By John Tamny

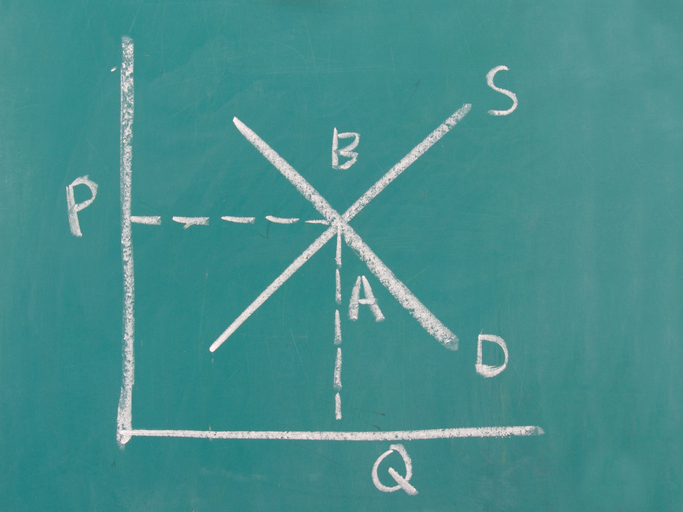

It’s accepted wisdom that supply and demand sits at the center of all economic thought. Figure that prices are what organize a market economy, at which point it’s only logical that prices are arrived at via supply of any market good or service versus demand for same.

The problem is that what’s accepted wisdom is nonsense. Or close to it. Think about it.

For background, consider a recent tweet by normally excellent Texas Tech economics professor Alexander Salter. Making a laudable case for immigration, he acknowledged that while the inflow of immigrant workers (“all else being equal”) depresses wages, he defended the suppression since immigrants “buy stuff” from existing businesses, “which increases demand for labor.” Salter’s usually sound reasoning doesn’t stand up to reason.

While there’s strong agreement with his desire for more immigration, the notion that more workers depress wages rejects history, along with basic common sense. In other words, he’s limiting his analysis to the analysis-limiting notion of supply versus demand. Based on the latter, the arrival of immigrants would shrink pay. More “working hands” as it were would logically render accession of those hands cheaper. Except that supply and demand for workers doesn’t dictate pay. In the “all else being equal” calculation, the supply/demand chart for labor (or whatever) is a very small factor.

If it weren’t, the arrival of women into the workforce over the decades would have coincided with an impressive decline in compensation. Better yet, growing automation whereby millions, billions, and realistically trillions of “hands” will enter the workforce 365 days per year, 24/7, signals mass future wage implosion in the most technologically advanced countries. Wouldn’t it? Not really. Stop and think. Fredric Bastiat once did. The wise French political economist noted the absurdity of the view that people are best off where technology is the least advanced. Bastiat’s logic applies to the observation of Salter about compensation.

Indeed, his hedge on immigration presumes that work is finite, when in truth it’s unlimited. Getting right to the point, the supply of work has little to do with the number of humans, or the number of robots, and most everything to do with investment. Crucial here is that the investment that is the source of all job creation (and subsequent compensation) has no limits.

That is so because work divided is the path to ever-increasing productivity. The previous statement is basic Adam Smith. Smith reported centuries ago that one man working alone could maybe – maybe – produce one pin per day, but several specialized men working together could produce tens of thousands.

Yet Salter unfortunately concedes that immigrants depress wages. He shouldn’t give in so easily. The minute any human enters the United States, the productivity of that human immediately soars by virtue of going to work. Wages are a function of productivity, period. To focus on labor supply is to miss the point.

Where it gets interesting is in consideration of the expected automation of more and more work forms in the future. The arrival of robots seemingly not “buying stuff” won’t be a wage depressant, but instead will be a massive wage accelerator. Goodness, if men working together could manufacture tens of thousands of pins in an 18th century factory, imagine what man will be capable of producing with tireless robots enabling human specialization on a level impossible to realistically contemplate at present.

Notable is that supply/demand comes up short in areas well beyond labor prices. Consider public equities. It’s widely believed that stock prices are arrived at care of supply of equities versus demand for same. Except that such a view isn’t true. In reality, the value of a business is just a market speculation about all the money it will make in the future. Supply and demand is irrelevant on the matter of share prices.

What about market goods? No doubt media members drool about businesses allegedly possessing “pricing power” that redounds to their value. The alleged “pricing power” is born of limited supply versus substantial demand. It all makes sense at first glance, but only at first glance. To understand why, consider where U.S. corporations are most highly valued: Silicon Valley. They sell goods and services at prices that continue to decline not based on abundant supply relative to limited demand, but instead because the pushing down of prices is their business model.

Salter’s a big follower of money, and here again it’s popular in this day for members of the Right in particular to say that “tight money” is the path to credible money. Quite the opposite, really. The most credible money is logically the money most circulated globally. As is, the dollar is the world’s currency such that it liquefies the vast majority of global exchange. The latter being true, imagine if the dollar were more fixed as a measure thanks to, for instance, a gold definition. If so, dollars in circulation would skyrocket. According to supply/demand theorists, an increase in so-called “money supply” would amount to devaluation, but in reality the currencies most circulated are once again the most trusted ones. Implicit in supply/demand as a driver of stable money is that up to 1971, the Fed, Treasury or U.S. Mint expertly supplied dollars equal to demand for same. Not really. The dollar price rule was what mattered.

Notable about a “weak” or “strong” dollar is that in periods of dollar weakness—think the 1970s and the 2000s—commodities including oil spiked. A supply problem? Think again. In reality, commodities are very sensitive to currency movements such that a weak dollar under Presidents Nixon, Ford, Carter, and Bush (W.) logically coincided with soaring oil the spike of which had less than nothing to do with supply.

Paraphrasing Henry Hazlitt, economics is stalked by myths. One of the biggest is the one about supply and demand.

Originally published by RealClearMarkets. Republished with permission.

[…] post Supply and Demand Is the Most Oversold Notion in Economics (Commentary) appeared first on Heartland Daily […]