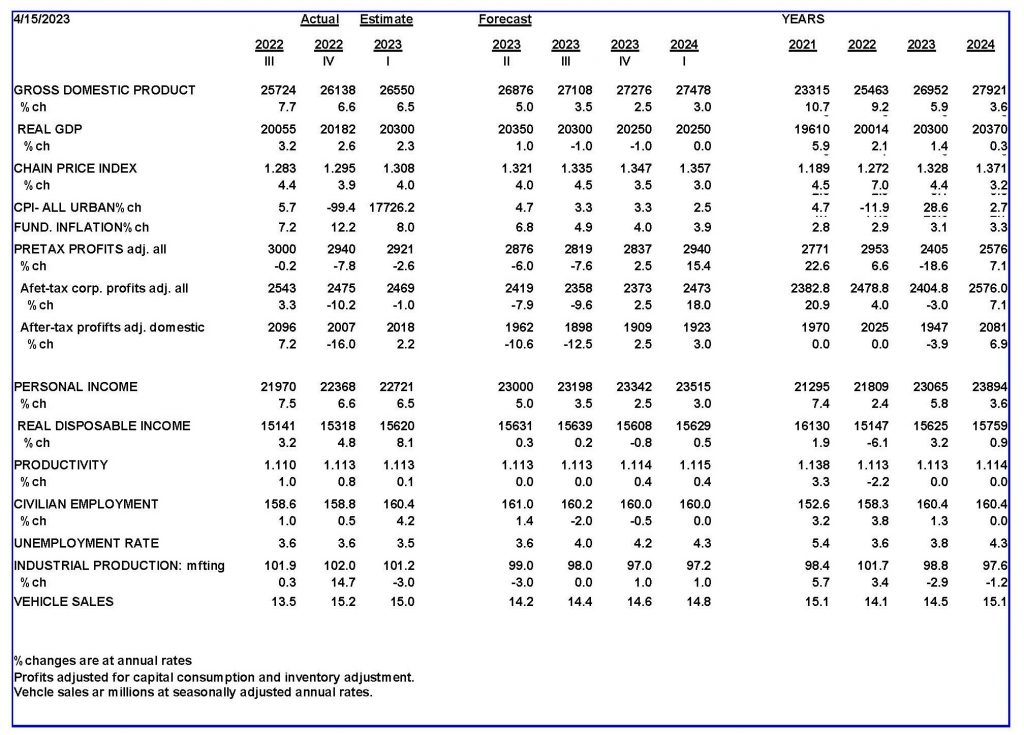

After nine months of monetary restraint, economic reports in April have provided the first signs the economy is slowing.

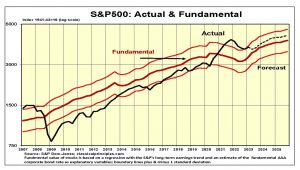

The stock market, which often looks three to six months ahead, peaked at the end of 2021. Back then, our analysis showed stocks and S&P500 earnings were 40 percent overvalued, leading us to anticipate an extended period of falling prices.

