Life, Liberty, Property #26: Fed’s interest rate hike makes a slow-to-no-growth stagflation scenario more likely.

IN THIS ISSUE:

-

-

- Fed’s Interest Rate Hike Strengthens Stagflation Scenario

- What’s Driving the Asian Slowdown

- Arresting the FBI

- Cartoon

-

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Fed’s Interest Rate Hike Strengthens Stagflation Scenario

The Federal Reserve (Fed) is taking another stab at taming inflation, long after the conditions for inflation seem to have ended and a recession appears more likely. Unfortunately, the Fed’s interest rate hikes are creating conditions for a return of inflation in addition to a recession.

The Federal Reserve (Fed) is taking another stab at taming inflation, long after the conditions for inflation seem to have ended and a recession appears more likely. Unfortunately, the Fed’s interest rate hikes are creating conditions for a return of inflation in addition to a recession.

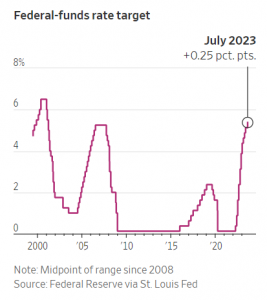

Fed Chair Jerome Powell announced on Wednesday the central bank was raising interest rates by a quarter of a point, bringing the Fed Funds Rate to its highest point in 22 years. The target rate is now 5.25 percent to 5.5 percent:

Source: The Wall Street Journal

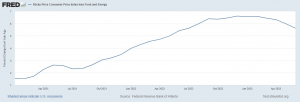

Raising interest rates slows the economy by making borrowing more costly, in addition to other effects. The Fed has been raising interest rates since March of last year (when rates were near zero), the most rapid sustained increase in four decades. The money supply has declined accordingly:

Source: St. Louis Fed

Upon announcing the latest rate increase, Powell said the central bank might push interest rates even higher and the Fed’s governors believe the ongoing monetary tightening will not lead to a recession.

The Fed continues to look at the unemployment rate as assurance that there will be no recession and that the real threat is still inflation. That is based on the Phillips Curve theory, which assumes low unemployment rates make workers too powerful and pushes up prices by increasing labor costs. The facts do not support belief in the Phillips Curve, however, as Cato Institute Senior Fellow Alan Reynolds notes:

[If the Phillips Curve were true,] the reduction of inflation since last June could not have happened. After 15 months in which the CPI inflation rate averaged 8.5 percent (and the fed funds rate was tiny), it has now fallen to 3.1 percent for 11 months. Did that happen because the unemployment rate went up? On the contrary, unemployment fell from 4.5 percent to 3.6 percent.

But the Fed and academic economists are not easily dissuaded by troublesome facts. They just keep on searching for new ways of explaining why the theory is still right, but the world has gone wrong.

A definite factor in the rise and fall of inflation over the past couple of years is federal fiscal policy, which has been absolutely harebrained. Hoover Institution economist John H. Cochrane explains how the federal government’s spending spree of the past few years fueled price inflation:

How do we get inflation from the big fiscal stimulus of 2020-2021, [a friend] asked? Well, I answer, people get a lot of government debt and money, which they don’t think will be paid back via higher future taxes or lower future spending. They know inflation or default will happen sooner or later, so they try to get rid of the debt now while they can rather than save it. But all we can do collectively is to try to buy things, sending up the price level, until the debt is devalued to what we expect the government can and will pay.

OK, asked my friend, but that should send interest rates up, bond prices down, no? And interest rates stayed low throughout, until the Fed started raising them. I mumbled some excuse about interest rates never being very good at forecasting inflation, or something about risk premiums, but that’s clearly unsatisfactory.

Of course, the answer is that interest rates do not need to move. The Fed controls the nominal interest rate. If the Fed keeps the short term nominal interest rate constant, then nominal yields of all bonds stay the same, while fiscal inflation washes away the value of debt.

As Cochrane observes, the money supply increased rapidly as the federal government pumped stimulus checks and other expensive boondoggles directly into the economy:

In March 2022, the Fed began raising the nominal interest rate to fight the inflation the federal government’s overspending was causing. The CPI began to turn the corner in late 2022.

The Fed has stubbornly implemented further interest rate increases since then, redoubling its efforts to increase unemployment in order to stop inflation. But the decrease in the money supply eliminates any need to push up unemployment even if you believe in the Phillips Curve. In fact, suppressing employment and overall economic output will fuel price inflation if the supply of goods and services decreases faster than the money supply.

