Analysis of the 2024 Medicare Trustees’ Report shows the Hospital Trust Fund will reach insolvency in 2036, says CRFB.

by Committee for a Responsible Federal Budget

The Medicare Trustees report that the Medicare Hospital Insurance (HI) trust fund will be insolvent in 2036 with a 75-year shortfall of 0.35 to 1.17 percent of payroll. All parts of Medicare will grow over the coming decades, and reforms are needed to slow that growth and increase revenue into the trust fund.

The latest report finds:

- The HI Trust Fund will run out of reserves in 12 years, with a projected insolvency date of 2036. That’s when today’s 53-year-olds will first be eligible for benefits and today’s youngest beneficiaries turn 77.

- The HI trust fund faces a large shortfall, totaling 0.35 percent of payroll (0.15 percent of GDP) over 75 years and peaking at 0.60 percent of payroll (0.27 percent of GDP) in 2044.

- Total Medicare costs will grow rapidly. Total gross Medicare costs have increased from 19 percent of GDP in 2000 to a projected 3.90 percent of GDP in 2025 and are projected to grow further to 5.86 percent of GDP by 2050 and 6.20 percent of GDP by 2098.

- Medicare’s financial outlook has largely improved since last year, with the insolvency date now five years later, the 75-year HI shortfall 44 percent smaller, and gross program costs in 2050 15 percent of GDP lower. However, Part B and D costs are projected to be higher after 2060 and gross costs higher after 2080.

- Medicare’s situation might be far worse than official projections. Under an alternative scenario created by the Chief Actuary, Medicare spending will rise to 8.38 percent of GDP in 2098 rather than 6.20 percent. The HI shortfall in this scenario would be 1.19 percent of payroll instead of 0.35 percent of payroll.

Despite some improvements to the overall outlook, the Medicare program remains costly and is projected to grow unsustainably.

Fortunately, policymakers have numerous options available to lower health costs broadly and ensure adequate funding is available for the Medicare program. They should act sooner rather than later to secure the Medicare trust fund and slow the growth of the Medicare program.

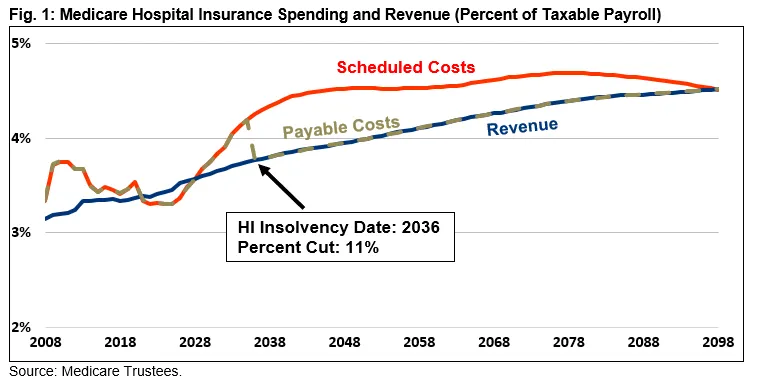

The Hospital Trust Fund will be Insolvent in 2036

The Medicare Hospital Insurance (HI) trust fund finances inpatient hospital care under Medicare Part A, paid for primarily from the Medicare payroll tax. The trust fund currently holds over $200 billion in reserves, and its trust fund is growing as it is projected to run modest surpluses through 2028. As the population continues to age and health care costs grow, however, costs are slated to rise and ultimately draw down the program’s trust fund reserves.

HI deficits are projected to grow rapidly in the 2030s, depleting the HI trust fund by 2036. At that point, the law requires an immediate 11 percent cut in payments. These cuts would likely lead to significant disruptions in health care services for older individuals and those with disabilities.

In the first year of insolvency, the HI program will face an annual deficit of 0.48 percent of payroll or 0.22 percent of GDP. That deficit will grow to 0.60 percent of payroll or 0.27 percent of GDP by 2043 and then gradually disappear by 2098.

The gap results from spending growth exceeding revenue growth. Costs for HI have grown from 2.63 percent of payroll in 2000 to 3.30 percent of payroll in 2024. The Trustees project they will rise to 4.25 percent in 2036, peak at 4.69 percent in 2078, then slowly decline to 4.51 percent by 2098. Revenue has also grown since 2000 – from 3.11 to 3.43 percent of payroll – but will grow more slowly to 4.37 percent in 2076 and 4.52 percent by 2098.

Over the full 75 years, the HI trust fund faces a 0.35 percent of payroll (0.15 percent of GDP) funding gap, which means restoring solvency would require boosting the payroll tax rate by 12 percent or reducing spending by 8 percent. Under the Chief Actuary’s alterative scenario, the gap totals 1.17 percent of payroll so the necessary adjustments would require raising the HI payroll tax by 40 percent or reducing expenditures by 22 percent.

Medicare Costs are High and Growing

The total gross cost of Medicare has grown from 2.19 percent of GDP in 2000 to 3.83 percent in 2024. The Trustees project costs will rise further to 5.30 percent of GDP in 2035 and 6.20 percent by 2098.

