Life, Liberty, Property #58: advice to GOP: just win, Baby, like Democrats do, then implement conservative policies.

IN THIS ISSUE:

- Advice to GOP: Just Win, Baby

- Tax Increases Are Not Revenue Increases

- Pro-Liberty Smackdown

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Advice to GOP: Just Win, Baby

One of the central premises behind this newsletter is the axiom that Republicans must start acting like Democrats—and not voting or governing like them. The idea is to apply Democrat-style hardball politics to the achievement of pro-liberty goals. Mainstream Republicans have always done the opposite, especially since the landslide defeat of Barry Goldwater for the presidency in 1964, with punctilious attention to processes and little evident regard for achieving real, lasting victories.

The two times that Republicans have achieved some success since the Reagan years occurred when non-mainstream Republicans briefly grabbed hold of power.

In the middle and late 1990s, the GOP was led by firebrand House Speaker Newt Gingrich. That team instituted four consecutive years of federal budget surpluses, sparked a strong economic expansion, and avoided new wars. In 2016, Donald Trump won the GOP presidential nomination over the strenuous objections of mainstream Republicans, won the presidency, and instituted major changes, such as significant tax cuts, massive expansion of domestic energy production, extensive regulatory reform, a tidal change in border control policy, innovative health-care policy reforms, and much more, despite the Russia collusion hoax and other forms of harassment—before getting derailed in 2020 by the Covid panic, when he went against his own instincts and governed like a mainstream Republican during the election year. (Trump’s combination of fiery rhetoric and Democrat-inspired policies in that year proved to be an awfully unappealing mixture.)

The reason the Reagan and Gingrich eras of GOP success were brief is not that their policies were unattractive to the American people, but that the party foolishly returned to its own vomit—the mainstream approach emblematized by the Bush family—and discarded the political capital it had built via attention to the issues Americans really cared about.

As to Trump, his choice of governing like a “responsible” Republican in 2020 led to a disastrous recession, which sealed his fate: no party has retained the presidency after a recession occurred in the final two years of an administration since the Democrats under Franklin Delano Roosevelt (as the public still blamed former president Herbert Hoover for the Great Depression).

Political analyst and TV host Auron MacIntyre understands this dynamic and makes this case in a recent article at The Blaze. Conservatives, MacIntyre notes, are by nature inept at politics because of their failure to understand that the only way to deploy political power is to get it and keep it:

As the political theorist Curtis Yarvin explained on my show, conservatives have a nasty habit of acting like broke heroin addicts when it comes to political power. Conservatives are not accustomed to having political power, even though they crave it, and the minute they get a hold of some, they want to blow it on the first political issue that comes to mind.

In contrast, the left understands that political power is a currency, and the best thing to purchase with that currency is more power. A victory on an important issue may feel great, but that victory is often quickly undone if the opposition regains dominance. Securing power does not just ensure victory today but also ensures that the victory will be retained and promises that additional wins will be easier to obtain in the future.

Did the Democrats campaign on open borders and trans kids in 2020? No. Did America end up getting open borders and trans kids anyway? You bet. Why? Because leftists understood that the most important thing was to secure their power first and to advance their agenda second. This did not mean abandoning their progressive principles. In fact, the left got to implement far more of those principles simply by understanding there is no substitute for victory.

Claiming that they are more principled than the opposition gets Republicans few if any votes. Giving your constituency what they want creates victories. It worked for Reagan, the Gingrich Congress (with a Democrat president, no less), and for Trump in his first three years.

Unlike the Democrats, who are transparent about being for sale, the Republicans try to play politics as if they are above the fray, more principled and hence more trustworthy than the other side. Voters, however, recognize that politics is all about running things, not about being considered nice. They know that they can always trust mainstream Republicans to buckle. (Cf. House Speaker Mike Johnson.)

On top of that, the press and culture always depict the Republicans as stingy, gun-toting, woman-hating religious fanatics regardless of how the GOP goes about things. Noble failure is not an attractive characteristic, especially when the media will depict your defeat as a catastrophe fortuitously averted. Better to kick the other team’s tail than to whine that they are a bunch of big dumb mean cheaters and what really matters is how you play the game.

