Life, Liberty, Property #45: It’s the excessive spending by the federal government that is causing prices to rise.

by S.T. Karnick

IN THIS ISSUE:

- It’s the Spending, Stupid!

- In Search of the Optimal Interest Rate

- You Don’t Own What You Think You Own

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

It’s the Spending, Stupid!

It’s the Spending, Stupid!

The latest reports on jobs and inflation send at best a mixed message about the state of the economy.

Inflation is starting to accelerate again. The Bureau of Labor Statistics (BLS) reported on Thursday that although inflation has slowed from its torrid pace of last year, prices remain high and the past few months’ trend toward lower inflation reversed in December:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in December on a seasonally adjusted basis, after rising 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment.

Translated to full-year numbers, price inflation in December was nearly one and a half percentage points above the Fed’s target of 2 percent and headed in the wrong direction, the BLS reports:

The all items index rose 3.4 percent for the 12 months ending December, a larger increase than the 3.1-percent increase for the 12 months ending November. The all items less food and energy index rose 3.9 percent over the last 12 months, after rising 4.0 percent over the 12 months ending November. The energy index decreased 2.0 percent for the 12 months ending December, while the food index increased 2.7 percent over the last year.

Shelter and energy led the price increases, whereas food price inflation remained stable, per the BLS:

The index for shelter continued to rise in December, contributing over half of the monthly all items increase. The energy index rose 0.4 percent over the month as increases in the electricity index and the gasoline index more than offset a decrease in the natural gas index. The food index increased 0.2 percent in December, as it did in November. The index for food at home increased 0.1 percent over the month and the index for food away from home rose 0.3 percent.

Removing food and energy, which are characterized by price volatility and hence can make longer-term comparisons less accurate, inflation stayed stable in December:

The index for all items less food and energy rose 0.3 percent in December, the same monthly increase as in November. Indexes which increased in December include shelter, motor vehicle insurance, and medical care. The index for household furnishings and operations and the index for personal care were among those that decreased over the month.

What all of this means is that the Federal Reserve (Fed) has some tough choices ahead. Fed Chair Jerome Powell and the central bank’s governors clearly want to start bringing interest rates back down, to avert a recession that would provide a very big incentive for voters to reject President Joe Biden’s reelection bid (if Biden ends up being the Democrats’ nominee, which still seems likely). Lowering interest rates, however, could bring on another bout of inflation, the Fed’s governors fear.

The reality is that no one knows what the optimal interest rate is (see next item, below) and hence what the Fed’s target should be. In addition, the most powerful influence on inflation—federal government spending—has continued to rise, which makes anything the Fed does even more dangerous: raising interest rates or keeping them at the present mark will reduce private sector investment and output, and thus bring on a recession, whereas lowering interest rates will fuel an acceleration of inflation as happened in 2021 and 2022.

The one thing that has kept the U.S. economy from collapsing into the deepening ravine between the Scylla and Charybdis of inflation and recession has been the House Republicans.

The GOP’s inability to agree on a budget deal with Biden and the Senate Democrats has slowed the increase in federal spending—slowed it, mind you, not stopped it by any means—and thus taken some of the inflationary pressure off the economy.

Unfortunately, what the economy needs from the federal government is not a stabilization of the massive ongoing budget deficits—currently at a brutal $2 trillion per year—but a rapid lowering of the deficit. The latter cannot be achieved by any means other than major spending reductions.

Spending cuts accompanied by tax rate cuts and a massive reduction of federal regulation of private-sector economic activity would be even better.

This combination of policies would reduce inflationary pressure in two ways. One, the spending cuts would directly reduce the effective demand for goods and services (that is to say, what people want and think they can afford). Two, the tax rate cuts and reductions of meddlesome federal regulation would increase the total output of goods and services—and rather rapidly, as history shows. With more goods and services being produced, inflationary pressure declines ceteris paribus (meaning no new funny business on the fiscal or monetary side).

In addition, the increase in private output of goods and services increases federal tax revenues, thus easing inflationary pressures even more.

The spending deal that House Speaker Mike Johnson and the congressional Democrats are conspiring to inflict currently working on will do nothing of the sort. It basically locks in the current spending level, which is far too high for the economy to sustain. Yes, as The Wall Street Journal notes, the proposed deal means “House Republicans have a chance to show they can actually govern.” Unfortunately, what that really means is that House Republicans will show that they can actually govern like Democrats.

Here’s my simple and indisputable message to Speaker Johnson and the House Republicans:

It’s the spending, stupid!

