Friday’s blowout jobs report shows the economy continues to move ahead in spite of rising interest rates. Both the Fed and stockholders have to be concerned about the ongoing rise in interest rates.

The Week That Was

Friday’s payroll job report shows an increase of 263,000 private-sector jobs. Government jobs accounted for another 73,000. Of the private jobs, 173,000 were for leisure, hospitality, and eating and drinking establishments.

S&P’s September business surveys show the service sector has stopped growing, with readings at break-even. In contrast, the ISM business surveys show the service sector with moderate growth and high inflation.

Things to Come

Inflation reports will provide the big news this week. Wednesday’s report on producer prices should show annual core producer price increases remain in the 2 percent to 3 percent vicinity, where they have been in recent months.

Thursday’s report on consumer prices will be the highlight news for the week. In August, the CPI rose at an annualized rate of 4.9 percent, and the core CPI rate was 2.4 percent. With major moves in oil, it’s best to focus on the core CPI, which we expect to remain in the 3 percent vicinity.

Market Forces

Stocks moved lower this past week. The S&P500 and Dow lost 1 percent to 2 percent, while small cap ETFs fell 3 percent, moving deeper into an ongoing bear market.

The ongoing upward move in interest rates remains troubling news for stocks. Each additional upward move reduces the underlying value of all assets, including stocks.

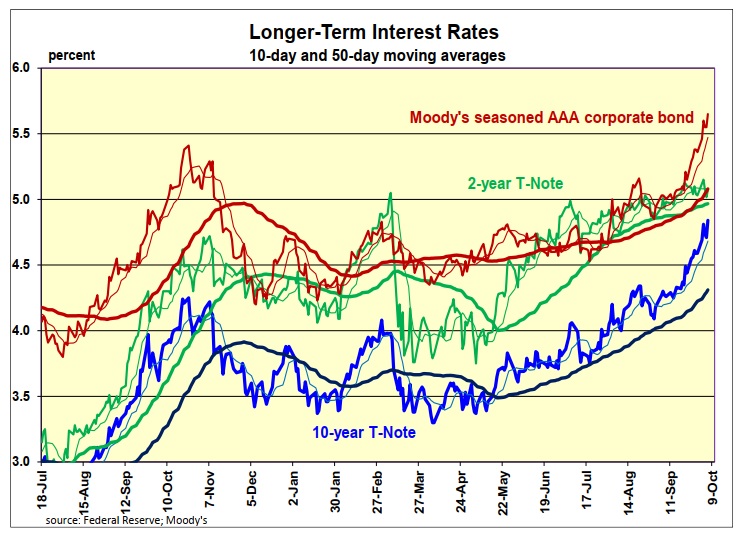

Moody’s AAA corporate bond (shown in the chart below) plays a key role in our model of the fundamental value of the S&P500. The current AAA rate, near 5.6 percent, lowers the value of the S&P500 to 3,750.

While inflation expectations are the main force driving interest rates higher, unprecedented deficit financing is also important. Businesses and government are each bidding for scarce credit. Government will pay whatever is necessary to fund the debt. Others are forced to drop out of the bidding when paying the cost is no longer worth it.

Long-term interest rates stop rising once enough businesses and individuals are forced to drop out of the bidding.

Friday’s blowout job report completed a week of news showing the economy continued growing in September. The immediate implication of growth is that current interest rates are not high enough to slow either the economy or inflation.

The Fed has its work cut out for it. With the 10-year T-Note approaching 5 percent, the Fed can no longer point to long-term financial markets as supporting inflationary expectations near its 2 percent target. What the Fed can’t control is the interest rate at which businesses drop out of the bidding for credit: no one knows where that rate will be.

One of the many reasons for our ongoing pessimism over stocks has been concern over the

potential for longer-term interest rates to continue rising. The same is true of prospects for the overall economy.

Outlook

Economic Fundamentals: restrictive

Stock Valuation: S&P 500 overvalued by 12 percent

Monetary Policy: restrictive

For more Budget & Tax News.

For more from The Heartland Institute.