Medicare Part B – which mainly funds outpatient physician services – explains most of this growth. Its costs are projected to rise from 1.85 percent of GDP in 2024 to 2.82 percent in 2035 and 3.61 percent in 2098. The cost of Medicare Part A is projected to rise from 1.46 percent of GDP in 2024 to 2.02 percent of GDP in 2045 and then slowly decline to 1.90 percent of GDP in 2098 due to the slow growth in provider payments. The cost of the Medicare Part D prescription drug program is projected to rise from 0.52 percent of GDP in 2024 to 0.69 percent of GDP by 2098.

A key contributor to the growth of all parts of Medicare comes from the Medicare Advantage (MA) program. The MA program provides Medicare benefits through a private option for beneficiaries. It now covers around half of all Medicare enrollees, up from only under a third of beneficiaries in 2010; by 2033, it is projected to cover nearly three-fifths of beneficiaries. MA costs the federal government significantly more per person than traditional Medicare, and MA spending is projected to grow from 1.76 percent of GDP in 2024 to 2.68 percent of GDP by 2033.

Lawmakers could address the rising cost of Medicare by utilizing some of our Health Savers Initiative proposed policies, including implementing equalizing payments regardless of site of care, reducing Medicare Advantage overpayments, correcting flaws in the MA quality bonus system, and policies to further reduce the cost of prescription drugs.

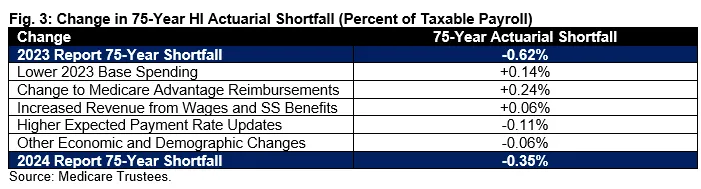

Medicare Outlook Has Improved Modestly from Last Year

The financial outlook of the Medicare HI trust fund has improved significantly since last year’s report; the outlook for Medicare Parts B and D has improved over the next four decades, but worsened over the very long run.

The projected HI trust fund insolvency date is now five years later – 2036 as opposed to 2031. Additionally, the 75-year shortfall is 0.35 percent of payroll instead of 0.62 percent. The near-term improvement is due to a combination of higher revenue and lower spending, while the long-term improvement is driven mainly by lower spending.

In particular, the Trustees expect significantly lower spending on the HI portion of Medicare Advantage due to a change in how reimbursements are calculated. They project additional improvements based on lower actual spending and higher actual revenue collection in 2023.

While the Trustees’ HI projections have improved, the outlook for Parts B and D is relatively similar – better for the first half the projection window and worse in the second half. For example, the Trustees project these programs will cost a combined 2.44 percent of GDP in 2025, down from 2.56 percent in their previous projections. But they project the programs will cost 4.29 percent of GDP by 2097, up from 4.16 percent in previous projections.

Changes to Parts B and D are driven by lower projected home health and outpatient hospital spending, changes to the assumed pace of growth in prescription drug purchases, higher enrollment in Medicare Part D, and revisions to projected economic output.

Overall, gross Medicare costs are now projected to be lower as a share of GDP than in last year’s projections through 2080 and higher thereafter. For example, the Trustees expect costs to total 3.90 percent of GDP in 2025 as opposed to 4.13 percent. By 2097, they project costs to total 6.20 percent of GDP as opposed to 6.12 percent.

Outlook Is Far Worse Under the Trustees’ Alternative Scenario

The projections and estimates in the Medicare Trustees’ report are based on current law. However, it is not clear if current-law provider payment levels will be adequate to ensure beneficiary access to providers over time – especially as both inpatient and outpatient physician reimbursements are scheduled to grow more slowly than underlying medical costs.

The Chief Actuary produces an alternative scenario in which provider payments grow faster than current law, with annual updates gradually transitioning to rates more reflective of the growth in underlying health care costs.

Under this alternative scenario, Medicare spending broadly would increase at a faster rate than their official projections and the HI funding gap would be significantly larger.

Gross Medicare costs would grow from 3.83 percent of GDP in 2024 to 6.36 percent in 2050 and 8.38 percent in 2098, compared to 5.86 and 6.20 percent under official projections. Medicare Part A (HI) costs would grow from 1.46 percent of GDP in 2024 to 2.89 percent in 2098, compared to 1.90 percent under official projections. Part B costs would grow from 1.85 percent of GDP in 2024 to 4.80 percent in 2098, compared to 3.61 percent under official projections.

As a result of the higher Medicare Part A spending, the HI funding gap would more than triple from 0.35 percent of payroll under current law to 1.17 percent of payroll. And whereas the official projections show HI spending and revenue to be in balance by 2098, the HI program would run about a 2.28 percent of payroll deficit under these alternative projections.

Conclusion

The Medicare Trustees’ report shows that the HI trust fund will be insolvent in just 12 years and Medicare spending will rise rapidly over the next few decades.

Without action from Congress, Medicare beneficiaries will face huge disruptions in their benefits and Medicare Parts B and D will continue to worsen deficits and crowd out other important government programs.

Lawmakers should consider both spending and revenue changes to shore up Medicare’s finances but should focus especially on reforms to lower overall health care costs. Such changes could improve value for current seniors while reducing the fiscal burden on younger generations.

Originally published by the Committee for a Responsible Federal Budget. Republished with permission.