Robert Genetski: Nvidia soars on extraordinary earnings report as AI optimism rises to a new level. As the AI market expands, there is growing belief in its potential to extend U.S. growth and productivity.

by Robert Genetski

The Week That Was

Standard & Poor’s advance business survey for early February shows the economy continues to move ahead. The service sector slowed with a reading of 51 (slightly above breakeven), but manufacturing increased to 51. At readings of 51, the margin of growth is fairly modest. However, S&P claims it still is consistent with real growth of 2 percent in the overall economy.

Things to Come

The coming week is important for economic news.

First up is Tuesday’s report on new orders for durable goods, an important leading indicator. The most stable measure of durable orders (without aircraft and defense) increased at only a 2 percent annual rate in the three and six months ending in December. Total durable goods orders were unchanged in the three months ending in December and down 4 percent over the past six months. The upcoming report will either confirm a flat to down trend or show that orders are rebounding.

Wednesday’s revised estimate of fourth quarter GDP is also important. This release will contain fourth quarter US company profits. This is a broader estimate of profits than the S&P. It is based on corporate tax filings and is more informative of the overall state of US businesses.

The GDP report will also have the first estimate of GDI (Gross Domestic Income) which is the GDP measure of the income side of the economy. Preliminary monthly data show the incomes growing slower than spending. The GDI will show the extent of slowing in fourth quarter incomes.

Another important release will be Thursday’s December report on consumer spending, income and inflation. It provides the most comprehensive data on the extent to which spending and incomes performed at yearend, along with the Fed’s favorite inflation measure. Since the inflation measure has a much lower weight for services, it tends to measure inflation lower than the CPI.

Friday’s February ISM manufacturing survey has been below 50 for more than a year. If the survey moves above 50 (as did the S&P survey), it will tend to confirm evidence the economy continues to perform reasonably well.

Market Forces

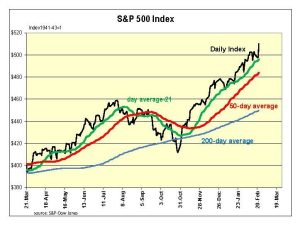

The surge in earnings and sales at Nvidia (NVDA) helped propel the major indexes to new all-time highs. The explosive demand for AI raised the odds that a new technological revolution will positively impact U.S. growth and productivity.

Optimism in stocks also was bolstered by S&P’s early February survey of business, showing both the economy and inflation increasing at rates close to 2 percent.

Optimism in stocks also was bolstered by S&P’s early February survey of business, showing both the economy and inflation increasing at rates close to 2 percent.

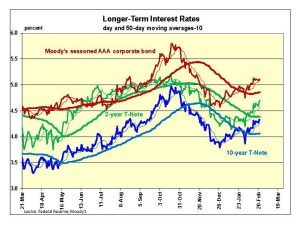

Fed member speeches continue to show concern over higher inflation. They spoke of the need to extend a restrictive policy. Without more convincing signs of a slowdown in both the economy and inflation, the Fed will maintain its current interest rate target and continue to sell securities.

The average lag from monetary restraint to a recession would have produced a downturn by the end of last year. However, the longest lag of 15 months, would point to a downturn by the spring of this year.

It is highly unusual for the stock market not to sense some weakness within three- to six-months of a downturn. So far, the economy has defied the monetary indicators and stormed ahead.

While the AI revolution will raise productivity and the economy, it remains to be seen if it is powerful enough to overcome a shortage of money. So far, in the battle over the direction of the economy, AI is winning.

We believe a shortage of money will continue to slow the economy, leading to a downturn. With the latest surge the S&P500 is overvalued by 28 percent. The market is overdue for a rest or a downward correction.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 28 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.