Life, Liberty, Property #54: vetoes for all over unconstitutional measures, because every state and each individual citizen has a duty.

IN THIS ISSUE:

- Vetoes for All

- Paul Offers Ban on Fed Bailouts of State and Local Governments

- Cartoon

SUBSCRIBE to Life, Liberty & Property (it’s free). Read previous issues.

Vetoes for All

Vetoes for All

With the U.S. national government having taken on ever-increasing power for the past 125 years, it appears that the United States is finally entering a necessary decentralization. Power has increasingly been concentrated in an unelected federal government bureaucracy allied with all the nation’s private institutions, such as business, the press, and the education establishment at all levels. The denizens of the government and these institutions largely attended the same elite educational institutions, and they mingle and migrate freely within these organizations and government.

This has built a permanent ruling class, the interests of which conflict with those of the nation’s public in almost all particulars.

This power bloc can be aptly and succinctly described as the Regime. It has no respect for the rule of law or for morality when they conflict with the accumulation of power, which is nearly always the case in the present situation. In addition, the Regime’s perceived need for ever-more power as the only possible means of holding its position against an increasingly frustrated and angry public leads to enormous government overreach that creates awful consequences for the people, ratchets up dissatisfaction with the government and other institutions, and further increases the threat to the powers at the top.

This ruling class’s power-madness is seen quite vividly in the COVID-19 lockdowns and the actions of governments, big business, the press, and the nation’s nonprofit institutions to brand all disagreement with Regime positions as misinformation, along with the government’s disgraceful, unfair, and entirely unlawful treatment of January 6 protestors. A stable government serving a free people does not do those things or anything like them.

After the 2016 election of President Donald Trump, the concerted, unscrupulous effort to remove him from office, or at least make it impossible for him and his allies to govern, showed the desperation of this Regime, as does the successful attempt to prevent a second term through deployment of the most bizarre and unlawful election shenanigans in modern times.

The attempt to undermine and remove the duly elected choice of the people for the presidency backfired badly on the Regime. Public respect for the nation’s institutions is at all-time lows, and those are the very establishments that constitute the Regime. Meanwhile, the weight of ever-expanding government on the people has become intolerable, and the competency of the government has become abysmal. Bidenflation, the border crisis, massive federal budget deficits and debt, a crisis-level Social Security shortfall on the way, drag queens in schools, the problems with the electrical grid, and many other lamentable current-day conditions all illustrate the disastrous consequences of this concentration of power.

The one thing that the Regime remains successful at is winning elections. That superiority now appears to be threatened, however, by the increasing gap between what the Regime wants to accomplish—reelection of Joe Biden or election of a Democrat alternative as president, plus majorities in the House and Senate—and what the public is willing to go along with. The failure of competence on the part of the Regime, in the person of President Joe Biden, is sparking a failure of competence in its apparatus for controlling election outcomes.

History shows that excessive concentration of power leads to the decline of civilizations. Today in America, the public has had far more than enough of the Regime, and the national government has set itself explicitly in opposition to the people. This conflict has brought pushback not only through public opinion but also, significantly, from state governments. That is a gamechanger, and it showcases the present hunger for decentralization in the United States.

Among the most vivid examples of reaction against the central government is the increasing interest in nullification of federal laws and regulations. If there is one thing nearly every faction in the United States has agreed on for the past two centuries, it is the presumed danger of nullification, in which states declare that federal decisions will not be enforced within their borders.

The reigning idea has been that nullification threatens the credibility and stability of the national government by undermining its authority. The reality, as we can now easily see, is that the enormously excessive authority claimed by the national government has undermined its credibility and stability. The states have rushed in to protect their residents—and the state governments’ authority and prerogatives—against a voracious and incompetent national government. The public generally appreciates the effort, as indicated by the reaction to Texas Gov. Greg Abbott’s moves to guard the state’s border with Mexico in defiance of the Biden government’s complaints.

Writing at The Blaze, Senior Editor Daniel Horowitz demonstrates how the concept of nullification fits into the original conception of the U.S. government, which I have described in this newsletter and elsewhere as veto power for everyone.

