The Week That Was

Biden’s poor debate performance is likely to force Democrats to replace him at their upcoming convention. Their current situation raises the odds Trump will be the next President.

Today’s report for spending, incomes and inflation shows inflation was essentially zero in May and 2.6 percent year over year. Both personal income and real disposable income were up at 6 percent annual rates for the month. Hence, there is nothing in these numbers to point to a slowdown in business.

Housing data continue to show weak conditions. Inventories of new homes were up sharply, while inventories of new homes moved modestly higher. Sales of new homes remain in a downward trend and sales of existing homes are down sharply after an upward spike earlier this year.

Home price data are mixed, but the Case-Shiller 20-city existing home Index is up 7 percent from a year ago.

Initial unemployment claims in the past four weeks were 236,000, up from 213,000 in the year ending in May. This number is highly erratic (it reached 253,000 in June, 2023), so the recent increase is not significant.

Things to Come

Monday and Wednesday the ISM and S&P June business surveys should confirm the economy continued to grow while inflation moderated. S&P’s advanced survey for early June showed the highest monthly growth in over two years. ISM was not as strong.

Also on Wednesday, the Fed will release minutes from its recent meeting. So far, the Fed has not indicated when it might stop selling securities. When they do, Fed policy will turn from restrictive to neutral. This would be a positive.

On Friday, the June jobs report is likely to continue to show gains in most employment measures. We expect a slowing in job growth from May’s 2 percent annualized pace.

Market Forces

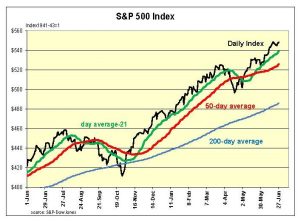

The bulls slowed to trot this week as most stock indexes had either slight gains or slight losses. The S&P500 closed yesterday right where it was a week ago.

Our stock market model still shows the S&P500 overvalued by 35 percent. Even so, our short-term directional model points to a temporary pause followed by a 90 percent probability the market will continue to rise.

Our stock market model still shows the S&P500 overvalued by 35 percent. Even so, our short-term directional model points to a temporary pause followed by a 90 percent probability the market will continue to rise.

Economic news remains mixed so there was little to motivate stocks one way or another. With the second quarter ending, the Atlanta Fed continues to place real growth at a strong 2.7 percent annual pace. Meanwhile, other reports tell a different story. Inverted yield curves, a weak housing sector and flat to down manufacturing orders and shipments indicate a flat to downward trend in many areas.

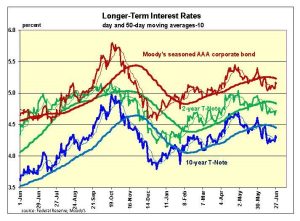

Today’s consumer spending and incomes report had good news on inflation, along with signs of continues growth in incomes. For the time being, this should be enough to keep the yield on the 10- year T-Note in the vicinity of 4.3 percent.

Next week’s June economic reports should show relatively strong growth. If so, the spotlight will be on June’s CPI report, due the following week. The average oil price in June was 0.4 percent lower than May. This should translate to only a slight gain in the total CPI. As before, the key will be the core CPI, which the Fed estimates will be up 0.28 percent.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 35 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.