Are Investors Smarter than the Fed? Of course.

You need to SUBSCRIBE to Life, Liberty & Property. Read previous issues.

IN THIS ISSUE:

- Are Investors Smarter Than the Fed?

- Podcast of the Week: From Breakthrough to Blockbuster: The Business of Biotechnology (Guest: Donald L. Drakeman)

- Paying Twice, or Leaving Once

- Give Me Land, Lots of Land

- Cartoon

Are Investors Smarter Than the Fed?

In the past few days, we’ve been hearing that financial markets show investors are regaining confidence in the economy.

In the past few days, we’ve been hearing that financial markets show investors are regaining confidence in the economy.

Are you? I’m not.

I have plenty of confidence in the ability of the American people to provide one another with an abundance of goods and services. It’s the government and central bank that scare me.

Prices of stocks and bonds rose last week as investors banked on the belief that the Federal Reserve will decide by midyear that its interest rate hikes have slowed down economic activity so badly (or, to the Fed, so admirably) that inflation is under control. With the consumer-price index showing that inflation slowed in December, investors started buying again, The Wall Street Journal (WSJ) reported on Friday:

U.S. stocks climbed Thursday and investors bought U.S. Treasurys, lifting bond prices and weighing on yields. The S&P 500 added 0.3%, while the Dow Jones Industrial Average gained 0.6%, or 217 points. The technology-heavy Nasdaq Composite also rose 0.6%.

Another story in the WSJ identified a longer-term trend of investor optimism:

The S&P 500 has risen 11% from its October low, with much of the gains being attributed to bets that the Fed will pivot from raising rates to cutting them some time this year. Government bonds have also retraced some losses after a brutal 2022. The yield on the 10-year U.S. Treasury note was at 3.446% Thursday, compared with its October peak of 4.231%. Yields fall as bond prices rise.

This activity, the story notes, is based on the premise that the Fed will stop raising the Federal Funds Rate, and hence interest rates overall, within a couple of months and then turn around and start cutting rates later this year, which will stimulate the economy, with some analysts even hoping that we’ll avoid a recession:

Evidence that inflation is pulling back has fueled bets that the Fed will cut [interest] rates as early as the second half of the year. Traders in interest-rate derivatives markets see a 90% chance that the Fed lifts rates two more times this year, to around 4.9% by March, according to CME Group. They see a 60% chance that the Fed then cuts rates at least once by December.

These investors, alas, are not getting their cues from the Fed. Quite the contrary: “To be honest with you, I don’t quite know why markets are so optimistic about inflation,” San Francisco Fed President Mary Daly said after the Fed’s meeting last month, according to the WSJ.

The demand for people to help produce goods and services is the Fed’s bête noire. The Fed fears that the current low unemployment rate will raise the price of labor, which will inevitably cause price inflation:

The Fed and many investors agree that inflation will keep declining this year as supply-chain bottlenecks abate and as housing costs slow down after soaring over the past two years. But Fed officials are nervous that the labor market’s strength could sustain wage growth that keeps inflation, as measured by a separate gauge, above their 2% target.

The idea behind the Fed’s concerns about unemployment is that the demand for goods and services is outstripping the ability of the economy to supply it. That means, according to this line of thinking, that prices will rise because businesses will have to pay people more for the same amount of goods, and the companies will have to pass these price increases along to the consumer in order not to take a loss on what they produce.

That makes sense from the businesses’ point of view: higher costs mean higher prices. However, this scenario assumes consumers will pay these higher prices. But will they? Monday’s Wall Street Journalsays no:

Conagra Brands Inc., which makes Hunt’s ketchup and Slim Jim meat sticks, raised prices 17% in its latest quarter, on top of two previous quarters, when it increased prices more than 10%.

The company said it is done boosting prices for now. Conagra’s sales volumes fell 8.4% for the quarter ended Nov. 27, which the company attributed in part to shoppers recoiling from the price increases.

The article also documents other companies that are lowering prices, on items such as chicken wings and beer. Alan Reynolds of the Cato Institute confirmed the easing of inflation in a tweet yesterday:

