By Robert Genetski

Inconsistent Fed policies are creating cascading distortions in the U.S. economy. It will be extremely difficult to repair the damage when the day of reckoning inevitably arrives.

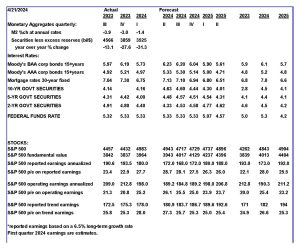

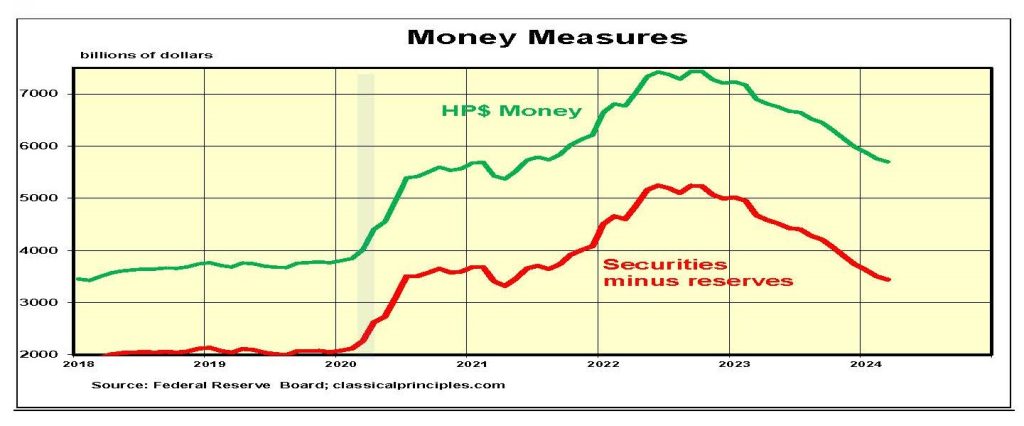

Although money supply indicators show a highly restrictive policy, the economy appears to keep going. Estimates of first quarter growth and inflation point both point to a 3 percent annual rate. Moreover, the latest business surveys suggest these rates are continuing into the second quarter.

When short-term interest rates are higher than longer-term rates, it is a clear sign of a shortage of money and a stressed financial system.

My recent article “Does Money Still Matter?” provides details on how the economy has become increasingly desensitized to the Fed’s more volatile monetary actions.

By alternatively buying and selling securities in greater and greater amounts, the Fed has bungled the transmission mechanism between money and the economy.

In addition, the escalating federal deficit has added a further dimension to monetary issues. Only two months ago the CBO estimated this year’s federal deficit at $1.4 trillion. The federal deficit totaled more than a trillion dollars in just the first six months of the fiscal year. As the federal government continues to spend money it doesn’t have, businesses and individuals are being fooled into going along with the ruse that this is real economic growth.

One client told me his business was booming with government-funded projects. All private activity had stopped.

Monetary restraint still matters. It just has taken longer for the full impact to be felt in the overall economy. The Fed’s removal of money from the economy over the past 18 months has stressed the system. The Fed’s ongoing sales of securities means the stress will continue and spending and growth will slow.

Despite estimates of 3 percent annual growth, the economy isn’t doing well. Part of the reason is the accelerating growth in budget deficits, which only boost the economy artificially.

As with consumers who continually add credit card debt to make ends meet, there is a day of reckoning. The impact of irresponsible financial actions can be postponed, but it cannot be avoided.

The current widespread expectation is that when the economy does weaken, the Fed will pour money into the system and all will be well. This is easier said than done. Playing games with financial markets is hazardous.

The longer the lead time between a restrictive policy and the response in the economy, the greater the weakness when the day of reckoning arrives.

We praised the Fed when it said it would take until at least 2025 to bring inflation back to its target. We were disappointed, however, when the Fed jumped the gun and talked about three interest rate cuts this year. By doing so, Fed members exposed their ignorance of financial markets. The Fed’s governors continue to reveal their shortcomings with incoherent policies that waffle more than a pancake breakfast.

When the Fed says its target interest rate is consistent with stable money, and at the same time sells securities (creating upward pressure on interest rates), its policy is both incoherent and inconsistent.