Under our Constitution, each branch of the national government has veto power over the actions of the other branches; the federal government is not to be allowed to do anything unless all three branches agree that the proposed law is in accord with the Constitution. In addition, the Ninth and Tenth Amendments extend that veto power to the states and the people, respectively. The Constitution explicitly limited the power of the federal government and gave all three branches, plus the states and the people through the Bill of Rights, the authority and responsibility to see that the government stays within those boundaries.

Horowitz discusses a decision by Tennessee Attorney General Jonathan Skrmetti to declare a bill before the state legislature, SB 2775, the Restoring State Sovereignty Through Nullification Act, as unconstitutional. As the bill’s title indicates, the legislation would establish a process for nullifying federal laws and regulations:

Here’s how it would work. The law would permit the governor to issue an executive order declaring a federal policy null and void. Or any member of the legislature could trigger a floor debate and vote to nullify the policy. Or any state court may find the policy unconstitutional if the question arises during a legitimate case or controversy. Or any combination of 10 local governing authorities—either through their respective executives or legislative branches—may submit a petition for nullification that would trigger a vote in the legislature. Or, last but not least, any group of 2,000 registered voters could submit a similar petition triggering an automatic legislative vote on nullification.

In other words, the bill underscores how we are all responsible for safeguarding the Constitution. When everyone understands the federal government frequently oversteps its boundaries, we have an obligation to push back.

Skrmetti argues that the proposed legislation is unconstitutional because only the judiciary can determine constitutionality: “Legislative action that vests the legislature itself with the authority to nullify unconstitutional federal action is not permissible because it arrogates to itself the power to interpret the law that properly belongs to the judiciary,” the attorney general argued, as Horowitz notes. “In short, under the Tennessee Constitution, the judicial branch alone has the power to determine the constitutionality of federal action.”

As Horowitz notes, Skrmetti’s argument exemplifies a common misconception that denies the fundamental premises of the nation’s constitutional order: “The attorney general’s argument isn’t new. He, like a great many of his colleagues, accepts the dual premise that the federal government is supreme to the states in constitutional interpretation and that, within the federal government, the judiciary is king,” Horowitz writes.

Those premises are strictly false, Horowitz observes. First, the Supremacy Clause applies only to laws that are valid under the Constitution, which is a legitimate issue in cases of nullification (as opposed to a simple dislike of a federal edict that falls within the national government’s authority):

Let’s begin with Skrmetti’s Supremacy Clause claim. True, states may not enact laws that are contrary to federal laws or the Constitution. But the Constitution only makes the federal government supreme when Congress passes and the president signs laws that accord with the charter’s enumerated powers.

For example, Congress may place tariffs on imported goods because that is a power enumerated under Article 1, Section 8 of the Constitution. Just because a tariff might be unfair to some states under certain circumstances does not make the tariff unconstitutional. A state may lobby and complain, but the Constitution is clearly on the side of Congress.

But what happens if the feds decide to force everyone in a state to wear a mask?

Alexander Hamilton, the most ardent supporter of a strong national government among our founders, told us what he thought would happen in such a circumstance. “It will not follow from this doctrine that acts of the large society which are not pursuant to its constitutional powers, but which are invasions of the residuary authorities of the smaller societies, will become the supreme law of the land,” Hamilton wrote in Federalist 33.

Skrmetti’s judicial supremacy doctrine is likewise in conflict with the Constitution and is in fact a “dangerous myth,” Horowitz argues:

Skrmetti asserts that only the courts have the final say over constitutional arguments. He cites the Supreme Court’s 1958 decision in Cooper v. Aaron, which was ostensibly about desegregation but really a brazen assertion of judicial supremacy. “The basic principle that the federal judiciary is supreme in the exposition of the law of the Constitution,” Chief Justice Earl Warren declared, is “a permanent and indispensable feature of our constitutional system.”

Warren was wrong. The Supreme Court is not king. It does not have the last word. This is by far the most dangerous myth Americans must purge from our law and body politic if we ever hope to remain a free people.

I would say “if we ever hope to become a free people,” at this point, but I agree fully with Horowitz’s observation that judicial supremacy is a dangerous myth.