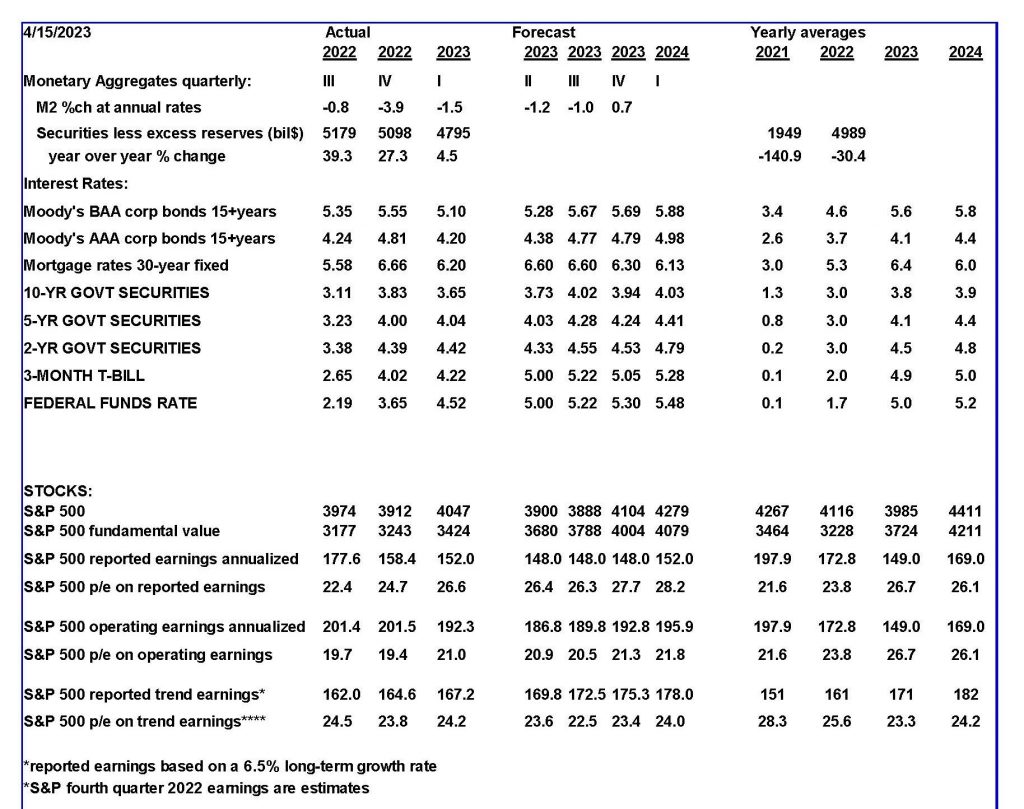

Prices declined through October, 2022, but they have since rebounded. The rebound is associated with the moderation in longer-term interest rates, which provide a guide to Fed policy success or failure.

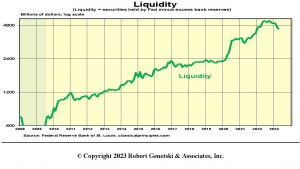

The Liquidity chart below, our main measure of monetary policy, includes both the impact of Fed purchases (and sales) of securities as well as that of banks shifting money into or out of the economy.

Liquidity peaked in June 2022. Since then we have had the most dramatic reduction in liquidity since the financial crisis of 2008. During the 2008 crisis, the Fed reduced the amount of liquidity by 40 percent, precipitating a wave of bankruptcies in the fall of 2008. Currently, liquidity is down 15 percent from June through mid-April.

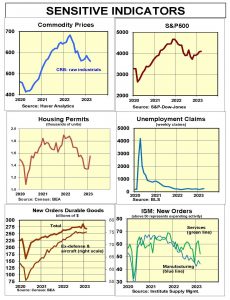

Monetary policy tends to affect the economy six to nine months later. Sensitive indicators (the stock market and housing) were the first to feel monetary restraint. Recent data suggest the weakness is now spreading to the rest of the economy.

Monetary Indicators and the Economy

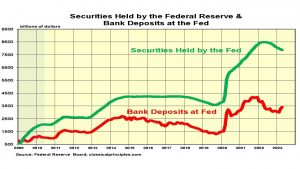

The chart below shows the two components of our measure of liquidity. Fed sales of securities from June 2022 to mid-April removed $600 billion from the economy, accounting for 75 percent of the liquidity decline.

The remaining decline came from banks shifting $186 billion of their funds into deposits at the Fed. For most of the period since June 2022, banks were a moderating factor, shifting money from Fed deposits into the economy.

After the failures of Silicon Valley, Silvergate, and Signature, banks have shifted more than $400 billion of their funds back to deposits with the Fed. Banks appear to be building deposits with the Fed in anticipation of a crackdown by regulators.

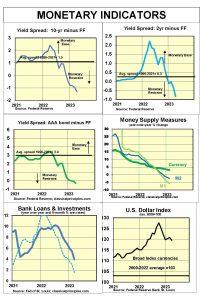

The restraint shown in the liquidity measure of money also is present in other measures of monetary policy. Yield curves into April are indicative of periods of moderate to severe restraint.

Traditional money measures such as currency, M1 (currency and demand deposits), and M2 (currency and bank deposits) also point to moderate to severe restraint.

