Robert Genetski: Major stock indexes hit all-time highs, but fourth quarter reports are coming in below analysts’ forecasts.

The Week That Was

Today’s report on December spending and incomes shows spending surging at an 8 percent, incomes up 3.7 percent, real disposable earnings at only 1 percent (all annual rates for the month). Both total and core inflation were at 2.5 percent rates. The disconnect between rapid spending and weak income growth points to a coming slowdown.

The broadest quarterly GDP measures of the economy continue to show only a modest slowing. Current dollar GDP rose at a 4.8 percent rate in the fourth quarter, down from a 5.8 percent rate over the past year. GDP inflation rose at only a 1.5 percent rate in the fourth quarter, leaving real growth at a 3.3 percent rate for the quarter, and up 3 percent for the year.

Why aren’t most workers happy with 3 percent real growth? It is because workers real wages are unchanged over the past year, and are down 3 percent from three years ago. Government programs to restructure the economy from energy, to utilities to vehicles have delivered economic growth to certain sectors of the economy. This growth has benefited areas favored by politicians, but failed to raise workers’ living standards.

S&P’s advance survey for early January shows the US business activity rose with readings of 53 for services and 50 for manufacturing. The survey also showed price pressures easing. New orders increased, confidence rose and price pressures continued to ease.

In contrast to the ongoing strength seen in many broad indicators, fourth quarter reports on total durable goods orders and orders ex-aircraft and defense were unchanged for third consecutive quarter.

Things to Come

The Fed will not change its interest rate target at Wednesday’s meeting. The target rate is an artificial Fed-dictated interest rate dictated instead of a market rate. More important than the Fed’s interest rate decision is their decision regarding the sale of securities.

The Fed will not change its interest rate target at Wednesday’s meeting. The target rate is an artificial Fed-dictated interest rate dictated instead of a market rate. More important than the Fed’s interest rate decision is their decision regarding the sale of securities.

If the Fed decides continues selling $95 billion a month, it further threatens future growth. It is possible the Fed will compromise and slow their sales of securities in preparation for ending these sales. This would be a signal that the Fed wants some restraint, but not quite as much as before.

On Thursday, a number of January business surveys are likely to show the economy growing with some modest inflation.

Next Friday’s employment report is also likely to show a growth in private payroll jobs in the vicinity of 150,000, similar to the past two months.

While the economy appears to be rolling along nicely, lurking beneath the surface are problems. Ongoing monetary restraint, flat to lower living standards, steep declines in commercial real estate prices and excessive government regulation will continue to weigh on the economy.

Market Forces

Stocks continue their gains as the major indexes moved to all-time highs. The latest economic reports reinforce the consensus view of a growing economy while inflation remains close to the Fed’s target.

The stock market correctly anticipated the economy would slow, while avoiding a serious downturn and an erosion of profits. With 10 percent of the S&P500 companies reporting, fourth quarter reported earnings are down slightly from the third quarter as analysts have revised downward their earnings estimates.

The stock market correctly anticipated the economy would slow, while avoiding a serious downturn and an erosion of profits. With 10 percent of the S&P500 companies reporting, fourth quarter reported earnings are down slightly from the third quarter as analysts have revised downward their earnings estimates.

After reducing their estimates of first quarter earnings by 6 percent, analysts now expect earnings to soar by 27 percent over the next four quarters. If the consensus is correct, S&P profits would go from close to its long-term trend to 23 percent above that trend by the fourth quarter of 2024.

The outlook for stocks depends on the extent to which the economy and earnings follow the consensus. With the S&P500 currently 22 percent above its value, any disappointment from analysts’ current optimism makes stocks vulnerable.

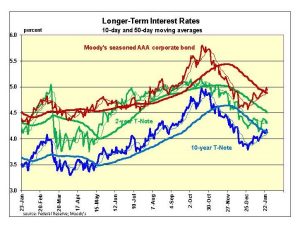

The precursors to an economic downturn already have occurred. The signs of trouble ahead include an extended period of monetary restraint, inverted yield curves, and a steep decline in housing sales. These signs all point to trouble ahead. While we hope this time is different, monetary history continues to point to headwinds for both the economy and stocks.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 22 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.