MacIntyre explores the debate over student loan forgiveness as an example of how the two parties’ differing approaches work:

While older GOP voters love to mock college graduates with too much debt and tell them to get a real job, the loan crisis is a real one. Most decent jobs in the United States are now gated behind an expensive college degree, and young people who would have previously gotten married, had kids, and voted Republican, now spend the downpayment of their first house to attend a progressive seminary instead.

Due to disparate impact standards in civil rights law, employers are basically mandated to use college degrees as their screening process for new hires. That means leftists created the market, controlled the ideology of the institutions, inflated the market, and now get to sell the solution back to their victims, all while casting conservatives as the heartless villains that want young people to live in debt slavery.

As I noted in LLP #24, Democrats’ debt “forgiveness” sounds much more appealing than Republicans’ “fiscally responsible, targeted response.” MacIntyre makes a similar case. Though “[w]hat the Biden administration is doing is immoral and illegal” and “[t]he Democrats are stealing money from the GOP base who are less likely to have college debt and using it to bribe voters, … this argument on the principles is a losing strategy. Student debt holders correctly understand that they are already stuck playing a rigged game, and they do not care if someone needs to break the rules to make things right.”

The phrase “if someone needs to break the rules to make things right” is powerful. As I see it, MacIntyre is not saying that breaking the rules is good, but instead observing that “student debt holders” have been lured into a bad situation and will understandably gravitate toward those who offer help. The key, then, is for Republicans to aid those debt holders in a way that will force restitution from those who have benefited from the current system, not those who had nothing to do with it (people who did not go to college or who have been paying off their college debt or never took loans in the first place) or were actively exploited by it (e.g., liberal arts majors who racked up huge loan totals). That means the colleges and universities themselves.

Such an approach would “offer an alternative solution that secures power for them in the future,” MacIntyre notes:

To help alleviate the student debt crisis and gain power, the GOP should begin by levying a massive tax on university endowments. These institutions are almost uniformly leftist and are sitting on massive piles of cash, which they accumulate by robbing their students and abusing the tax code. Take that money and use it to pay off student loans in addition to removing all federal subsidies and making student debt dischargeable through bankruptcy.

Strip out civil rights law and its disparate impact provisions so that employers can once again use simple aptitude or IQ tests to screen employees. This plan might not offer the immediate catharsis of debating woke college kids on the merit of their gender studies degrees, but it would fundamentally change the balance of power in the United States by removing the leftist monopoly on employment credentials.

The policies MacIntyre advises Republicans to adopt are things that I have recommended in the past, and they come from the same impulse: to find a winning strategy that holds people responsible for their own choices. The same approach will work for other issues as well. “The right can spend this election cycle focusing on issues that are both popular and secure additional power,” MacIntyre concludes, and he provides some examples:

Closing the borders is good for the country and increases the likelihood that the right will win elections. Reducing crime and incarcerating criminals is good for the country and increases the likelihood that the right will win elections. Solving the student debt crisis by destroying the university stranglehold on employment is good for the country and increases the likelihood that the right will win elections.

As MacIntyre notes, the Democrats do not run on open borders and “trans kids.” They run on widely appealing proposals, win, and then impose their full agenda while Republicans moan about how unfair it all is. Republicans should act like Democrats. As the late Al Davis, longtime owner of the highly successful Oakland Raiders football team, regularly said, “Just win, baby!”

Source: The Blaze

Tax Increases Are Not Revenue Increases

Tax Increases Are Not Revenue Increases

Debates over the federal budget and taxes are dominated by stupidity.

The alleged need for ever-higher “taxes” in response to the perpetual clamor for ever-greater government transfers of resources from working people, entrepreneurs, and investors to those who are none of the above is bosh. So is the belief that tax cuts create budget deficits. The facts prove both propositions to be false.

I put quotation marks around the word “taxes” because the term is always used falsely in budget debates.

Raising taxes and raising tax rates are two different things. Cutting taxes and cutting tax rates are two different things.

