Life, Liberty, Property #33: latest plan for federal overspending stalls in Congress as fiscal year-end looms for appropriations.

IN THIS ISSUE:

- Latest Plan for Federal Overspending Stalls

- The Fed Pulls the Football Away

- Labor Unions Strike Against Bidenflation

- Does the United States Need More People, or Just More Workers?

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Latest Plan for Federal Overspending Stalls

Progress toward votes on appropriations to fund the federal government beyond the end of the fiscal year on September 30 stopped on Thursday when Republican fiscal hardliners blocked a proposal to advance an $826 billion national defense appropriations bill for a floor vote.

Having defeated consideration of a continuing resolution to fund the government into next year, Republican budget hardliners opposed consideration of the defense bill, instead favoring a plan that the chamber first consider appropriations bills for operations the coalition has slated for spending cuts.

The strategy would force Speaker Kevin McCarthy and the thin GOP majority to prove their support for spending cuts before voting on appropriations on other areas, such as defense, that usually garner strong Republican support and are expected to receive increases in funding.

The Western Journal (TWJ) reports,

The House of Representatives reportedly will be voting on individual appropriations bills next week rather than a continuing resolution as a stopgap measure that would keep the government open.

NBC News political analyst Jake Sherman posted on the social media platform X on Thursday that Florida Rep. Matt Gaetz and other Republicans came out of a meeting with McCarthy saying that bringing individual appropriations bills is now the plan.

“Gaetz said that he’s advocating for pausing consideration of the Pentagon spending bill and moving to bills that cut spending,” Sherman said.

Although the House adjourned for the weekend, the situation may change by the time this newsletter, being written on Friday, hits your inbox on Monday. The process, however, is instructive regardless of how it will ultimately play out.

McCarthy gave in to the demands of a small but determined 20-person group within the Republican caucus who opposed the GOP’s original plan for a continuing resolution (CR) that would fund the government at Democrat-preferred or at least -acceptable levels and take a potential shutdown off the table as an election-year issue.

Rep. Matt Gaetz (R-FL), one of the leaders of the budget hardliners, had told the GOP leadership that seven Republicans would vote against the proposed CR and if McCarthy were to collaborate with Democrats to pass it, the Speaker would lose his position “promptly,” The Western Journal reported, quoting a Wednesday tweet by CNN chief congressional correspondent Manu Raju.

With a 221-212 majority and 217 votes needed to pass legislation if the Democrats stick together (which they always do on anything important), McCarthy could not afford to lose more than four GOP votes on the CR. In addition, three GOP members were absent from the House for medical reasons. After agreeing to the budget hardliners’ demand that he offer individual appropriations bills instead, McCarthy then found that he could not even get his hoped-for first appropriation bill through the chamber, which served as a test of his ability to keep the coalition together for a possible CR. TWJ reports:

On Thursday, five Republicans joined Democrats in voting against moving forward on the defense appropriations bill, which failed 212-216, according to NBC News.

The five conservatives want more spending cuts.

Gaetz tweeted his happiness at the outcome:

The federal government’s fiscal year ends on September 30. For government spending to continue beyond that date, Congress is required to appropriate it explicitly, under Article 1, Section 9 of the U.S. Constitution: “No Money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of the Receipts and Expenditures of all public Money shall be published from time to time.”

Congress has not passed an appropriations bill before the end of the fiscal year since FY 1997, and it has done so only three times over the past 48 years.

The use of CRs benefits members of Congress by delaying any major changes to the budget until after elections take place in November. The process thus reduces any urgency for reforms in federal spending.

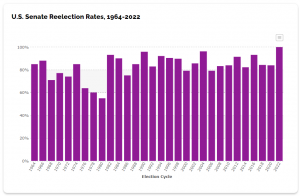

Members of Congress use this strategy to insulate themselves from vulnerability in elections. That may seem odd given that nearly all seats in the U.S House of Representatives and most Senate seats are safely in the hands of one party or the other and in fact of the individuals holding them:

Source: Open Secrets

Source: Open Secrets

Nonetheless, members of both parties benefit politically from the CR approach. High-spending Democrats and complicit Republicans use CRs to reduce the chance that the voters in general elections will let overspending change their minds about returning them to the trough. Republicans further benefit by decreasing the likelihood that voters will kick them out in the primaries in favor of challengers offering to cut spending. Democrats go along with the benefit to Republican incumbents because they would much rather enjoy the support of a Surrender Caucus than be forced to deal with a pack of so-called radicals who might actually cut spending appreciably.