The Fed’s interest rate hikes are now compounding the damage caused by the government’s overspending. Our fundamental economic problem is weakness on the supply side, which the interest rate hikes are designed to worsen. Domestic employment has stagnated, as economist Vance Ginn notes in The Daily Caller:

Turning to the latest jobs report for June, the figures are disappointing, falling well below expectations. Only 99,000 net jobs were added after accounting for downward revisions in the two prior months. Moreover, many of these jobs were government jobs, straining the productive private sector that pays for those jobs. According to the household survey, employment has remained nearly stagnant since March, indicating a lack of substantial job creation. To make matters worse, the labor force participation rate has yet to return to its pre-pandemic rate, indicating millions of Americans are uncertain about their job prospects.

In short, the economy is struggling—outside of government spending, which increases GDP far more than it raises the real supply of goods and services (if it does the latter at all, when you consider that the private sector would have used that money for things people want to buy). Continuing increases in federal spending—such as the debt ceiling deal and the Biden administration’s latest plan to forgive student loans—drain even more resources out of productive uses in the private sector for purposes of income redistribution.

As economist Robert Genetski notes at Heartland Daily News, the U.S. economy may already be weaker than most people think:

[W]e should be skeptical about the Atlanta Fed’s estimate of a 2 percent growth rate for the quarter now ending. Many economic estimates are based on soft numbers. One hard number estimate comes from the Treasury’s monthly report on tax receipts. With two-thirds of fiscal 2023 completed, the Treasury reports tax receipts down 11 percent from the previous year. Tax receipts are highly erratic and difficult to interpret. Nonetheless, these data through May point to a weaker economy than either the GDP or [Gross Domestic Income] would suggest.

A decrease in taxable income (and thus tax receipts) is particularly consequential in a time of continuously increasing government spending, as it makes the federal deficit even higher than expected. That raises the cost of the government’s interest payments, and the Fed’s interest rate hikes push them even higher, further draining resources from the productive private sector.

The most worrisome prospect for the U.S. economy at present is not low unemployment but instead the government’s ongoing suppression of the supply of goods and services produced domestically. That, plus excessive government spending, creates the conditions for inflation and slow or negative economic growth. When those conditions combine as they do today, stagflation is the dismal result.

It is hard to overstate how dire the government spending situation has become.

Sources: Cato at Liberty; The Grumpy Economist; The Daily Caller; Heartland Daily News

What’s Driving the Asian Slowdown

The U.S. interest rate hikes are suppressing economic activity elsewhere as well. As The Wall Street Journal noted earlier this month,

The U.S. interest rate hikes are suppressing economic activity elsewhere as well. As The Wall Street Journal noted earlier this month,

Exports are crumbling in China and across Asia, showing the deepening toll that rising interest rates are taking on global trade and economic growth.

Trade has been slowing for months, but the pullback has further to run, economists say, as central banks keep up their campaigns to beat back inflation and the U.S. and Europe slide toward recession.

Chinese exports fell at their steepest annual pace in June since the early days of the pandemic in February 2020. China isn’t the only Asian export powerhouse reporting sinking overseas sales. Exports from Taiwan fell 23% in June compared with a year earlier, while Vietnamese exports were down 11%. Exports from South Korea were down 6%, according to official figures compiled by data provider CEIC.

The Journal’s report takes a Keynesian approach to the matter, arguing that a decrease in demand in the United States and Europe is driving the slowdown in imports to the West. The reality is that the Asian economies are responding to internal problems: they took on too much debt, and China’s lockdowns have created the same sort of supply-side crash the United States imposed in 2020.

“Chinese economic growth has ground to a halt as a result of President Xi Jinping’s zero-tolerance COVID-19 policy and … a number of emerging market economies are already defaulting on their debt,” wrote American Enterprise Institute Senior Fellow Desmond Lachman at The Hill last December.

The Fed’s tight money regime is aggravating this retrenchment. “As the World Bank keeps warning us, a tighter U.S. monetary policy now threatens to set off a wave of emerging market debt defaults by creating emerging market balance of payments problems for those highly indebted economies,” Lachman notes.

In addition, intense U.S. and European government military and economic support for the war in Ukraine has exacerbated Beijing’s pivot away from the United States as a critical outlet for exports from China, as China’s ally Russia turns to the East to sell its oil and natural gas:

A growing share of China’s exports are heading to regions including the Middle East and Latin America, reflecting strengthening economic links thanks to Chinese investment and its hunger for natural resources. Exports to Russia surged in June, reflecting close ties between Moscow and Beijing and the effect of Western sanctions on Russian imports.

The Journal blames Trump-era tariffs for this, but that invites the question of why taxes imposed in 2018 should have waited until now to suppress imports from China. Imports from China to the United States were near a record high last year. “U.S. imports of goods from China totaled $536.8 billion in 2022, a 6.3% increase from the prior year and close to the record $538.5 billion reached in 2018,” The Wall Street Journal reported on February 9. As those stubborn facts indicate, the problem emerged only this year, so the Trump tariffs cannot be to blame.