Things are similarly muddled on the other side of the balance sheet. Cutting spending generally means raising spending. Raising spending always means raising spending. Alleged spending cuts are nearly always reductions in a previously projected (i.e., hoped-for) rate of increase. They are spending increases, not cuts.

In general, “raising taxes” lowers federal government revenue. “Cutting taxes” increases federal government revenue. That is so because “raising taxes” is always taken to mean “raising tax rates,” and “cutting taxes” is conceived as “cutting tax rates.” Revenues do not follow rates in the way politicians hope they will.

In an excellent article at Law & Liberty, economist Brian Domitrovic, the Richard S. Strong Scholar at the Laffer Center, notes that high tax rates are often softened considerably by large tax deductions:

One can gainsay 1950s prosperity, call it a myth. … And yet there were all the houses, the cars, the corporate jobs, the vacations, the inventions, “The Life!” as Tom Wolfe marveled while watching throngs of kids from that time cruising the ice cream shops and drive-ins at night, the scene exuding high-Roman levels of apex mass prosperity. We did not get this—halcyon days—while in any material way having high tax rates. We got this while not enforcing high tax rates due to high deductions, by making nosebleed numbers on a tax table inapplicable and irrelevant.

Before the Kennedy tax cut of 1964, official tax rates were very high, yet the government’s actual revenues from personal income taxes were much lower, Domitrovic notes:

Personal income tax rates ran from 20 to 91 percent. The corporate rate was 52 percent. The capital gains rate was 25. The tax on top estates was 77. Personal income and corporate income is national income. The tax take was 16 percent.

Domitrovic is right. “When we look at income taxes specifically, the top 1 percent of taxpayers paid an average effective rate of only 16.9 percent in income taxes during the 1950s,” Scott Greenberg noted in a 2017 article for the Tax Foundation. Greenberg explains:

There are a few reasons for the discrepancy between the 91 percent top marginal income tax rate and the 16.9 percent effective income tax rate of the 1950s.

-

-

- The 91 percent bracket of 1950 only applied to households with income over $200,000 (or about $2 million in today’s dollars). Only a small number of taxpayers would have had enough income to fall into the top bracket—fewer than 10,000 households, accordingto an article in The Wall Street Journal. Many households in the top 1 percent in the 1950s probably did not fall into the 91 percent bracket to begin with.

- Even among households that did fall into the 91 percent bracket, the majority of their income was not necessarily subject to that top bracket. After all, the 91 percent bracket only applied to income above $200,000, not to every single dollar earned by households.

- Finally, it is very likely that the existence of a 91 percent bracket led to significant tax avoidance and lower reported income. There are many studiesthat show that, as marginal tax rates rise, income reported by taxpayers goes down. As a result, the existence of the 91 percent bracket did not necessarily lead to significantly higher revenue collections from the top 1 percent.

-

The tax-relief provisions are a practical matter and not (necessarily) a conspiracy by governments to keep the rich from “paying their fair share of taxes.” The Tax Policy Center estimates that, in 2022, the top 1 percent of income earners in the United States “contribute[d] 26 percent of all federal revenues collected.”

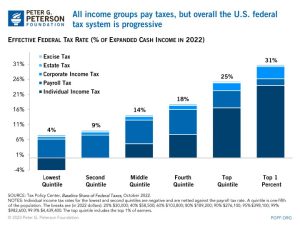

Having the 1 percent pay taxes at 26 times their share of the population might not be enough to satisfy Antifa radicals and liberal arts professors, but it is certainly a progressive tax system, as the Peter G. Peterson Foundation notes in finding the top 1 percent paid 31 percent of federal taxes in 2022:

Governments that do not provide backdoor tax relief through deductions do not get more revenue by that refusal but instead cause people to gravitate to lower-taxed activities, move to other countries, or reduce their investments of money and effort because they do not pay well in after-tax terms. That reduces government tax revenues well below their potential.

Governments that do not provide backdoor tax relief through deductions do not get more revenue by that refusal but instead cause people to gravitate to lower-taxed activities, move to other countries, or reduce their investments of money and effort because they do not pay well in after-tax terms. That reduces government tax revenues well below their potential.

