Robert Genetski: Economy and employment still growing, though slowing, so a Fed interest rate cut in March is less likely.

The Week That Was

Today’s December employment report shows an explosive gain of 216,000 jobs, 52,000 of which were government jobs. Since government jobs are funded by the private sector, private jobs are the key to real growth.

Downward revisions to prior months continue to mask a slowdown in job growth. Private job growth was down to a 1 percent annual rate in the fourth quarter from the third quarter. An alternative Household Survey shows job growth at 0 percent for the fourth quarter. The employment report was not as strong as headlines suggest.

December business surveys were mixed. Both ISM and S&P500 surveys show a decline in manufacturing and only modest overall gains in the service sector. On balance the economy continued to grow, but at a slower rate than prior months.

Things to Come

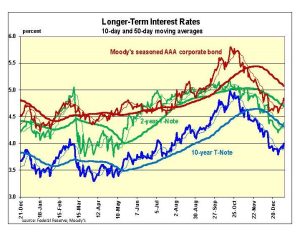

The main news this coming week will be Thursday’s CPI report. Most forecasts are for an increase of 0.2 percent to 0.3 percent in core inflation and 0.1 percent to 0.2 percent in total inflation. Even if the core inflation is only 0.1 percent, the year-over-year core rate will still be 3¾ percent. Inflation is fighting hard to survive.

(Expect) Friday’s producer price reports to show inflation close to 0 percent at the producer level. While not as important as the CPI, any hint of increases in producer prices would represent bad news for those anticipating a near-term decline in short-term interest rates.

Market Forces

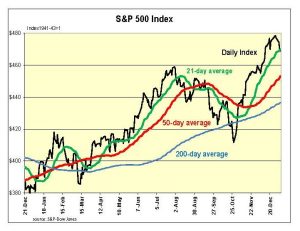

We waved goodbye to 2023 as stocks surged to new highs. Then started the new year with the market sending us raspberries, as stocks moved down to where they were in mid-December.

As happened back in October 2023, there appears to be another 180° turn in psychology. At that time the reversal from negative to positive psychology sent stocks sharply higher. Another abrupt shift has shifted psychology to negative, at least for now.

Today’s strong report on job gains in December shows the economy continues to grow. In addition, business surveys suggest inflationary pressures remain. As a result, expectations the Fed will be lowering interest rates as soon as March are likely to change. Short-term interest rates will stay higher for longer.

Despite signs the economy is still growing, the rate of growth continues to slow. Hence, monetary restraint is working. As the Fed continues to sell securities, the lagged impact of this policy will continue. Look for further economic weakness in the months and year ahead.

Despite signs the economy is still growing, the rate of growth continues to slow. Hence, monetary restraint is working. As the Fed continues to sell securities, the lagged impact of this policy will continue. Look for further economic weakness in the months and year ahead.

Outlook

Economic Fundamentals: neutral

Stock Valuation: S&P 500 overvalued by 17 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.