Selling securities may or may not be appropriate. It is only appropriate if the market interest rate is above the Fed’s target rate. Unfortunately, no one knows what the market rate is because the Fed chooses to dictate that rate.

The only way to know the current market rate is for the Fed to stop selling securities and allow market forces to adjust short-term interest rates to market conditions. Then, if short-term interest rates move above the Fed’s current target, it means the Fed’s target is too low to foster stability. Under such circumstances, selling securities could be appropriate. However, if the market rate were to go below the current Fed target, it means the Fed is too restrictive. Under those conditions, selling securities is highly destructive.

We doubt the Fed will allow the free market to operate. Without further progress in lowering inflation, expect the Fed to continue selling $95 billion a month in securities, whiich will further stress financial markets.

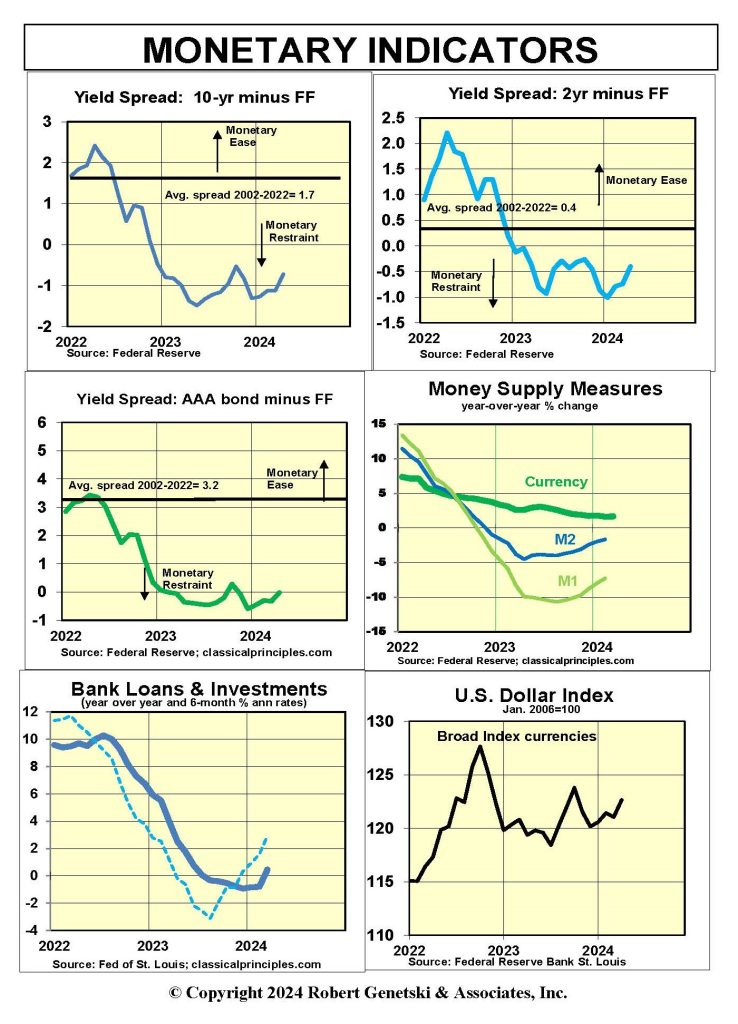

Monetary Indicators

Traditional money measures currently confirm Fed restraint is in place. Yield curves remain consistent with a tight money policy. However, with the latest increase in longer-term rates, yield curves have become slightly less restrictive.

A similar pattern occurs with the more traditional measures of money (M1 and M2), which remain negative on a year-over-year basis though they have become less negative over shorter-term time periods. In yet another anomaly and mystery, bank loans and investments have recently turned positive. This might normally be a sign of more, not less liquidity in the banking system. But is it?

Monetary policy is extremely complex. No one fully understands the process, which is why allowing markets to provide key information is so important.

On balance, most signs indicate a highly restrictive monetary policy is in place. Although there are few outward signs of any significant slowing in the economy, we continue to expect it is only a matter of time before the stress in the financial markets spreads to the rest of the economy.