There is no escaping that reality.

I have written before about the 17.4 percent limit: “federal revenue has historically hovered around 17.4 percent of GDP for the past half-century, no matter what the tax rates have been,” I wrote in LLP #7. It remains true.

Given that stubborn fact, the only way to increase the federal government’s revenues on a continual basis is to increase economic growth. That is exactly what happened in the 1990s, when the Republican Congress and President Bill Clinton cut government spending, as Domitrovic notes:

In the debate over the national debt, the silence over what transpired in the 1990s is deafening. President Clinton, with Newt Gingrich in Congress, consolidated the Reagan tax-reform rates in the low part of their range—especially on the corporate and capital gains side—and cut spending, if more disproportionately in defense. Budget surpluses emerged. The surpluses immediately quashed all concern, rampant in the 1980s, that Reagan’s deficits would prove debilitating, in particular, as the common phrase went, for “our grandchildren.” It became apparent that in a handful of years, by the early 2000s, the national debt, unthinkably large a few years before, was shrinking so quickly that the ordinary market demands for treasury debt instruments might have to be fulfilled by other securities.

Domitrovic agrees with my argument (in LLP #19 and noted several times since) that the solution to the federal debt crisis requires a return to the 2019 spending level (or, preferably, a much lower number):

A balanced budget automatically eviscerates (amortize: “to kill”) debt, since debt service is an outlay item within the budget. If the federal government reset spending to the ample levels of 2019 and reinitiated Reaganite tax reform, a debt-free twenty-first century can be ours, complete with levels of mass prosperity competitive with any in our history. Lower, not higher tax rates are consistent with a full expression of natural economic vitality and therefore the capacity of the country to meet its debt obligations with ease.

This budget approach would also stop inflation, as self-described “grumpy economist” John Cochrane of the Hoover Institution notes. Cochrane quotes a recent Wall Street Journal article that argues, “Most economists don’t believe Biden can do much at this point to bring down inflation, absent major tax increases or spending cuts that could curtail consumer spending. Even those policies, which aren’t being seriously considered in Washington, would take time to work their way through the economy.” Cochran replies, tartly and correctly:

Nothing we can do? We have, now admittedly, a deficit-fueled inflation. One could start by not pouring more gas on the fire. Such as cancelling billions of [dollars of] student loan debt, never mind the Supreme Court and the quaint idea that Congress votes spending. The CBO reports “The deficit totals $1.6 trillion in fiscal year 2024, grows to $1.8 trillion in 2025, …” with a 3.8% unemployment rate (ellipsis in original). Even in the simpleminded Keynesian economics that dominates left-of center Washington, there is no excuse for such stimulus.

There’s nothing we can do except the one thing that we all know would work. So we’ll rearrange the teacups on the side tables of the deck chairs of the Titanic instead. Which means [there is] nothing we want to do.

Echoing my comments over the past year in this newsletter and in a variety of op-eds elsewhere, Cochrane notes that the recent inflation started as soon as the Biden administration took office and immediately went on an insane government spending spree—and the connection was no coincidence:

For all of the excess stimulus under Trump, the fact is that inflation broke out precisely in February 2021, and not a minute beforehand. If you want an event, the Feb 2021 “American Rescue” act, with a few trillions more stimulus though the pandemic was clearly over, made clear that this administration was not going back to standard fiscal policy.

Deficit spending is the problem, and reversing course is the solution, Cochrane notes:

[W]e’re pretty clearly now in the situation that expected systemic deficits are the problem. Germany stopped a hyperinflation in a month. A credible announcement of spending, tax, and growth reforms that put the budget on a sustainable track would do the job [for us today]. Scaling back the IRA, Chips, [and] student debt river in recognition of inflation would help a lot more than complaining about how many potato chips are in a bag. Even just saying we recognize that’s needed would help.

Raising tax rates will only create further distortions in the economy. It won’t increase revenue. Cutting tax rates will increase revenue by increasing the size of the economic pie from which the federal government commandeers its desired share. The only solution to our present economic problems is to cut federal spending. The morally and economically right response would be to reduce federal spending back to its 2019 level.

