The U.S. economy is recovering rapidly. August data suggest output is back to 97 percent of its Februrary 2020 peak. Although the labor market has lagged the rest of the economy, a surge in new orders in August will produce a sharp jump in jobs and the economy in September.

Today’s employment numbers show an increase of 1.5 million private-sector jobs in early August.

The job market is back to 92 percent of its peak level of February. In contrast, the recovery has brought total output for August back to 97 percent of what it was at its peak in February.

Weekly data show initial claims for unemployment insurance were at 992,000 in August, a decline of 343,000 from July. Claims were down to 881,000 in the last week of August. Unemployment insurance payments are at 13 million in the third week of August. This is down by two million from a month earlier.

The Institute for Supply Management surveys of business activity show a rapid recovery in August. Manufacturing improved to a strong reading of 56, while the service sector was 58. More importantly, new orders for both sectors soared to the upper 60s.

This means we can expect even more rapid growth and hiring in the months ahead.

What to Expect This Coming Week

The only significant reports due next week are for inflation in August. Most commodity prices, including oil, were sharply higher last month. Business surveys for both manufacturing and service companies report readings in the high 50s, indicating a strong overall increase.

Hence, inflation reports for August will show strong increases for the third consecutive month.

Market Outlook

After soaring to new all-time highs on Wednesday, the major indexes fell by 3 percent to 5 percent yesterday. Thursday’s decline came despite more good news on both the economy and the virus.

At its peak on Wednesday, the S&P500 moved to 7 percent above my estimate of its fundamental value. The Nasdaq was even more overextended.

Within the past week, almost all psychological indicators reached new highs. A survey of newsletter writers had more than 60 percent bullish and only 16 percent bearish on stocks.

We were overdue for a normal correction in an overvalued bull market. One bad day is not sufficient to change anything. However, with stocks still overvalued, bad news on either the economy, politics or the virus would continue to send stocks lower.

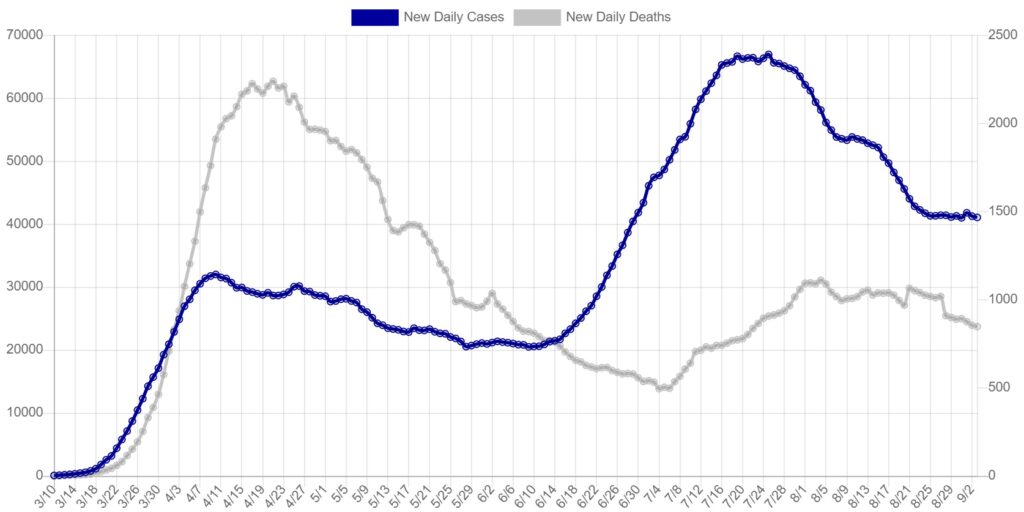

COVID-19: Daily Death Rates Trend Lower

As the economy continues an impressive recovery, daily COVID cases and deaths continue to trend lower.