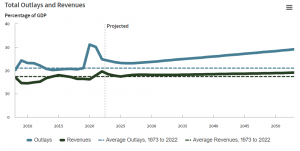

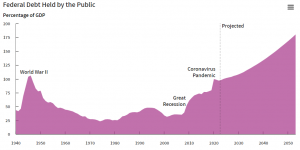

As a result, federal spending and debt have risen steadily since the last on-time appropriations bill in 1997 and are projected to continue increasing into the foreseeable future:

Source: St. Louis Fed (graph created by author)

Source: Congressional Budget Office

Source: Congressional Budget Office

The best thing that could happen to the American taxpayer would be an end to the CR scam and a return to appropriations bills completed and sent to the president on time. Unfortunately, one floor vote means practically nothing when the system allows members of Congress to preserve their political positions by delaying the reckoning until elections have passed.

Source: The Western Journal

The Fed Pulls the Football Away

The Federal Reserve is now indicating that it will hold interest rates higher than expected for much longer than expected. The Wall Street Journal reports:

On Wednesday, Federal Reserve officials surprised markets by signaling interest rates won’t fall as much as previously planned.

The tweak might be more important than it looks. In their projections and commentary, some officials hint that rates might be higher not just for longer, but forever. In more technical terms, the so-called neutral rate, which keeps inflation and unemployment stable over time, has risen.

To combat inflation, the Fed always raises interest rates too late and too high and holds them too high for too long. That “squeezes inflation out of the economy” by suppressing the private sector’s production of goods and services, which is the source of all economic growth. Millions of people are thrown out of work, people’s retirement funds decrease, and the economy contracts, reducing the public’s standard of living. That is success, as the Fed governors see it.

Markets being “surprised” by this are reminiscent of Charlie Brown continually expecting Lucy to hold the football while he kicks it.

Source: https://tenor.com/view/missed-kick-kick-missed-football-fall-gif-12718504

Source: The Wall Street Journal

Labor Unions Strike Against Bidenflation

While the Fed promises to kill jobs (see item immediately above), labor unions are striking for higher pay. “Union strike activity is up more than 50% since [President Donald] Trump left office,” the Unleash Prosperity Hotline from the Committee to Unleash Prosperity (CTUP) reports.

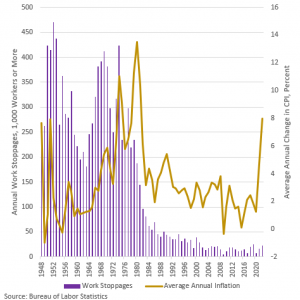

Work stoppages generally increase in the wake of rises in the Consumer Price Index, the CTUP notes:

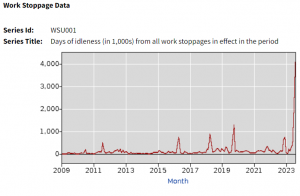

This year, workers have been missing more workdays because of stoppages than in any recent year:

Source: Bureau of Labor Statistics

Hollywood writers and actors have been on strike for several weeks. In addition, airline workers are considering a work stoppage, The Street reports.

Inflation is the problem causing workers to strike, the CTUP notes:

They’ve been losing money under Biden’s inflation. Since Biden entered office the CPI is up around 17.5% and most union contracts fell well short of that mark. Historically, strike activity is highly associated with inflation—and that’s been proven true statistically. The chart above shows the surge in the number of work stoppages in the late 1960s and ’70s. That’s the period of Nixon-Ford-Carter when inflation surged from 3 to 6 to 8 to 11%.

What irony that Biden (who boasts that he is the most “pro-union president in history”), has done more damage to union real take-home pay than any other president since Jimmy Carter.

The CTUP article argues that a sound dollar is the best way to foster peace between employers and workers:

As CTUP economists EJ Antoni and Stephen Moore have shown:

“History proves that mismanagement of the money supply and a dollar that loses value causes convulsions in the labor market. Annual inflation spiked to 7.9 percent for 1951, and a record 470 strikes occurred the next year. In the late 1960s, inflation rose to 5.4 percent and the number of strikes rose above 400.

But as price volatility moderated starting in the Reagan years, so did strikes. Not only did inflation decrease in the early 1980s, but it became more predictable too. A stable dollar that retained its value allowed labor and management to reach mutually agreeable contracts on wage increases.”

Overall, workers’ wages have been catching up with inflation this year.

