The bear market took a sickening dive this week. The main news sending stocks lower was the Fed’s announcement that it is determined to get inflation down to 2 percent. The same procedures that led to the current inflation can easily lead the Fed to become overly restrictive.

The market’s technical indicators have been very negative for some time. They have not changed.

The steep decline in the stock markets has brought stocks somewhat closer to their fundamental levels. As the Fed shifts its policy toward restraint, market conditions remain risky for investors.

The Week That Was

At Wednesday’s Fed meeting Chairman Jerome Powell reaffirmed the bank’s commitment to lowering inflation. The governors raised their target interest rate by three-quarters of a percentage point and reaffirmed their policy of selling securities.

May retail sales declined by 0.3 percent from April but were up at a 7 percent annual rate from the first quarter average.

As expected, gasoline sales rose 10 percent since April. Most other categories, particularly autos, were weak.

Housing permits fell in May from 1.8 million to 1.7 million. The June Homebuilders’ Index fell to 67 from 69, confirming a developing slowdown in the market for new homes.

With sharply higher home prices and rapidly rising mortgage rates, it’s interesting the index still in the high 60s. Although housing activity has slowed, any readings above 50 reflect increases in new home construction. The high 60s is still a strong market.

The upward drift in initial weekly unemployment claims continued in the first two weeks of June, with initial unemployment claims at 231,000. This is up from 209,000 in May, 188,000 in April, and 175,000 in March.

Things to Come

Later today the Fed will report on May manufacturing. By all indications, manufacturing was strong through May. Business surveys for May show manufacturing readings at healthy levels in the upper 50s.

The main economic news for next week will be Thursday’s advance June Markit business survey. The May surveys show readings in the mid-50s, indicating a real growth rate in the economy of 2 percent to 3 percent. If the June surveys show a decline to the lower 50s, it would confirm some slowing in the economy as suggested by the increase in initial unemployment claims.

Money, Money, Money

The main news sending stocks lower came from the Fed’s announcement that it is determined to get inflation down to 2 percent. This month it began reaching its objective.

The Fed still has a problem with its operating procedures. Just as it had no basis for its previous targets, the Fed has no basis for either its interest rate targets or the amount of the securities it will sell. Hence, the same procedures that led to the current inflation can easily lead the Fed to become overly restrictive.

To Market, to Market

The bear market took a sickening dive this week. All the major indexes declined by roughly 10 percent. The collapse brings the S&P500 down 24 percent from its peak.

The market’s technical indicators have been very negative for some time. They have not changed.

The current analysis from my technical guru, Joe Barto, has 3,500 as a major support area for the S&P500. If he’s correct, the market can still fall another 5 percent before it reaches support.

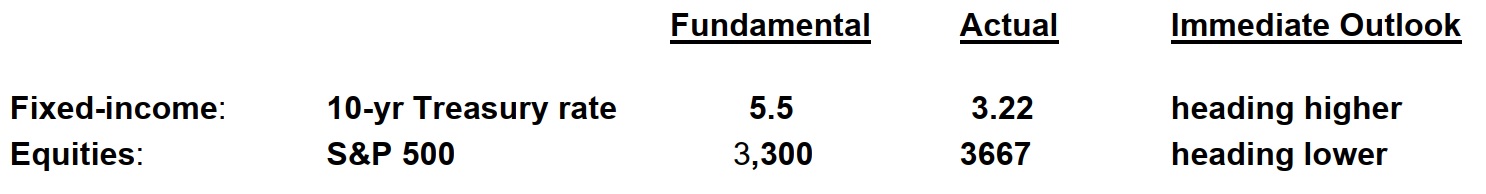

My analysis shows the S&P500 remains about 10 percent above its fundamental value. This is down from a peak overvaluation of 40 percent. At current levels, stocks are far more attractive than they were at the end of last year.

Problems for investors go beyond an incompetent Fed. The Biden administration’s regulatory burdens on the economy have soared. The movement to end fossil fuels is taking its toll on energy companies and all those who rely on them—which is everyone.

Without a reversal of regulatory policies, the consequences of a restrictive Fed policy will become increasingly painful.

Outlook

Outlook

Economic Fundamentals: weakening

Stock Valuation: S&P 500 overvalued by 11 percent

Monetary Policy: changing

For more from Robert Genetski.

More on inflation and unemployment.

For more Budget & Tax News articles.

For more from The Heartland Institute.