year—higher interest rates, post-pandemic inflationary pressures, and the recent banking failures—there is little evidence of widespread financial distress for consumers. American consumers have so far withstood the economic difficulties of the pandemic and post-pandemic periods with resilience. However, rising balances may present challenges for some borrowers, and the resumption of student loan payments this fall may add additional financial strain for many student loan borrowers. Even so, thus far, household credit shows some early signs of stabilizing at pre-pandemic health, albeit with higher nominal balances.

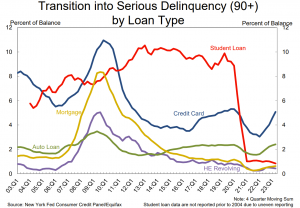

Given that credit card debt changes more rapidly than other kinds, and hence is an indicator of where households’ finances are headed, the NY Fed economists’ optimism seems not entirely justified by this graph from their institution’s website:

Credit card delinquencies hit an 11-year high in the second quarter of the year. “The share of debt newly transitioning into delinquency increased for credit cards and auto loans, with increases in transition rates of 0.7 and 0.4 percentage points respectively,” the NY Fed reports. Credit card debt defaults are outpacing those of other forms of consumer debt, the institution notes:

Credit card delinquencies hit an 11-year high in the second quarter of the year. “The share of debt newly transitioning into delinquency increased for credit cards and auto loans, with increases in transition rates of 0.7 and 0.4 percentage points respectively,” the NY Fed reports. Credit card debt defaults are outpacing those of other forms of consumer debt, the institution notes:

In sum, American households owe more in expensive credit card debt, and the amount is increasingly steadily, but that’s not a problem, according to the New York Fed.

Sources: Federal Reserve Bank of New York; CNN; Reuters; Liberty Street Economics (New York Fed)

San Antonio Give-and-Go

With the San Antonio Spurs having won the first pick in this year’s National Basketball Association player draft, the franchise is looking forward to an improvement on their anemic won-loss record of recent years.

With the San Antonio Spurs having won the first pick in this year’s National Basketball Association player draft, the franchise is looking forward to an improvement on their anemic won-loss record of recent years.

Naturally, the team is now pushing the city to authorize a new stadium for the franchise. San Antonio Report columnist Robert Rivard describes the situation as follows:

The talk is of a potential development that might extend to both sides of the ugly Interstate 37 scarring downtown, with more than enough room for both a Spurs arena and a new Missions [baseball team] ballpark, all set amid an entertainment zone that would help activate the space year-around.

A “City Hall source familiar with the talks” told local TV station KSAT “a public bond is not part of the current discussions.” Of course, that doesn’t mean the team won’t ask the city to have the taxpayers pony up. They just haven’t got to that yet: “Though those talks include whether a downtown move may be feasible, the source said none of the hard details, like locations or financing, have been nailed down,” KSAT reports.

The team has been indicating a possible interest in moving to Austin, Texas, where the Spurs play a couple of “home” games each year. That’s what’s called gamesmanship.

The Spurs’ current arena, the newly renamed Frost Bank Center, was financed through bonds issued by the county and supported by taxes on hotel stays and car rentals. That’s a common way for smaller cities to pay to keep sports franchises in town. The Spurs paid $28.5 million of the $186 million cost of the county-owned arena which opened in 2002 as the SBC Center.

Public funding of these sports palaces is becoming an increasingly contentious issue. As Rivard notes,

Any public funding of new sports facilities will be met with significant support as well as significant opposition. Proponents will overstate the economic development benefits, while aginners will ignore the intangible value of protecting the Spurs as Hecho en San Antonio. Let’s face it: Without the Spurs, San Antonio becomes a much less interesting city.

Why low- and middle-income people should have their taxes increased to pay billionaires to make a city more “interesting” is indeed a fraught question. The economics are certainly unjustifiable, as Rivard acknowledges:

Opponents often cite the work of Stanford University economist Roger Noll, who produced a noted study in 2015 demonstrating that public financing of stadiums and sports facilities seldom generates beneficial economic development in the surrounding neighborhoods. Opponents also are critical of a loophole that allows sports franchise owners to win federal tax exemptions.

The Heartland Institute has produced numerous documents showing that these fully or partially publicly funded arenas turn out to be a bad deal for the taxpayers. Former Heartland Institute President Joseph Bast referred to this as “sports stadium madness” in a Heartland policy study published in 1998. Bast described the situation at the time as follows:

Future historians will look back on the 1980s and 1990s with amazement. Communities that were hard-pressed to keep their schools open or police on the beat nevertheless spent billions of dollars on stadiums and arenas for use by professional sports teams. Even mediocre athletes were paid more for a single season than the average hard-working taxpayer would earn in a lifetime. The average taxpayer, who was taxed to build sports facilities and support players’ salaries, could not afford to walk through the turnstile and watch a live game.

That is still true today. Noll in fact told The Economist in 2017 that he had never found an example in modern history of construction of a football stadium having a significant positive impact on a local economy.

The Spurs’ present home has followed the rule for these sports boondoggles, failing to produce the promised economic benefits to the community, Fox29 San Antonio reports:

When the AT&T center was built more than two decades ago, there was a promise of expansion and development on the East side.

But decades later and that still has not happened—with the east side now feeling left out in the cold.

“Largely, my district is concerned about what was promised to us and how do we get that because we have not gotten it thus far,” Jalen McKee-Rodriguez, district two councilman, said.

Now the Spurs are looking to abandon the neighborhood, which will be left with nothing but broken promises:

“Obviously the AT&T Center was placed there without intentionality with this hope that the private sector would come in and invest,” McKee-Rodriguez said. “But you can’t force private entities to invest in communities that they don’t care about.”

When government and business cooperate, the people generally come out in last place.

Sources: San Antonio Report; KSAT; Fox29 San Antonio

Cartoon

Source: Comically Incorrect