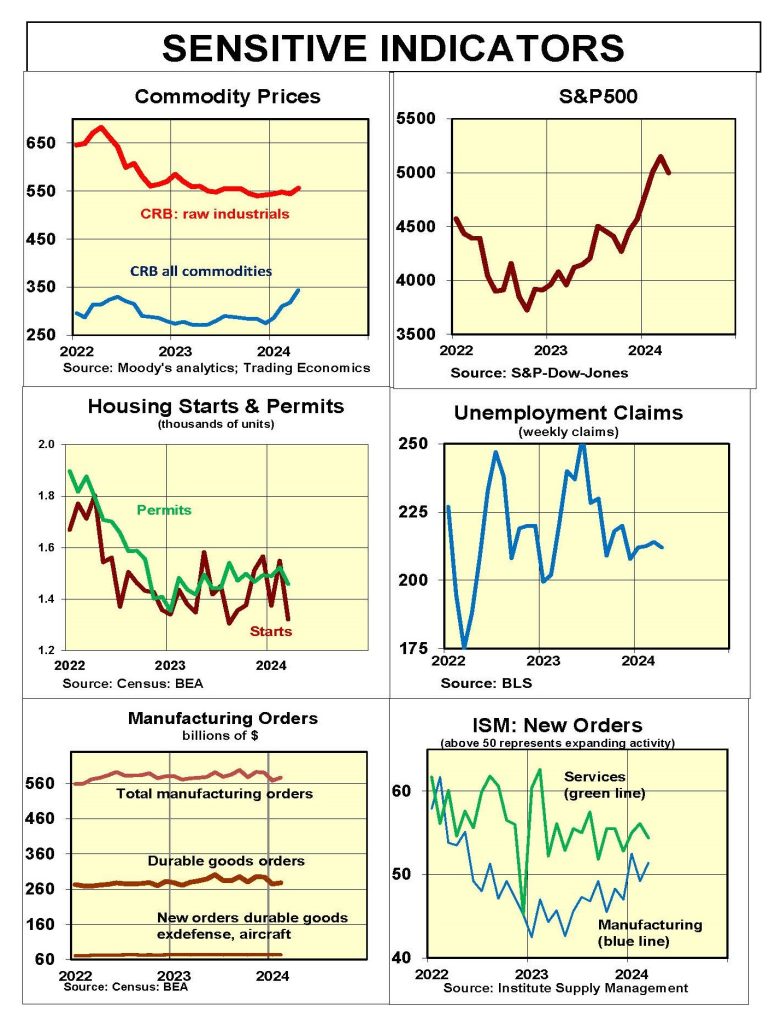

Sensitive Indicators

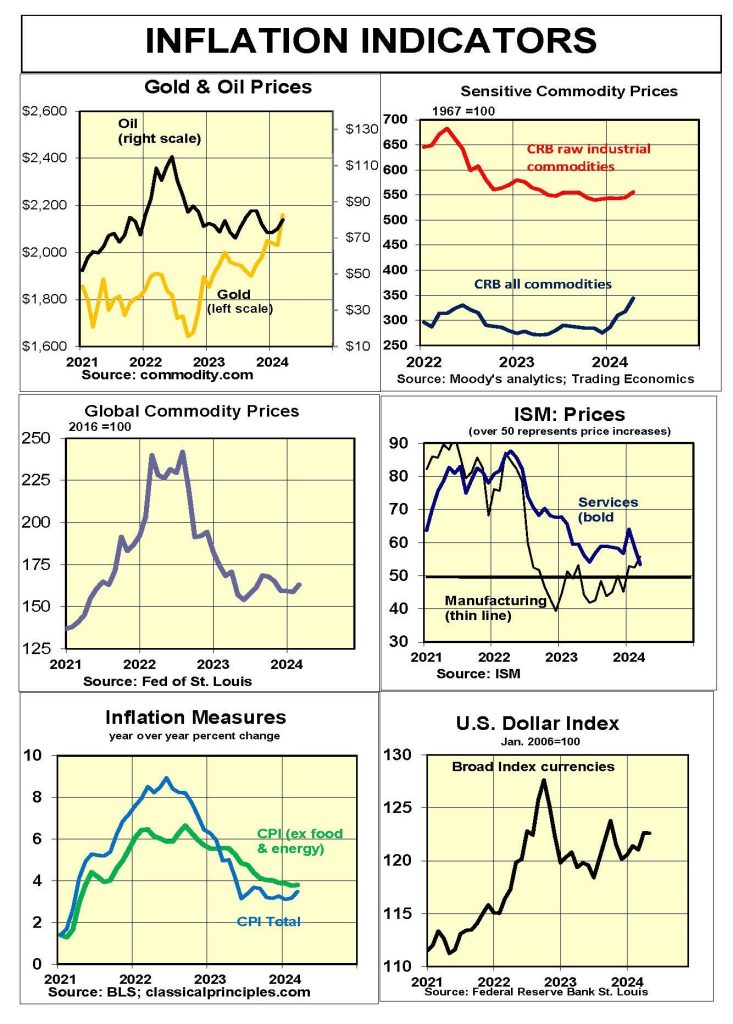

Sensitive indicators remain mixed.

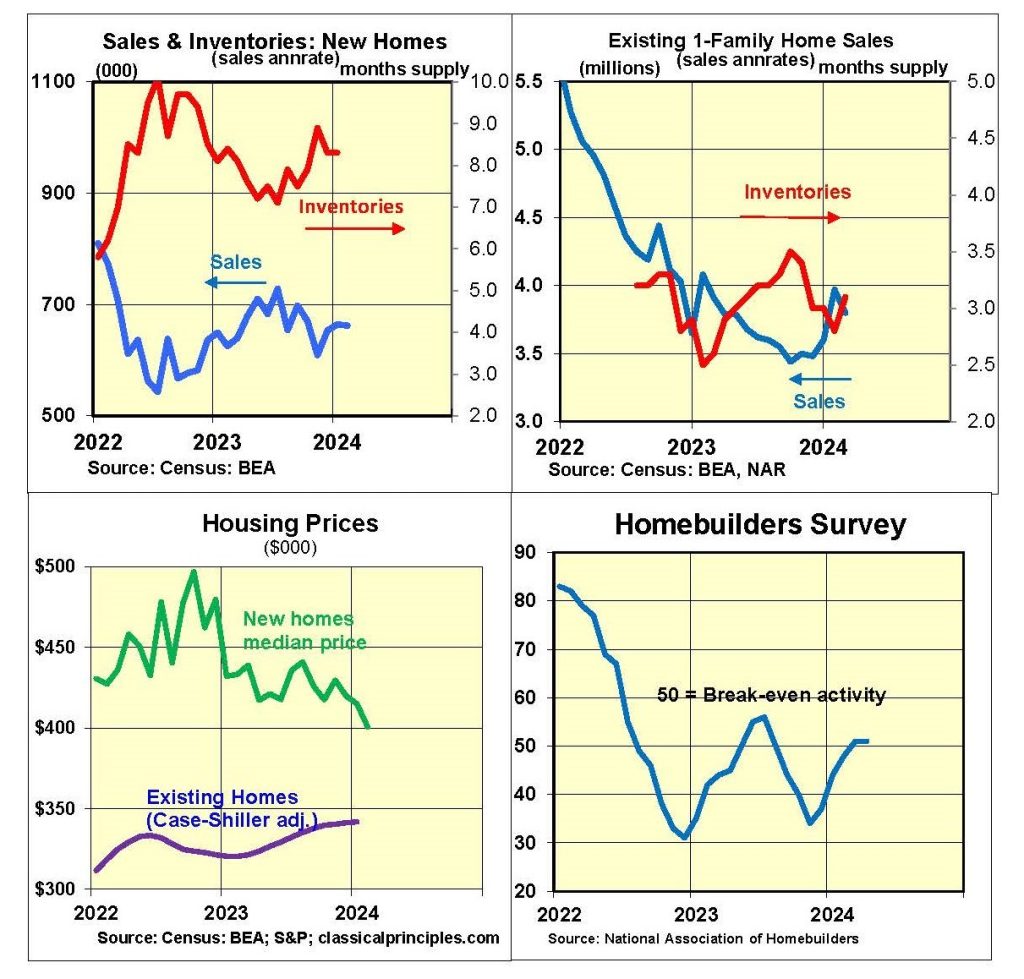

Both new and existing home sales remain depressed. A surplus in new homes has led to discounts in builders’ prices. Existing-home sales are lower due to the reluctance of many sellers to relinquish their low-rate mortgages.

