Monetary data point to greater restraint while economic data point to a growing economy.

The Week That Was

This week’s economic news shows the economy continued to advance in November. Today’s job report shows a gain of 150,000 private jobs as well as 50,000 government jobs. Although the economy is holding up well, much of the strength appears fragile. Heavy consumer borrowing and increases in government spending are not characteristics of a healthy economy.

Earlier this week business surveys confirmed an increase in the overall economy. Although manufacturing activity continues to decline, the larger service sector continues to grow. Most significant is the strength in new orders for service companies. S&P and ISM surveys show increases in new orders. The ISM reading remained at 55.5, indicating strong growth.

Things to Come

Tuesday the most visible inflation numbers are expected to show continued moderate month-to-month changes. A sharp decline in oil and gas prices should mean a second month of no increase in the overall CPI. Core CPI is expected to increase by 0,2%. If so, the year-over-year CPI would fall to 3.2%, while the core CPI would be 3.9%.

The Fed meeting on Wednesday is significant. Fed members already have indicated they will not change their target interest rate. However, we believe they are likely to announce further sales in securities. It will likely take clear signs of a slowdown in spending or more convincing evidence of a decline in inflation for the Fed to stop selling securities.

On Thursday retail sales data for November are expected to be weak. For the three and six-months ending in October retail sales have increased at annual rates of 5% to 6%. Over the same period, personal incomes have increased at annual rates of 3% to 5%. The spread of spending over income is even greater on a year-over-year basis. Consumers are out of ammunition. Despite recent signs of strength, the economy faces serious headwinds in 2024.

Market Forces

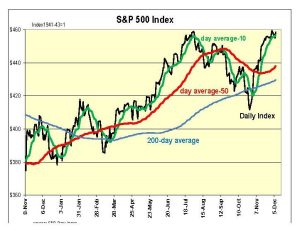

Stocks moved slightly higher this week with the Dow approaching its all-time high. The major indexes registered only fractional gains from last Friday’s close while small cap ETFs (IWM, IJR) increased by 2%.

Technical indicators remain positive for most indexes. Even the badly depressed small cap stocks moved above their 200-day averages. Technical indicators continue to point to further gains in stock prices.

Technical indicators remain positive for most indexes. Even the badly depressed small cap stocks moved above their 200-day averages. Technical indicators continue to point to further gains in stock prices.

The sharp decline in longer-term interest rates is significant in determining the fundamental value of the S&P500. If Moody’s current AAA bond yield of 4.9% persists into the first quarter of 2024, our model shows the fundamental value of the S&P500 at 4,050, up from 3800. Lower interest rates are positive for stocks.

The sharp decline in longer-term interest rates is significant in determining the fundamental value of the S&P500. If Moody’s current AAA bond yield of 4.9% persists into the first quarter of 2024, our model shows the fundamental value of the S&P500 at 4,050, up from 3800. Lower interest rates are positive for stocks.

Financial markets currently reflect confidence the Fed soon will succeed and declare victory over inflation with a cut in interest rates as soon as March.

The timing of any cuts in short-term interest rates will depend on upcoming inflation numbers and signs of weakness in the economy. We continue to believe the Fed will not cut its target until year-over- year core inflation is firmly in the 2% vicinity. This is likely to occur by the middle of next year.

Although the economy held up well in November, monetary and financial indicators continue to flash warning signals. Yesterday’s report from the Fed shows the Fed has removed $1.5 trillion in liquidity from the economy in the past 18 months. Yield curves remain inverted and housing remains weak. These indicators continue to point to potential problems for the economy and stocks in 2024.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 20 percent

Monetary Policy: restrictive

For more Budget & Tax News articles.

For more from The Heartland Institute.