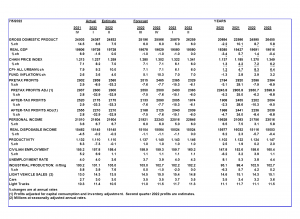

Fed shocks economy: “The Fed’s determination to shock the economy into a downturn appears to be working. … With federal regulations bringing productivity to a halt, the economy has entered a period of no growth at best and a steep downturn at worst.”

Is it a recession, or isn’t it? We’ll find out later this week when the National Bureau for Economic Research gives its verdict.

There is some good long-term news for the economy. Recent Supreme Court decisions have clarified the rule of law by placing a series of restraints on government power. Since the rule of law is paramount as a policy prescription for prosperity, these rulings are good news.

The most important of the rulings in this regard places limits on the Environmental Protection Agency (EPA). The agency’s rulings had involved restrictions on critical parts of the economy, such as the mandates that closed coal plants. The Court ruled such requirements must be explicitly authorized by Congress, instead of from unelected bureaucrats. The damage done by EPA rulings which shut down coal plants has been significant. Unless Congress decides otherwise, clean-burning coal plants will be able to contribute to U.S. energy production and aid an ailing national power grid.

Placing authority directly with the people’s representatives was the original intent of the Constitution. The Court’s ruling can help reduce the extensive regulations and mandates that have recently slowed the nation’s productivity and weakened the economy.

Other rulings placed more responsibility in the hands of state legislatures and clarified the power of executive orders. Strengthening the rule of law can have a positive impact on the economy in the years ahead.

As for the economy, the most anticipated recession in history has begun. So far, the recession has been so mild, few would know it’s here were it not for the decline in stock prices.

As yet, there is no indication of any restraint from the Fed in terms of the amount of money entering the economy. However, the Fed’s determination to shock the economy into a downturn appears to be working. Sharp increases in short-term interest rates, along with promises of additional hikes, have caught the attention of businesses.

The latest business surveys show the economy was flat to down in June. New orders also are declining. With federal regulations bringing productivity to a halt, the economy has entered a period of no growth at best and a steep downturn at worst.

Businesses have responded to promises of monetary restraint by laying off workers and cutting new orders. As the economy suffers, the initial reaction in the fixed-income market has been a decline in inflationary expectations and lower longer-term interest rates.

If the Fed is able to restrain spending with tough talk about higher interest rates and restraint, the end result will take pressure off inflation. In response to the developing weakness in the economy, spending is likely to slow.

If the Fed follows through on its efforts to restraint spending, without overdoing restraint, there is a chance of avoiding a severe downturn. However, without significant relief from government spending and regulations, it will be difficult to improve productivity and reignite the economy.

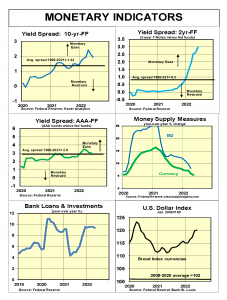

Monetary Indicators

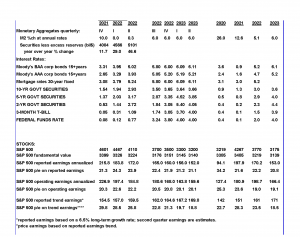

Having completely missed the magnitude of the current surge in inflation, the Fed is insisting it will now do whatever is necessary to contain it.

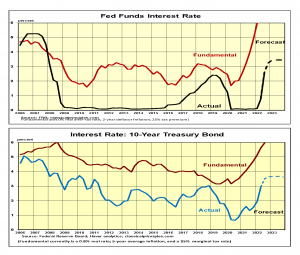

The Fed’s first move was to raise the fed funds rate to 0.33% in April, then to 0.83% in May. They added ¾% at its mid-June meeting and indicate they will add another ¾% at its July meeting, which runs today and tomorrow.

Most commenters associate higher interest rates with monetary restraint. However, monetary restraint usually happens when the Fed sells securities. Selling securities not only reduces the money supply but also lowers security prices, which raises interest rates naturally.

Traditionally, shifting from an expansive to a restrictive policy was fairly simple. The Fed would sell securities and drain money from the economy while the higher interest rates would help restrain spending.

Current Fed policy is different. The Fed sets targets for the interest rate and for purchases or sales of securities independently. Since the two targets are not directly related, the net effect on monetary policy is confusion.

In June, the Fed increased interest rates by ¾ of a percentage point, and there was an increase in money. The increase occurred because banks shifted $93 billion from their deposits at the Fed into the economy.

Can higher interest rates restrain spending even if money continues to flow into the economy? Since the Fed’s monetary experiments are unprecedented, we can’t be certain.

The best we can do is track the shape of the yield curve (see charts below) and various monetary aggregates to see if a clear pattern develops.

The yield curves indicate expectations of a highly expansive policy over the next two years and a slightly less expansive policy over the next ten years.

Traditionally, the raw ingredients of money should dominate. However, if the Fed follows through on its intent to drive interest rates artificially high enough to slow the economy, it will eventually succeed.