Raw industrial commodity prices have recently moved higher, and new orders for manufacturing have been flat to down.

Although the stock market has moved slightly lower, the underlying trend remains positive.

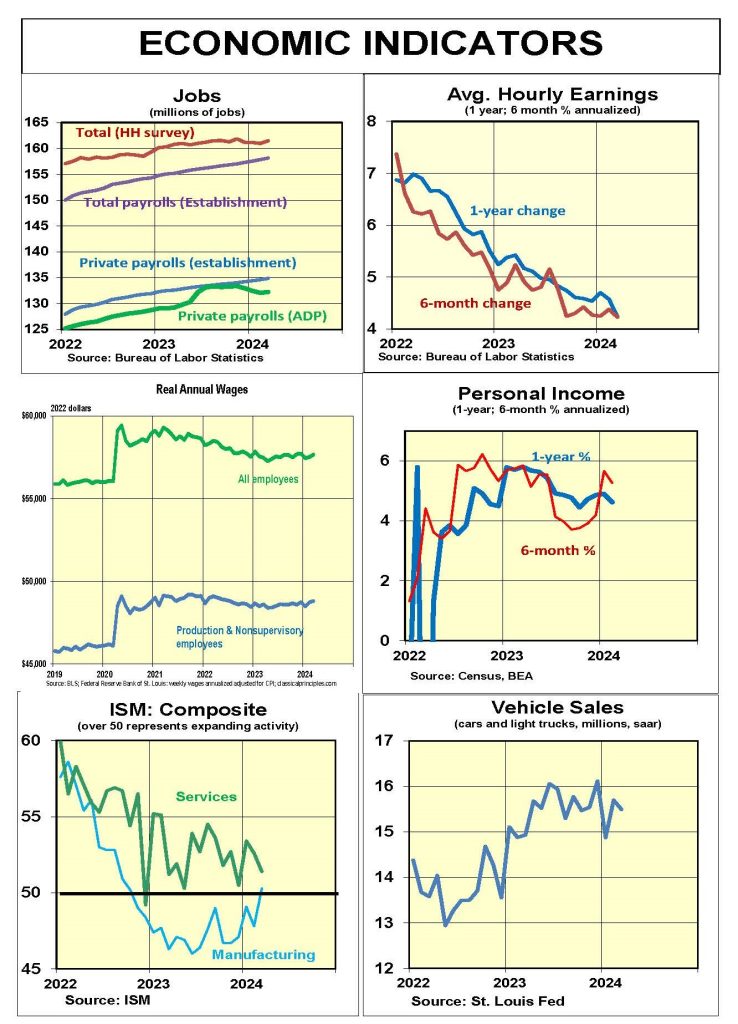

Coincident indicators show the economy continued to expand going into the second quarter. ADP payrolls (the most reliable job indicator), show employment grow slowing, but only gradually.