A much more likely cause of the reversal, in addition to the domestic factors noted above, is Western reluctance to invest in a Chinese economy that has little prospect of the kind of rapid economic growth it achieved in the previous two decades. China’s population is aging rapidly, and President Xi Jinping has been tightening his authoritarian rule. The Wall Street Journal reports,

Foreign direct investment in China fell to $20 billion in the first quarter of this year, compared with $100 billion in last year’s first quarter, according to an analysis of government figures by analyst Mark Witzke at research firm Rhodium Group.

Goldman Sachs economists predict outflows from China this year will cancel out investment going into the country, a stunning change for a country that over the past four decades has consistently seen more money coming in than going out.

The Journal speculates Xi is choking off the flow of foreign capital into China for national-security reasons, which may be a factor. The main reason for the investment pullback by the West, however, seems to me to be a recognition of the natural waning of Chinese economic growth as suppliers of goods and services increasingly become consumers thereof because the population is getting older and people are retiring. Add to that the lockdowns and their implications for future anti-market actions by Xi, plus high interest rates in the United States (and thus higher returns for bonds, bank deposits, etc.), and you have a sufficient explanation for investors putting their money elsewhere.

Sources: The Wall Street Journal; The Hill; The Wall Street Journal

Arresting the FBI

I have long thought that there is no excuse for having a Federal Bureau of Investigation. We did not have a federal police force before the Progressive Era and did just fine. The protection of the public from domestic crime (as opposed to foreign invasions) is a responsibility of the states, not the national government. The positive things that the FBI can do—such as coordination of police efforts across state lines—could be accomplished without having armed agents from the federal government scattered across the country and blurring the lines between federal and state authority, much less overstepping those boundaries.

I have long thought that there is no excuse for having a Federal Bureau of Investigation. We did not have a federal police force before the Progressive Era and did just fine. The protection of the public from domestic crime (as opposed to foreign invasions) is a responsibility of the states, not the national government. The positive things that the FBI can do—such as coordination of police efforts across state lines—could be accomplished without having armed agents from the federal government scattered across the country and blurring the lines between federal and state authority, much less overstepping those boundaries.

Meanwhile, the political corruption of the agency that has become increasingly obvious since 2016 has given rise to demands for reform or even defunding the FBI.

Writing at The Federalist, a former federal and state law enforcement officer offers an interesting proposal: “Disarm the FBI and force it to partner with local law enforcement agencies for any investigative and enforcement activities,” writes Stephen Friend, a fellow on domestic intelligence and security services at The Center for Renewing America.

Removing the agency’s power of arrest would be a dramatic and positive reform.

Friend describes how Congress could do this, with reference to numbered employment positions defined by the U.S. Office of Personnel Management (OPM):

Through budget appropriations, Republicans can defund all 1811 [meaning: armed] criminal investigators from the FBI. Eliminating special agents will disarm the agency and remove its ability to arrest alleged criminal violators.

Next, Republicans should direct OPM to create a new, 1812 “unarmed criminal investigator.” Any current FBI special agents can transition to unarmed criminal investigators. Like 1810 investigators, 1812 unarmed criminal investigators will not carry firearms. Like 1811 criminal investigators, the new position should be charged with all necessary duties to investigate alleged or suspected criminal violations of federal laws. In addition, 1812 unarmed criminal investigators will not earn availability pay enhancement offered to federal law enforcement personnel. This reduces total FBI investigator salary expenditures by 25 percent.

Then, to “diminish the FBI’s ability to investigate and persecute innocent Americans,” Congress should “use budget appropriations to prohibit the FBI from investigating any alleged criminal violators without the expressed approval of state, local, or tribal law enforcement agencies holding arrest authorities within the area the investigation transpires,” Friend writes. “Further, Republicans can require federally deputized ‘Task Force Officers’ from the approving agencies to partner and participate in all FBI investigations.”

That would put the FBI in a position to assist local law enforcement agencies in conducting investigations, while removing any police powers from the agency and placing them back with the states where they belong:

These appropriation measures empower local sheriffs and police as a final stopgap measure against an out-of-control, politicized FBI. Once forced to partner with state, local, and tribal police, the FBI must demonstrate the righteousness of investigations to leaders within these agencies and gain their approval. Since these agencies are more accountable to local constituents, they will logically serve as a bulwark against FBI overreach.

Friend’s plan is at least a very good starting point for a much-needed discussion of how to rein in an agency that has grown far beyond any justifiable amount of power.

Source: The Federalist

Cartoon