I would even be willing to support spending at the inflation-adjusted 2019 level instead of the actual 2019 number, which has of course been reduced in value by inflation in the intervening years (which was caused by excessive government spending). It would be a better lesson for future governments if we used the actual 2019 number, but any talk of spending cuts is a visit to Fantasyland anyway, so there’s no point in splitting hairs over it.

In any case, the only possible solution is obvious: cut spending.

Sources: Law & Liberty; The Tax Foundation; The Grumpy Economist

Pro-Liberty Smackdown

Pro-Liberty Smackdown

Brazilian-born mixed martial arts fighter Renato “Money” Moicano spoke—in fact shouted—about his love for the U.S. Constitution, property rights, the First Amendment, carrying guns, and Austrian economics, in his post-fight interview after a win in the ring on April 13.

Yes, you heard that right: Moicano told the crowd of fight fans that they should read Ludwig von Mises and other Austrian economists. ZeroHedge reports (with emphasis):

While the Middle East wobbled on the precipice of World War III on Saturday, a Brazilian UFC fighter gave us hope by using his victory speech to deliver an emphatic endorsement of Austrian economics, Ludwig von Mises, the First Amendment and gun rights.

Renato Moicano’s televised speech came after he pulled off a comeback win over Jalin Turner at Las Vegas. Joe Rogan joined him in the ring to discuss the fight, but Moicano had other priorities, and proceeded to drop a profanity-peppered liberty bomb on the T-Mobile Arena crowd and a worldwide audience:

“I’m a huge advocate of the First Amendment. Today, of course I want the $300k bonus but they not going to give [it to me] because somebody say, ‘hey, this is f-cking Disney, you cannot curse’ … so I’m not going to do my speech, but …

First [of] all, I love America. I love the Constitution. I love the First Amendment. I want to carry all the f-cking guns. I love private property. And let me tell you something: If you care about your f-cking country, read Ludwig von Mises and the six lessons of the Austrian economic school, motherf-ckers!”

Moicano’s speech quickly sparked an interest in Mises’ books, Decrypt reports:

Since the fight, at least 26,000 copies of “The Six Lessons” have been downloaded as a free PDF from Amazon. Several other Mises books are also top rankers in the site’s economics section. There have also been anecdotal accounts on Twitter from Moicano fans who say Mises’s book has been sold out at their local bookstores.

Other UFC fighters have spoken out against big government and the woke agenda, though generally without references to Austrian economics, and UFC boss Dana White has made headlines repeatedly with his comments defending traditional American values and taking leftists directly to the mat, such as the following:

Where you going to go? Nowhere. All these other f*cking places that you think are f*cking cool, and that you think are so f*cking great, when the shit hits the fan, you find out who’s who and what’s what. We saw it during Covid. Places that I thought were awesome. Places that I thought I would love to live. And then we go through Covid. Gang, this is it. So, all the people that are out there marching and f*cking crying, and protesting and all this f*cking bullshit, man, this is the greatest country on Earth. And we should be f*cking defending it. Fighting for our freedom. Everyone of us.

It’s no different than the conversation I had with [comedian and podcaster] Theo Von the other day where we’re talking about stupid shit like sponsors and all this stuff. Everybody’s afraid to stand up. Everybody’s afraid to be pro-American. What other f*cking country—and some of these other countries are completely f*cked up—but the people who live are proud of where they come from. They carry their flag, and they stand up, you know. You talk about people coming over the border from Mexico for a better life in America. Show me a f*cking Mexican that doesn’t love his country and isn’t proud to be a Mexican.

Wake up. Wake up. This is the greatest country. So, if we go to war right now, are you confident in this generation that we have right now that these guys are going to go out and storm some f*cking beach somewhere? There’s a small handful of people. Most of them [are] probably down around the Bible Belt and down south that’ll actually f*cking stand up and fight for this f*cking country. It’s scary.

Speaking out against the woke regime may not require physical courage—but it obviously helps.

Cartoon

via Comically Incorrect

For more great content from Budget & Tax News. For more Rights, Justice, and Culture News.

For more from The Heartland Institute.