Inflation Indicators

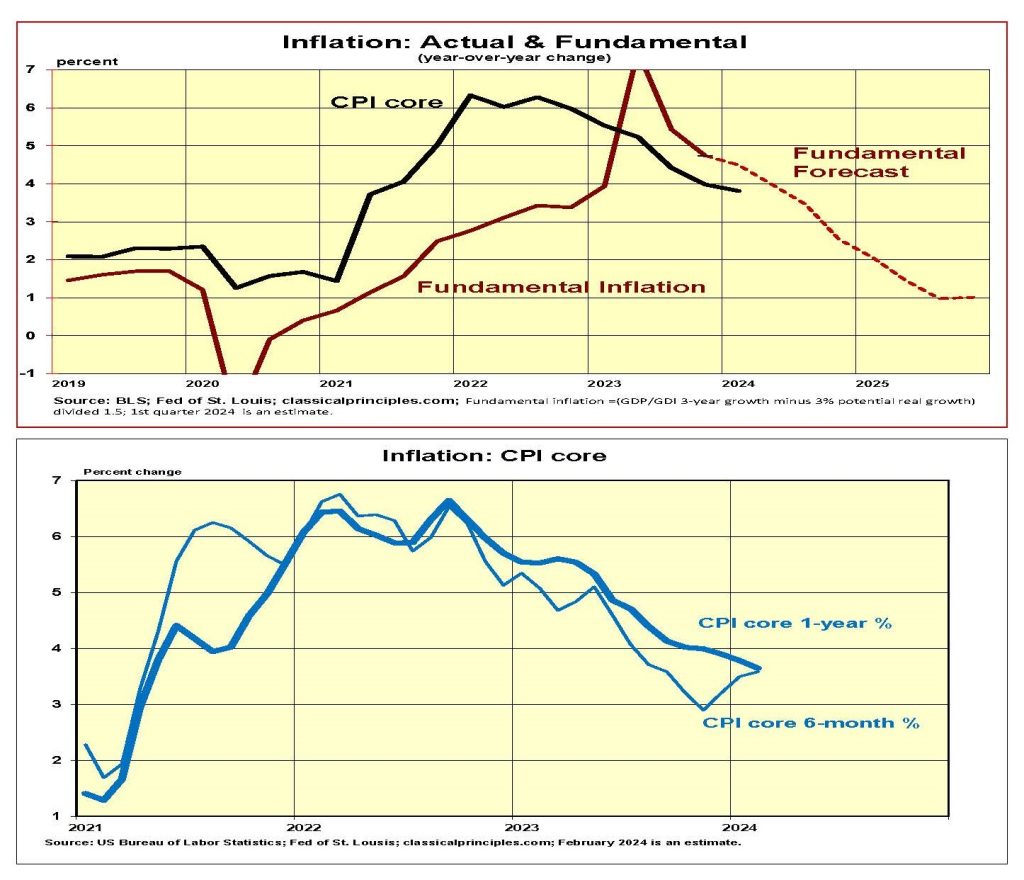

Inflation continues to moderate, slowly. With current dollar spending increasing faster than we had expected, our estimate of the underlying or fundamental inflation is currently in the 4 percent vicinity.

The core CPI is at 3.8 percent year-over-year. However, in the three months ending in March it is up at a 4½ percent annual rate. These numbers are consistent with our estimate of the fundamental rate.

Our analysis projects the fundamental inflation rate declining to the 2 percent to 3 percent vicinity by year-end. The decline is based on our assumption that current dollar spending will slow considerably to a 3 percent annual rate by the fourth quarter of this year.

The persistence of relatively strong rates of spending and inflation has led the Fed and financial markets to postpone any interest rate cuts until late this year, if then.

