(The Center Square) – Proposed new legislation would revoke the tax-exempt status of any nonprofit organization that is providing material support for terrorist groups.

The bipartisan bill, introduced by U.S. Rep. David Kustoff, R-Tenn., and U.S. Rep. Brad Schneider, D-Ill., comes out of the House Ways and Means Committee, which unanimously approved the legislation last week.

“The abuse of the charitable system for support for terrorist organizations is sickening,” Cliff Smith, Washington Project Director at the Middle East Forum, said in a statement. “Unsuspecting donors deserve better, and the leaders of these charities who take advantage of them certainly don’t deserve to keep their charitable status.”

The issue has been thrust to the forefront after the Oct. 7 attack by the terrorist group, Hamas, on Israel that left more than 1,400 dead and hundreds captured, including Americans.

Since that attack, pro-Hamas and anti-semitic demonstrations have broken out around the country and the world. Several top U.S. universities came under fire for refusing to condemn the worst elements of those protests, and now lawmakers are considering taking a closer look at just who receives federal funds and if those funds make their way to terrorist-supporting groups.

The committee pointed to one instance where the tax-exempt charity, the Holy Land Foundation, funneled $12.4 million to Hamas before being shut down about 20 years ago.

“The Committee learned of other groups, currently operating in plain sight in America, led by many of the same individuals as the Holy Land Foundation,” the committee said in a statement.

Federal foreign aid efforts have wrestled with this issue as well, making clear it is difficult to send financial aid to Gaza without it falling into the hands of Hamas.

In fact, the Office of Inspector General for the USAID, the federal foreign aid agency, released a “situational alert” earlier this year saying it has “identified this area as high-risk for potential diversion and misuse of U.S.-funded assistance.”

“It is USAID OIG’s investigative priority to ensure that assistance does not fall into the hands of foreign terrorist organizations (FTOs) including, but not limited to, Hamas,” the federal watchdog said.

Currently, efforts to block funding to Hamas and other terror groups have focused on overseas work. Under the new legislation, U.S. nonprofits making that same mistake could lose their tax-exempt status.

“It is unconscionable that American taxpayers are forced to provide indirect support for terrorist groups, giving allied organizations and their donors generous tax breaks intended for charitable activities,” Rabbi Yoel Schonfeld, Coalition for Jewish Values president, said in a statement. “There is nothing charitable about supporting atrocities, and there should be no tax exemptions for terror.”

It remains unclear if and when the new bill will get a vote on the House floor.

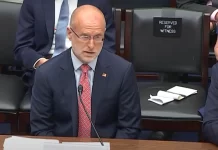

“Our tax code should not be used to support or finance violent terrorism around the world,” House Ways and Means Chair Rep. Jason Smith, R-Mo., said at the committee meeting on the bill last week. “This bill revokes tax-exempt status for ‘terrorist supporting organizations,’ defined as groups that have provided material support or resources to a listed terrorist organization within the past three years.”

Originally published by The Center Square. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.