Robert Genetski: The economy, inflation, and stock prices are all moving ahead, making an interest rate cut unlikely any time soon.

by Robert Genetski

The Week That Was

Yesterday’s consumer spending and income report showed a surge in personal income in January. The 13 percent annualized increase was due mostly to government payments for Social Security and social benefit programs. Wages and salaries increased at a more subdued 4.4 percent annual rate.

The Fed’s favorite measure of inflation soared in January. Total inflation rose at a 4 percent rate and core inflation at a 5 percent rate. Although year-over-year inflation for both measures was below 3 percent, the latest monthly increases will keep the Fed from considering any near-term cuts in interest rates.

The news from the revised GDP report was—no news. Key data on corporate profits and the GDI income measure of GDP were not available.

We estimate fourth quarter GDI growth was at a 3 percent annual rate. This is based on a 3.9 percent rise in personal income and estimated declines in corporate profits. The income side of the economy continues to show slower growth than the expenditure side.

One leading indicator signaling a problem for the economy is January new orders for durable goods. January orders fell 6 percent after showing no increase for the last three months of the year.

Total durable goods orders include orders for aircraft and defense, which tend to be highly erratic. Without these items, new orders essentially were unchanged in current dollars and have been essentially unchanged for the past year. They are likely down after inflation.

Things to Come

Next week the most significant economy news includes Tuesday’s business surveys for service companies. The service sector accounts for 80 percent of the GDP and is the key driver of the economy. S&P’s advance survey for early February points to a continuation of moderate real growth in the 2 percent vicinity. We expect Tuesday’s surveys will likely confirm this pattern.

Friday’s employment report also will be interesting. Three different surveys of the job market provide different conclusions.

The government’s household survey shows no job growth for the past six months, and even the past year. The government’s payroll data show private sector job growth at 1.8 percent (annualized) over the past 6 months. ADP’s payroll data show private sector growth at a 1.2 percent rate for the past 6 months.

Hopefully, February jobs data can reconcile some of these differences.

Market Forces

Stock prices edged higher again this week as economic news continues to show both the economy and inflation moving rapidly.

The Atlanta Fed estimates real growth in the first quarter is at a 3 percent rate while the Cleveland Fed estimates inflation is rising at a 4 percent annual rate. This combination would mean current dollar spending is advancing at a high 7 percent annual rate.

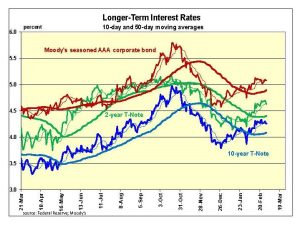

These estimates are so huge, it is inconceivable the Fed will seek to lower interest rates any time soon. The report showing the Fed’s favorite inflation indicator rose at a 5 percent annual rate in January further reduces the odds of a near-term cut in interest rates.

Our view is that the economy is weaker than current estimates suggest and that consumers and businesses are stressed financially. However, without more signs of weakness in the economy, the Fed will be forced to continue its restrictive policy.

Our view is that the economy is weaker than current estimates suggest and that consumers and businesses are stressed financially. However, without more signs of weakness in the economy, the Fed will be forced to continue its restrictive policy.

In addition to signs of strong growth, the stock market’s technical indicators remain positive. Yesterday’s upward spike to a new high on the S&P500 came on higher volume. This suggests expectations can continue to feed the upward momentum in stocks.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 28 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.