Interest Rates

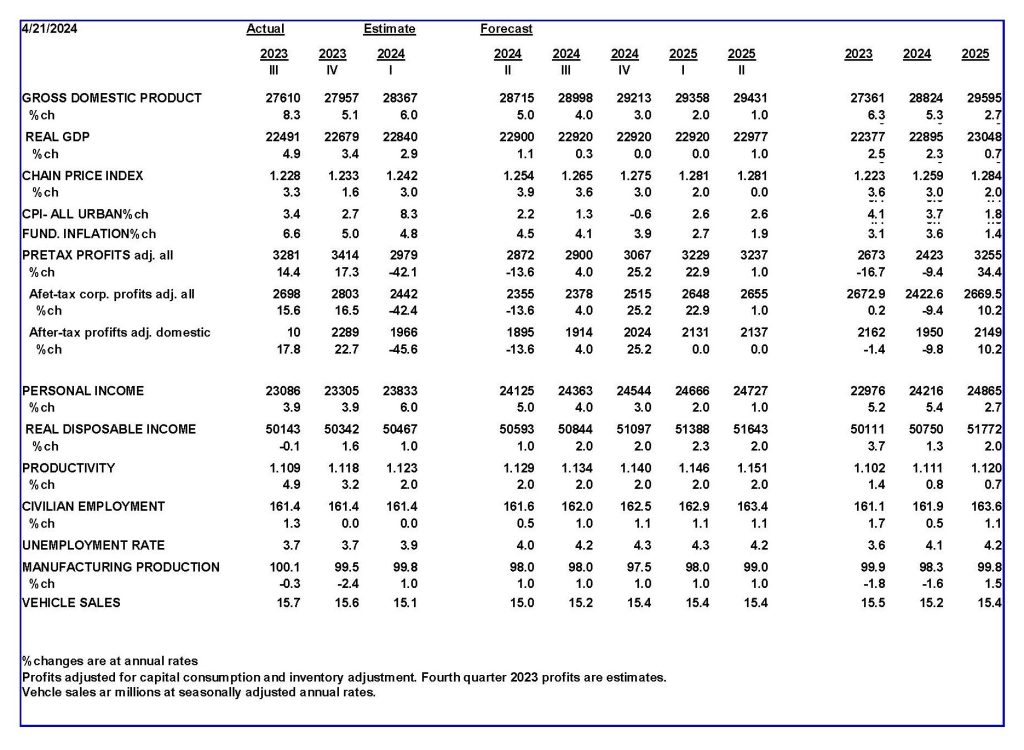

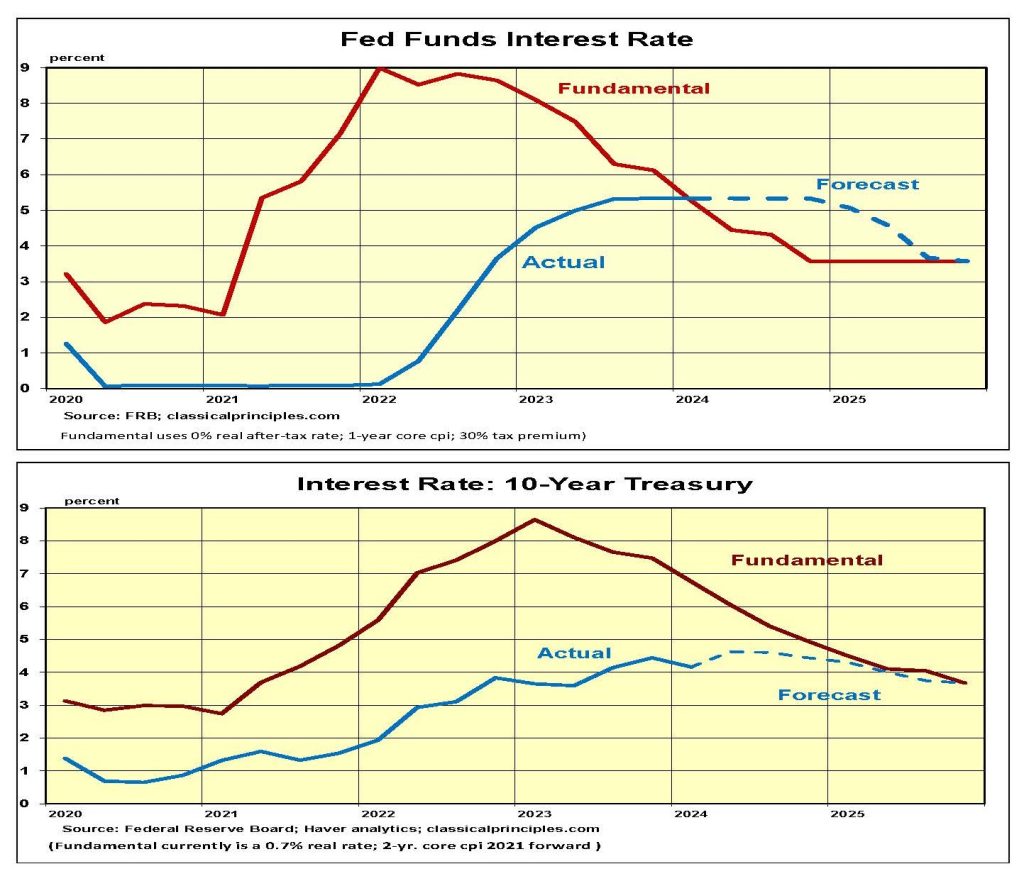

Continued strong growth in spending and inflation have led financial markets to delay the timing of any interest rate cut. We believe the markets currently are correct in assuming it will be at least year-end before the Fed will reduce interest rates. As with our forecast for inflation, the timing of a decline in rates depends on when the economy slows.

The chart below shows our estimate of the fundamental market rate moving below the Fed’s interest rate target. It should take at least another six to nine months before the Fed is confident enough on inflation to begin lowering its target interest rate.