Source: Bureau of Labor Statistics

In Search of the Optimal Interest Rate

In Search of the Optimal Interest Rate

As if the bloated federal budget were not giving the Federal Reserve (Fed) enough headaches, the central bank faces a fundamental problem that nobody has ever been able to solve: what is the optimal interest rate for the U.S. economy, or any economy?

Given that the Fed’s major tool for accomplishing its dual mandate to “foster economic conditions that achieve both stable prices and maximum sustainable employment’ is the manipulation of interest rates, obviously it would seem that hitting the optimal interest rate would be a critical goal for the Fed. Presumably, that rate would achieve both stable prices and maximum sustainable employment.

Ah, but it’s not so simple as that. Note the massive, distorting effect of federal government spending and regulation I outline above. As I show in that item, excessive federal spending and regulation increase prices and unemployment. What is the optimal interest rate for a distorted economy? Not what would be optimal for a largely free and undisturbed economy, you can be certain.

Financial Times economics columnist Soumaya Keynes tackled this issue in a recent article for the newspaper:

Everyone is struggling to see where interest rates are headed. Investors are jittery, as shown by gyrating long-term Treasury yields. America’s central bankers are trying to project calm, but they are in a fog too. On August 25, Federal Reserve chair Jay Powell summarised the mood when he said “we are navigating by the stars under cloudy skies”. Economists do have some tools to illuminate the path ahead. But they aren’t very helpful.

The object everyone is searching for is the neutral rate of interest, or R-star for short. (Economists seem to struggle with nicknames.) It is the (real) rate that neither buoys nor depresses the economy once temporary shocks have faded away. Central bankers believe that they can neither influence it nor observe it. Their task is merely to divine it.

The central bankers want to identify R-star so they can target that as the prevalent interest rate in the economy. Unfortunately, you cannot target what you cannot see. Keynes discusses the shortcomings of some of the estimates of R-star that have been offered.

The Richmond Fed’s estimate, Keynes writes, is data-heavy but has “statistical error bands the size of a bus,” meaning it does not provide a sufficiently specific reliable number. The New York Fed’s more theory-based estimate proved useless during the pandemic, Keynes notes. The impressively sophisticated model from the International Monetary Fund “is the most theory-driven of them all,” Keynes says, but “the danger is that these results tell you more about modelling than reality. Particularly if you believe a 2017 study from the Bank for International Settlements, which argued that the simultaneous events of falling real interest rates, stalling productivity growth and ageing populations ‘appear coincidental’.”

That last clause is really funny, and intentionally so.

Keynes concludes that the search for R-star has yet to succeed, and in the meantime central banks are wandering in the darkness in their quest for the perfect interest rate that neither suppresses nor stimulates economic activity. The obvious conclusion to Keynes’s valuable exercise, which she does not say, is this: central banks’ control over the money supply reaches the sweet spot of R-star only by accident, if ever. Obviously, that is not a sensible way to manage a currency.

Central banks and economic theorists will continue to pursue the elusive correct estimate of R-star. Without it, or at least the pretense that they are aiming for it, central banks have no foundation for their actions.

With that in mind, maybe central banks are causing more and bigger problems than they solve. Maybe their real function is to help the central government redistribute resources among the population as a means of buying votes. Now, that’s a theory that might have something behind it.

Source: Financial Times [behind paywall]

You Don’t Own What You Think You Own

You Don’t Own What You Think You Own

[The following is a guest column by two colleagues of mine: Heartland Institute policy advisors Bette Grande and Don Grande. It first appeared last Friday at RedState and is republished with permission. The Grandes make important observations about obscure but highly consequential laws on the books in all 50 U.S. states that turn your ownership of investments into an easily breakable “securities entitlement”—essentially a contract between your broker and you—which can push you back in line behind big banks and investment firms in the event of a default. This situation calls for reform via the Uniform Law Commission, which created the system in the first place.]

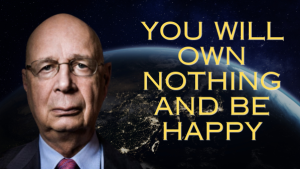

“The board is set; the pieces are moving. We come to it at last.” My husband and I rewatched Lord of the Rings over the holidays, and that line stuck with us. The board has been set without us knowing, and when the pieces move, we will lose. A 2016 World Economic Forum video included a young women’s view that in 2030 you will own nothing and be happy. In many ways, 2030 is already here; the board is set.