We expect the recent tightening in monetary policy to lead to a longer and deeper weakness in the economy. With the Fed continuing its restrictive policy in May and not ruling out further tightening in June, the weakness in the economy will extend at least through the end of this year.

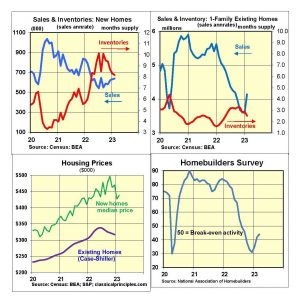

Sensitive Indicators

Sensitive indicators are mostly negative at present, with the exception of stock prices and new home sales. The decline in longer-term interest rates appears to be restoring life into both of these key sensitive indicators.

Other sensitive indicators are not performing as well. The new orders components in the ISM business surveys weakened significantly in March. New orders for durable goods and most commodity prices also have experienced weakness.

Although many coincident indicators continue to show strength, the behavior of the March business surveys is consistent with an economy shifting from growth to recession.

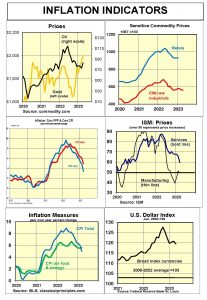

Inflation Indicators

Recent inflation data show a sharp slowdown in core inflation rates. Core inflation excludes the volatile food and energy components. It provides the best and earliest guide to any change in inflationary pressures. The Fed is likely to declare victory in terms of containing inflation if the core inflation rates return to the 2 percent vicinity.

As the chart below shows, the core producer price index often leads the consumer price index (CPI) on a year-over-year basis.

The good news is the core CPI has fallen from 9 percent to 5 percent. The not-so-good news is the past three months and the past six months have also been close to 5 percent. Hence, through March there has been no clear sign of further progress in containing inflation.

In spite of the lack of recent progress, we expect a decline in the core CPI to continue through the remainder of this year. Our forecast of a growing weakness in business conditions should be sufficient to drive inflation down to the 2½ percent to 3½ percent range by early 2024.

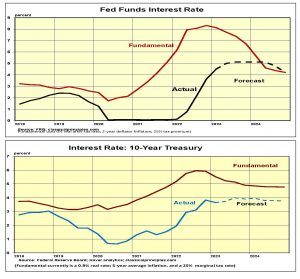

Interest Rates

With monetary restraint becoming progressively greater and the emerging signs of economic weakness, we believe we are close to the peak of short-term interest rates. We continue to expect inflation to decline only slowly, which would mean the peak in short- and long-term interest rates is still ahead.

Financial markets anticipate an early decline in short-term interest rates. Although it is possible for inflation to decline rapidly, we doubt that it will happen quickly enough for the Fed to begin any easing of monetary policy until the end of this year.

Although we may be close to the peak in interest rates, expect both short- and longer-term interest rates to stay higher and longer than financial markets currently expect.

Stock Prices

S&P500 earnings continue to come in below analysts’ estimates. Reported earnings for the fourth quarter of 2022 were down 27 percent from a year ago. At an annualized rate of $158 a share, earnings were slightly below their long- term trend. A further decline is likely, given our forecast of a downturn in the economy.

The decline in longer-term interest rates is a key development in terms of valuing stocks. The moderation in longer-term interest rates indicates financial markets are convinced the Fed will achieve its inflation target.

While we believe the Fed will hit its inflation target, we expect it will take much longer than financial markets currently anticipate. Our forecast calls for the Fed to keep the fed funds rate slightly above 5 percent through the end of this year.

The current moderation in longer-term interest rates increases the valuation of stocks, raising our estimate of the market’s fundamental value. As a result, the fundamental value of the S&P500 in currently 3,700. That means stocks are only moderately overvalued.

With the economy entering a downturn, investors may still become concerned about the prospects for earnings. Other factors, including the battle of the debt ceiling, also can weigh on stock prices. However, as long as the Fed remains resolute in containing inflation, any rise in longer-term interest rates should be minimal. Our expectation is for the yield on 10-year T- Notes to peak at 4 percent. At these levels, stock prices should soon begin to anticipate a likely recovery in earnings in 2024.

For more Budget & Tax News articles.

For more from The Heartland Institute.