A similar analysis of the fundamental yield on the 10-year T-Note shows it too is slipping toward 4 percent. The speed at which it declines will depend on the market’s perception of the Fed’s commitment to reaching its inflation target. The Fed’s timing is driven by upcoming data. We expect the Fed’s inflation-fighting resolve will keep the 10-year Treasury headed toward the 4 percent vicinity for an extended period.

Stock Prices: S&P500

Stock Prices: S&P500

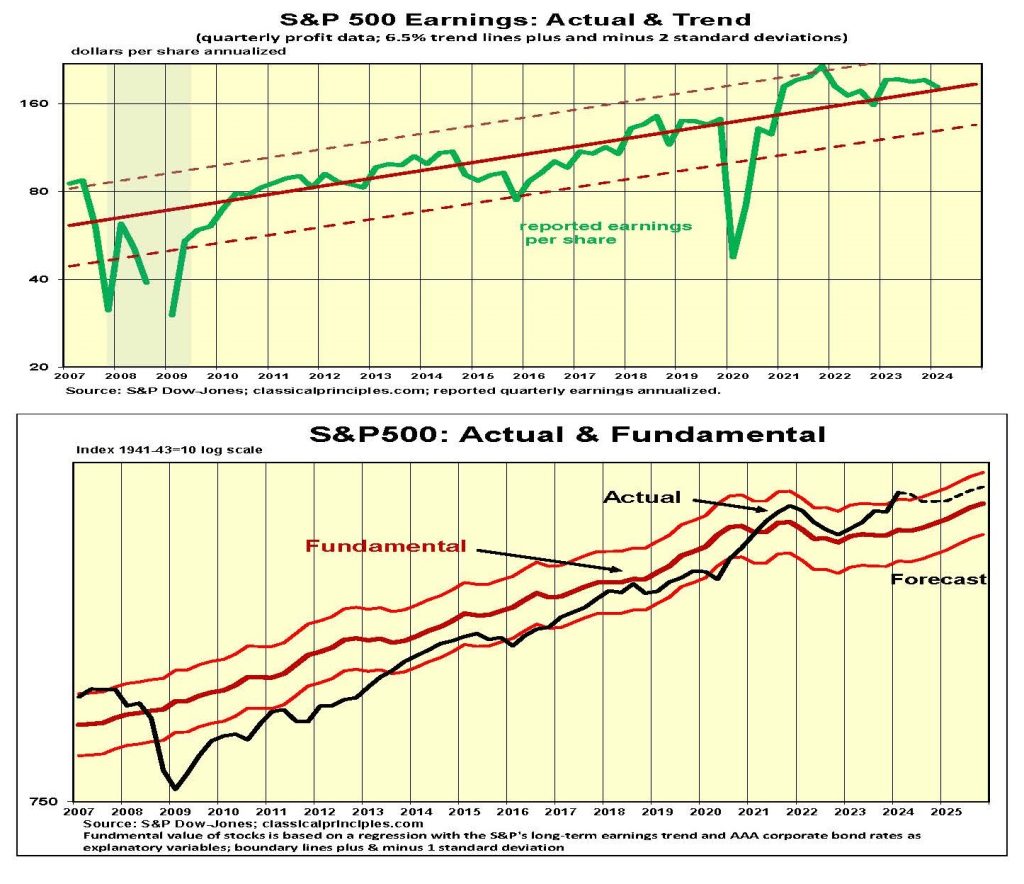

Our S&P500 stock market model uses the Index’s long-term profit trend, which dates back to the end of WWII. For the second quarter of 2024, trend profits are $181 a share. First quarter profits are coming in at $183 a share (with 12 percent of companies reporting). This estimate puts actual profits extremely close to their longer-term trend.

Although earnings are coming in consistent with their longer-term trend, interest rates are higher than normal. Our stock market model uses both the longer-term earnings trend and current AAA bond rate (5.3 percent) to calculate a fundamental value for the S&P500. For the second quarter of this year its value is 4,000. With the S&P500 at 4,967, the market is currently 24 percent overvalued.

We continue to believe stocks are vulnerable. Our forecast continues to call for a modest decline in stock prices in the coming quarters. As the second chart below suggests, we cannot rule out the potential for a much greater decline in prices, one taking the market much closer to its fundamental value.