If you call your stockbroker to buy 100 shares of Apple, you probably think that you own 100 shares in that company. You don’t. In the old days, when you bought a stock you received a paper certificate of ownership—you owned the shares on the certificate, no middleman. But paper certificates are so yesterday.

In today’s enlightened, digital age, your purchase is simply an entry at your broker’s computer, and you do not own what you think you own. Under laws in all 50 states, what you actually own is a “securities entitlement.” This is a new form of “property ownership” that is more like a contract between you and your broker. Progress.

But if the financial system collapses—think 2008, but much bigger—nearly every stock and bond that is in electronic form can be legally taken as collateral by the largest “too big to fail” financial institutions. Sure, it would crush many millions of individual investors. But it’s all for a good cause: saving the systemically important financial institutions. You can’t make an omelet without breaking a few eggs, right?

This will happen without your knowledge and without any action or fault on your part—even if you are entirely debt-free. If that sounds wrong, it’s because it is. It is also legalized fraud.

So, how did we get here? It is a fascinating story involving some of the most boring and dense state laws on the books. Hat tip to ZeroHedge for posting an article titled “Intentional Destruction: First COVID, Now Comes ‘The Great Taking,’” by Matthew Smith, which was in part based on the work of David Webb and his book The Great Taking.

Most of us have a pretty good understanding of private property. If you buy something outright, you own it and control it. Private property rights were a significant issue at the formation of the United States and have played a vital role in the success of the American experiment. However, some felt that property rights needed to evolve to keep up with technological progress and the fertile imaginations on Wall Street.

The Uniform Law Commission (ULC) was formed for the purpose of developing state-level laws that would change the patchwork quilt of state laws into a more uniform set of statutes. The most prominent uniform law is the Uniform Commercial Code (UCC), and this issue centers around UCC Article 8. The ULC presented a model law revising Article 8 in 1994, and the law was passed by all 50 states over the next several years.

Sitting inside the new Article 8 language are several provisions that put the rights of individual investors at risk. The first significant change is the concept of “securities entitlement.” This is a new form of “property right” that has a few wrinkles. When you buy 100 shares of stock, your broker punches a few keys, and the 100 shares show up in your account.

However, other parties have securities entitlements to the shares as well, even without your knowledge or permission. The section titled “Priority among security interests and entitlement holders” deserves a look. In simple terms, a brokerage company has two accounts with a custodian, a “securities intermediary.” One account holds the brokerage company’s own securities entitlements, and the other account holds all their customers’ securities entitlements, including the entitlement to your 100 shares of stock.

When the brokerage company borrows money from their bank, the assets of the borrower are pledged as collateral for the loan, which makes sense. But if the brokerage firm becomes insolvent, say due to a systemic financial crisis, a secured lender has priority over all the accounts of the brokerage firm, including your 100 shares of stock. Another conspiracy theory?

Here is a summary of a proof-of-concept example offered by David Webb in The Great Taking:

Lehman Brothers filed for bankruptcy when the 2008 housing bubble burst. One of the primary lenders to Lehman Brothers was JP Morgan Bank (JPM). A subsidiary of JPM was Lehman’s custodian, both of Lehman’s own assets and the assets of Lehman’s customers. As custodian, JPM had control of Lehman’s assets, and as lender JPM had a security interest in Lehman’s assets. As a result of UCC Article 8 (and a friendly change to the federal Bankruptcy Code made in 2006), JPM took all of Lehman’s accounts as collateral for the loans that Lehman could no longer pay.

At this point, you may be asking yourself: why would the Article 8 drafting committee do this? The individual investors have no role in the lending practices of their broker, so why does the law allow the taking of their assets?

To answer that question, you need to know the fundamental objective of the Article 8 revisions. The driving motivation was systemic risk in the financial markets. (If they were worried about systemic risk in 1994, what do they think about it now?). Importantly, the Article 8 revisions did not do anything to reduce the likelihood of systemic risk. In fact, the committee made it worse by removing risk and consequences for shady financial activity. Instead, what the changes actually do is protect the “too big to fail” banks if a systemic financial collapse occurs.

The UCC has turned the concept of property rights upside down, but the UCC is embodied in state law, and state legislators can therefore take steps to restore the rights of investors, or at the very least require informed consent.

As states step up to protect their citizens, the “too big to fail” financial institutions will likely claim that any changes to Article 8 will bring down the financial system; that it will be the end of the world as we know it. Perhaps it will, but for us, any system that requires the people to sacrifice their property to support the financial institutions that built this mess in the first place is not a system worth saving.

Source: ZeroHedge

Cartoon