For now, my forecast assumes businesses will adjust their plans by limiting new orders and new hiring. The expected result would be a slowdown in the pace of spending from the double-digit rates of 2021.

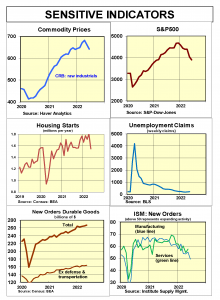

Sensitive Indicators

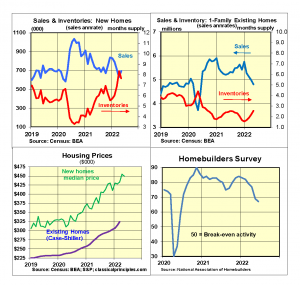

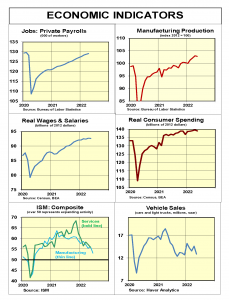

Sensitive short-term indicators have turned negative. Two of the most reliable—stocks and housing—already have pointed to a downturn. In June, a decline in commodity prices, a negative reading for manufacturing new orders, and a persistent increase in initial unemployment claims all point to an emerging downturn.

Higher mortgage rates and soaring home prices led to a sharp decline in sales of existing homes through May. Although new home sales rebounded in May, a sharp increase in inventories of new homes suggests the downward trend in sales will continue.

Coincident indicators are leveling off. Job growth is the only coincident indicator with an upward trend through May. High inflation rates have reduced real growth, with little if any increase in June.

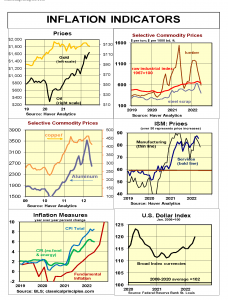

Inflation Indicators

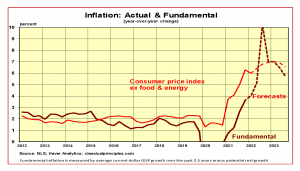

Inflationary pressures show signs of easing as demand in the economy slows. Most sensitive commodity prices declined recently.

Although business surveys show some moderation in price pressures, prices are a continuing problem, with overall readings showing rapid prices increases.

The signs of some easing in inflation are due to a moderation in demand. Current dollar spending (GDP) was up at a 6.6% rate in the first quarter. Personal spending and incomes in May rose at 7% rates from the first quarter. Hence, demand is clearly slowing from the 10% rates of 2021

Our analysis of money shows rapid increases in interest rates, like what the Fed is currently using, can reduce the rate of spending and demand in the economy. This appears to be happening.

The more aggressive the Fed is in raising interest rates, the sooner demand will ease and the sooner inflationary pressures can abate.

Interest Rates

At the Fed’s July meeting, expect to see another increase in the Fed funds target to 2¼%-2½%. While that is still very low, the speed of moving from 0.08% in March to as much as 2½% in July is a shock to financial markets. Those markets are beginning to believe the Fed is serious about containing inflation.

The Fed’s main concern is inflationary expectations. The difference between the yield on 10-year T-Notes and inflation-adjusted notes shows longer-term inflationary expectations peaked at 2.9% in April and currently are 2.2%.

This decline in inflationary expectations indicates financial markets assume the Fed will contain inflationary pressures. If the Fed follows through with those actions, the most likely outcome is a downturn in the economy in the second half of this year. While the magnitude and length of the downturn remain speculative, the Fed is on track in acting decisively to contain inflation.

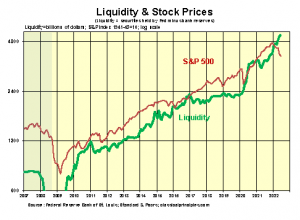

Stock Prices

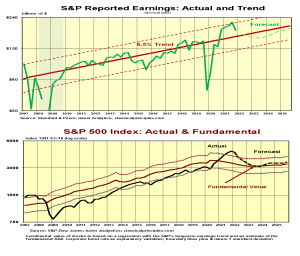

First quarter S&P500 companies’ reported earnings were down 16% from the fourth quarter of 2021. Even so, first quarter earnings were still almost 20% above their longer-term trend. Given the pressures from increased costs and higher interest rates, earnings are likely to continue to decline in the period immediately ahead.

Historically, earnings tend to return to their longer-term trend. Given the weakness in productivity, cost pressures from higher energy and the turmoil in Ukraine, the odds are that earnings will decline to below their longer- term trend.

Our estimate of the fundamental value S&P500 is currently near 3,100. Despite a 20% decline, the S&P500 still remains close to 20% overvalued.

While all projections of the stock market are highly speculative, our projected scenario points to further weakness in stocks. With the mistakes the Fed has made so far in underestimating inflation, the potential for future policy errors remains high. Investors should remain cautious in facing what is likely to continue to be a difficult financial environment.

More economic analysis from Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.