“This summer, wage gains surpassed inflation for the first time since 2021. Price increases have slowed more than expected, while competition for workers has put pressure on employers to raise pay,” The Wall Street Journal reports. The Journal provides a graphic that shows the change:

Of course, people live on their own incomes, not those of the overall workforce. Workers whose wages have not yet risen sufficiently to catch up with Bidenflation are struggling. WSJ reports:

Some households are already stretched thin. The percentage of credit-card and auto-loan balances that became past due rose above prepandemic levels for the first time in the second quarter, New York Fed data shows.

Federal student loans are about to restart after a three-year pause, which could further pressure budgets for millions of Americans. …

Traditional loans, meanwhile, have gotten harder to come by. Nearly 60% of households said recently it was more difficult to get credit than a year ago, according to the New York Fed. That is the highest level recorded in data going back to 2013.

(You may recall that I reported on that New York Fed data five weeks ago in this newsletter.)

The UAW members are living on pre-Bidenflation wages. As a result, they are unhappy being among the households that are “stretched thin.” Although these workers make more money than a good many others in the workforce, their expectations about what their wages can buy are being continually disappointed by price inflation brought on by excessive federal government spending.

As with Hollywood’s striking writers and actors, one may doubt whether the auto workers are worth the compensation they are demanding, or that the industry can hope to survive the move to unpopular electric vehicles the Biden administration is forcing them to undergo. What is without a doubt, however, is that working people as a group are going to remain less well-off than they were before Bidenomics hit them, unless average hourly earnings continue to rise more rapidly than consumer prices.

Unfortunately, that looks unlikely. Once wages start to rise, the Federal Reserve makes sure to suppress economic activity because it sees workers as becoming too powerful. Over the past 18 months, the Fed has raised interest rates and sold securities to do exactly that. If you look at the right end of the graph of changes in prices and earnings above, it’s clear that the two lines have been moving toward convergence and we can soon expect to see a reversal of the trend of the past year. That means more trouble for working people in the United States.

Sources: Unleash Prosperity Hotline; The Wall Street Journal

Does the United States Need More People, or Just More Workers?

Writing at his Contra Corner Substack page, former congressman and Reagan-era Office of Management and Budget Director David Stockman rightly castigates the House GOP leadership for “fixing to sell-out the nation’s fiscal future still another time in order to protect missions that have nothing to do with true conservative governance. As one element of budget waste, Stockman cites “[b]uilding physical and enforcement walls at the Mexican borders when we desperately need more imported workers.”

That is a common complaint among many business-oriented conservatives, but is it true?

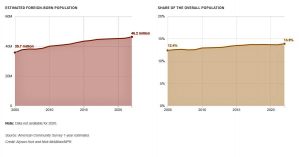

Writing at The Western Journal, journalist Richard Moorhead notes that there are now more foreign-born people in the United States than ever before. Moorhead provides a graphic from an NPR article that expressed approval of the increase as identified in new estimates by the U.S. Census Bureau:

Moorhead quotes software engineer Shantha R. Mohan’s report on the numbers in a post at X:

According to Census Bureau estimates, the total immigrant population grew by almost 30% between 2005 and 2022, climbing to just over 46 million people. Foreign-born Americans made up 13.9% of the U.S. population in 2022, up 1.5 percentage points from 2005.

“That’s an all-time record in terms of population, and as a percentage of the population,” Moorhead writes.

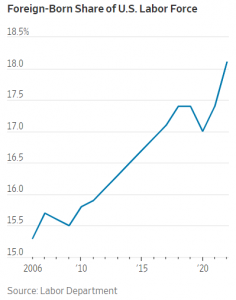

In fact, this immigration inflow has already begun to affect the labor market significantly, The Wall Street Journal (WSJ) reports:

The U.S. economy’s prospects of a soft landing are getting a boost from an unexpected source: a historic rise in immigration.

The inflow of foreign-born workers, which had slowed to a trickle in the years up to and including the pandemic, is now rising briskly as the U.S. catches up on a backlog of visa applications and the Biden administration accelerates work permits.

The WSJ article provides a graphic showing a rapid rise in immigration during the past two Democrat presidencies—which should surprise anyone who thinks Democrats are out to protect the American worker:

“That is helping ease labor shortages and wage and price pressure,” the WSJ notes, confirming the worries of opponents of mass immigration and the hopes of big businesses.

It seems that we do not need more immigrants so much as we need more workers regardless of their place of birth.

Sources: David Stockman’s Contra Corner; The Western Journal; The Wall Street Journal

Cartoon

For more great content from Budget & Tax News.