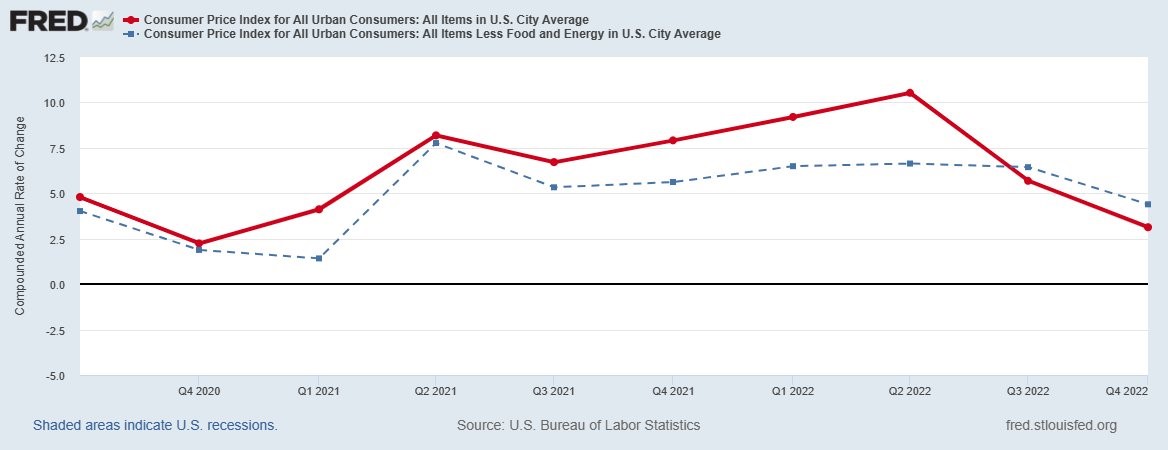

Fourth quarter CPI inflation was the lowest in two years (and the same as Q2-2019). It might prove informative if a reporter dared to mention that the next time any FOMC Fed official gives another speech about the necessity of raising interest rates to expedite recession.

What the above-named products with stabilizing prices have in common is substitutability. Although we may like ketchup and Slim Jims, we can get by without them. Prices for necessities such as milk and eggs have proven stickier, but they too will get back to normal as supplies increase in response to steady demand and higher prices. We will probably end up with a higher normal price for those goods, at least for a while, but the Fed’s policies should be based on inflation now, not inflation from a year ago. As is demonstrated by the anecdotes above and Reynolds’ graph, people will adjust their consumption choices, and businesses will adjust their pricing and supply choices in response.

Unfortunately, the Fed is not very good at responding to market forces. The Fed always reverses course after sharp hikes in interest rates, but it generally does so later than it should. Reynolds, who has been writing about this for years, wrote in mid-December that the Fed was wasting precious time by using an inaccurate number for rental costs:

Some prices went up over the past five months and others went down, but the weighted average increase for everything in the average consumer’s shopping basket was nil once we properly exclude disingenuous and outdated estimates of shelter inflation. …

The Federal Reserve Board’s Chairman Jerome Powell now faces the unenviable task of trying to explain why the Fed is trying to steepen the already perilous inversion of the yield curve despite very little inflation since June (aside from a statistical illusion in the way the BLS slowly collects and estimates from outdated rent data).

The Fed’s institutional memory of prior bouts of inflation is in fact a false memory (at best), Reynolds notes:

A centerpiece of the Federal Reserve’s favorite institutional self‐defense mechanisms has long been to rewrite the history of the 1970s as a contrast between “prematurely loosening” under Chairman Burns and “staying the course” under Chairman Volcker. That fable is entirely false, as I have documented here and here.

Volcker was, in fact, much quicker to cut rates in the 1980 and 1982 recessions than Burns was in 1975, and Volcker cut the funds rate more deeply (by 10 percentage points). Yet the useful mythology about “prematurely loosening in the seventies” (rather than 1980) still exerts mesmerizing influence on policymakers and their compliant media messengers.

Maybe the Fed’s institutional memory is just a lie, a fairy story invented to excuse the central bank’s continual damage to the nation’s economy, which happens because central banks do not and cannot work as intended. In any case, the Fed clearly intends to stick to its guns, reality notwithstanding. The damage the Fed is doing by its suppression of voluntary economic activity, on top of the long-term destruction already inflicted by President Joe Biden and the Democrat-controlled Congress of the past two years, is incalculable.

Perhaps that, too, is intentional. The incalculability, I mean.

So, the answer to the question I posed at the top of this article is this: “Yes, but it won’t do them, or us, any good at all.” The Fed will bring on a recession because that is what its false memory tells it to do.

Sources:The Wall Street Journal; The Wall Street Journal; The Wall Street Journal; Alan Reynolds on Twitter; Cato at Liberty; Econlib

The news from a free-market perspective

Edited by S.T. Karnick

Podcast of the Week

From Breakthrough to Blockbuster: The Business of Biotechnology (Guest: Donald L. Drakeman)

Hosted by Heartland’s Tim Benson, the Ill Literacy Podcast features great discussions with nonfiction authors on their latest books.

SUBSCRIBE to it wherever you get your podcasts.

Heartland’s Tim Benson is joined by Donald L. Drakeman, Fellow in Operations and Technology Management at the Cambridge Judge Business School, Distinguished Research Professor in the Program on Constitutional Studies at the University of Notre Dame, and a Venture Partner at Advent Life Sciences, to discuss his new book (co-authored with Lisa Drakeman and Nektarios Oraiopoulos), From Breakthrough to Blockbuster: The Business of Biotechnology.

They chat about how medical innovation happens, specifically how biotech companies have created 40 percent more of the most important treatments for previously unmet medical needs than the major pharmaceutical companies at a lower cost. Benson and Drakeman also discuss the crucial roles played by academic research, venture capital, contract research organizations, the capital markets, and the pharmaceutical companies in creating medical breakthroughs.

Paying Twice, or Leaving Once

As the nation’s cities become increasingly terrifying cesspools of crime and filth, residents are turning to for-profit providers of policing services to provide some line of defense, Tate Fegley of the Independent Institute notes at Mises Wire:

While “private policing” is in many people’s minds a feature of dystopian science fiction or the fantasies of libertarian economists, the reality is that private security is far more common than most think. Indeed, as Georgetown professor John Hasnas points out, it is all around us. Unfortunately, the impetus for much of the growth in the private security industry has been the inadequacies of state-provided protection.

