Congressional Fiscal Commission to address nation’s debt crisis is the best first step toward sanity. (Commentary)

By Paul Winfree

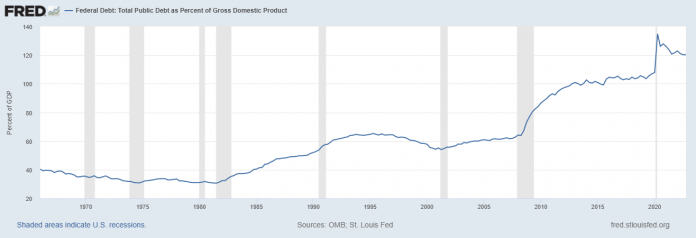

The COVID-19 pandemic was the catalyst for a tsunami of federal spending that has since continued apace. What’s worse, since 2020, the United States has paid for 76 percent of the additional spending with interest-bearing debt. That’s more debt as a percent of total spending than the federal government issued to pay for the Civil War and both the World Wars.

More than ever before, we need a fiscal commission to confront the looming debt crisis head-on, and it is extraordinarily welcome news that House Speaker Mike Johnson (R-LA) has embraced legislation to impanel one.

Some in Washington have argued for years that historically low interest rates on public debt were permanent, and that justified more debt-financed government spending. However, interest rates on public debt have been rising steadily since 2020. Today, the Treasury Department is routinely forced to roll over debt at much higher rates relative to when it was first borrowed. For context, the last time that interest rates on debt were this high, the amount of debt held by the public was $3 trillion less than the amount of debt that is maturing in the next year.

Higher rates are being driven by two forces. The first has been persistent inflation. Though it is easing slightly, prices remain almost 20 percent higher than they were at Biden’s inauguration.

The second is that rising spending has forced the issuance of more debt, far exceeding supply. We are seeing this play out in real time as banks, other financial institutions, and foreign investors have bought less debt. In essence, their current demand for debt has been satisfied and they know that more debt is on the horizon.

In the next three years, the elements of the perfect debt storm will come together. At the end of 2025, most of the provisions of the 2017 tax reform that lowered taxes for American workers, families, and small businesses will expire.

A year later, $350 billion in funding that states and local governments have become addicted to (and that was part of the $1.9 trillion Biden spending bonanza) will also expire, as will $400 billion in contract authority from the bipartisan “infrastructure” bill.

Meanwhile, hundreds of billions of dollars in unpopular provisions used to pay for the Inflation Reduction Act will kick in along with unanticipated costs associated with the new green energy tax subsidies.

The summation of these proposals could add an additional $3.5 to $5 trillion to the debt over the next 10 years. This is exactly why the rating agencies, such as Fitch and Moody’s, are sending up warning flares.

To avoid this crisis, Congress must thread this needle: bring down the supply of debt without compromising economic growth. In practical terms, this means Congress needs to signal to the credit markets that it needs to authorize less debt over time while also taking tax increases off the table.

That process has to start now. It is a unique moment when Washington lawmakers are focused on the national debt, but the work of the fiscal commission is urgent and straightforward. Congress should start by clawing back wasteful and inflationary spending immediately. For example, there is about $90 billion in state and local funding that has not been obligated by the federal government. In total, only $198 billion of the $350 billion included in Biden’s American Rescue Plan has been committed to projects by state and local governments.

Second, Congress needs a credible proposal to ensure that taxes do not go up for American families at the end of 2025 without increasing debt. The 2017 tax law reduced the average federal tax rate for households by 7 percent and for middle-class families by about 10 percent. Increasing people’s taxes at a time when the cost of living has exploded and Americans have spent down their savings would be harmful to economic growth and opportunity.

By the way, it must be said that raising taxes is not a prerequisite to confronting the debt crisis. Spending cuts and higher revenue are not equal choices, just as bloated government and economic growth are not equal outcomes.

The looming debt crisis is rapidly coming into focus for the American economy, and under new leadership, Congress is poised to take action. Success is far from guaranteed, but if the fiscal commission can clearly see the problem, the solutions are ready and waiting as are the American people.

Paul Winfree, Ph.D., who was the director of budget policy and deputy director of the White House Domestic Policy Council during the Trump administration, is president and CEO of the Economic Policy Innovation Center.

Originally published by RealClearPolicy. Republished with permission.

For more great content from Budget & Tax News.