The takeover of local prosecutors’ offices by Soros-funded lawyers determined to put those accused of crimes back on the streets as quickly as possible has raised crime rates and spread the disorder out, far from the benighted low-income neighborhoods in which it was largely (and unconscionably) prevalent in the nation’s major cities. In Philadelphia, this has everyone in justifiable fear for their lives, Fegley notes:

Temple [University] students living off campus fear for their safety. This is understandable, considering the amount of crime North Philadelphia is experiencing. On November 28, 2021, Temple senior Samuel Collington was fatally shot in a parking lot near campus during what appears to have been an attempted robbery. Less than two weeks earlier, on November 16, high school senior Ahmir Jones was also killed during a robbery attempt just blocks from Temple. In 2021, Philadelphia as a whole surpassed its murder record; the previous peak of over five hundred murders annually was during the crack cocaine epidemic of the early 1990s.

After a broad-daylight armed robbery took place outside one student’s residence, his mother decided to hire JNS [Protection Services] to patrol his neighborhood. Although JNS was initially hired to patrol the area three days per week, the plan came to the attention of a Facebook group of Temple parents, and they contributed funds to expand the service to five days per week.

Of course, the government police don’t like this trend. Hasnas notes a Philadelphia Inquirer opinion column quoted David Fisher, a retired Philadelphia police officer and president of the Greater Philadelphia chapter of the National Black Police Association, disparaging these private security teams as “just a town watch.” Fisher’s “condescending attitude is notable for two reasons,” Fegley observes:

[W]hile Fisher expressed concerns over whether private security will be effective, the Philadelphia Police Department is able to escape such scrutiny despite the record number of murders and students being killed by armed robbers. In contrast to JNS Protection Services, the city police do not have to demonstrate their effectiveness to Philadelphians in order to get paid. Local (as well as US) taxpayers will continue to fund them regardless.

Perhaps parents will find that JNS’s services are ineffective or unsatisfactory. Perhaps a competitor will provide a better service at a lower price. But just as school choice creates financial incentives for public schools that give parents more control, security providers are more responsive when parents have police choice.

As with the schools, residents end up paying private providers to do what the public servants they are already paying for fail to do. We may choose not to blame the individual public servants for this problem, but it is only fair to observe that they are taking money from taxpayers to participate in an increasingly corrupt system.

It’s interesting that as city governments take up social-justice causes and pledge to “get to the root of problems,” they increasingly fail to perform the basic functions of government while charging ever-higher taxes. People notice the obvious, and those who can escape the chaos move out. That is happening in Illinois and other states as the big cities’ pathologies bleed out into the surrounding areas and high taxes and terrifying pension crises threaten to make good government impossible. The Wall Street Journal reports,

Last month a Journal editorial noted U.S. Census data showing that Illinois lost more than 141,000 residents to other states in just one year, which made Illinois the third biggest loser after California and New York.

Chasing productive people out of state would seem to be a bad idea. For corrupt politicians, however, dependence on government is an exciting prospect: more votes for those who promise to redistribute goodies from the haves to those who have less (there being virtually no involuntary have-nots anymore, thank goodness). That is the inevitable outcome of decades of perverse incentives.

Sources: Mises Wire; The Wall Street Journal

Give Me Land, Lots of Land

Having given the Disney company a thrashing, Gov. Ron DeSantis of Florida is now aiming at an even bigger target: the Chinese Communist Party. The Epoch Times reports:

Florida Gov. Ron DeSantis is mulling a move to ban Chinese entities from purchasing property in the state due to the economic and security risks posed by China’s communist regime.

“If you look at the Chinese Communist Party, they’ve been very active throughout the Western Hemisphere in gobbling up land and investing in different things,” DeSantis said during a press conference on Jan. 10.

“And, you know, when they have interests that are opposed to ours, and you’ve seen how they’ve wielded their authority… it is not in the best interests of Florida to have the Chinese Communist Party owning farmland, owning land close to military bases.”

China has indeed been buying up land all across the United States, and Florida has been the CCP’s top target, the paper reports:

Chinese investors purchased more than $6 billion in U.S. real estate between March 2021 and March 2022, according to the National Association of Realtors, making it the largest foreign buyer in terms of dollars spent.

Florida has been at the center of that purchasing binge, with 24 percent of all foreign property purchases in the nation occurring there. The state with the next highest amount of foreign purchases was California, which accounted for 11 percent.

The purchases have come to the attention of Congress, and the House, now under Republican control, is preparing to investigate the matter.

One can make the case that these concerns are unfounded and the land buys are just the good old free market at work. That argument has little force, however, when the “purchasing binge,” to use The Epoch Times’ apt term, is being orchestrated by a Communist government. Investigation and an at least temporary ban on such purchases make sense in response to an avowed enemy’s attempt to use our free markets to undermine our national sovereignty and control of our own soil.

Source: The Epoch Times

Cartoon