The argument for judicial supremacy and the very origin of judicial review themselves refute Skrmetti’s claim, which has nonetheless been the conventional wisdom for well over a century, Horowitz notes:

The very rationale undergirding the concept of the courts also having a say in constitutional interpretation (despite being unelected)—namely, that judges swear an oath to uphold the Constitution—is a repudiation of the idea of judicial supremacy.

After all, every member of the federal and state government also swears an oath to the Constitution. The same way a federal judge can’t violate his oath by giving the force of law in a case or controversy to an unconstitutional law, an elected state or federal official cannot promulgate, fund, or enforce an edict of a court that violates the Constitution.

Chief Justice John Marshall said in Marbury v. Madison that it would be “immoral” and “a crime” to issue an opinion contrary to the Constitution. “How immoral to impose it on them [i.e., other branches of government] if they were to be used as the instruments, and the knowing instruments, for violating what they swear to support!” an indignant Marshall thundered in his most famous opinion.

Thomas Jefferson noted that the very premise of a federal government operating under a written constitution refutes the notion that the government has the authority to decide what its own authority is, Horowitz writes:

As Thomas Jefferson admonished in his Kentucky Resolution of 1798, “The government created by this compact was not made the exclusive or final judge of the extent of the powers delegated to itself; since that would have made its discretion, and not the Constitution, the measure of its powers.”

Veto power over actions taken by the federal government belongs to each branch of that government, and to the states, and to the people. Unless all agree on any action by the federal government, that action does not have rightful force of law under our nation’s Constitution.

The United States has moved inexorably away from the Founders’ intention almost from the very beginning, and the abandonment of this constitutional order accelerated greatly with the dawning of the Progressive Era in the 1890s. The process has reached its practical limit with the black-hole concentration of power in today’s Regime. Either we will decentralize or the government will implode as its unfulfillable ambitions destroy the capacity of the people to pay for it all—along with any remaining desire to do so.

Now, even duly elected state governments are rightly pushing for decentralization and a return to rule of law by asserting their prerogatives under the nation’s founding documents. This is the one positive outcome of all the destruction wrought by the Regime thus far.

Sources: The Blaze; The Collapse of Complex Societies

Paul Offers Ban on Fed Bailouts of State and Local Governments

Paul Offers Ban on Fed Bailouts of State and Local Governments

An aspect of the debate over the recent stopgap legislation to fund the bloated federal government did not receive much attention but should have: a proposed amendment by Sen. Rand Paul (R-KY) to prevent the Federal Reserve from bailing out deficit-spending states and municipalities by buying their debt.

Paul’s amendment was a simple proposition of just two paragraphs:

The Board of Governors of the Federal Reserve System may not establish any emergency lending program or facility, including pursuant to section 13(3) of the Federal Reserve Act (12 U.S.C. 343(3)), that purchases or sells any security issued by a State or municipality, including a bond, note, draft, or bill of exchange. …

No Federal reserve bank may purchase or sell any security described in subsection (a), including pursuant to section 14 of the Federal Reserve Act.

Even a senator could understand it.

Paul’s amendment was defeated 53-37, perhaps as a direct consequence of its clarity. All the yes votes were from Republicans (of course, and of course there were multiple turncoats within that caucus).

The idea behind the amendment was that the Federal Reserve should not bail out high-spending states and municipalities by buying their bonds, and it does not have the authority to do so.

“We now know that the Federal Reserve is not only buying the federal debt, they’re buying debt of profligate, large-spending states like California, New York, and Illinois,” Paul stated on the Senate floor in offering the amendment on February 29. “My amendment would make it explicitly illegal for the Federal Reserve to buy the debt of these big-spending, profligate individual states. It was never intended that Congress give the Fed the power, and we should make sure that it is explicit that the Federal Reserve cannot buy the debt of individual states.”

The Fed did just that in 2020, Paul pointed out. “‘We don’t think Congress ever intended to be buying state debt, and they did during the Covid lockdown,’ Paul said, citing the U.S. national debt of more than $34 trillion,” Politico reported.

The amendment “would prevent government bailouts of mismanaged states” and would have banned “the central bank from circumventing Congress to unilaterally provide a financial bailout of profligate states, the costs of which would be borne by the taxpayers through the form of forced subsidized losses or through the hidden tax of inflation,” a press release from Paul’s office stated.

All but two states (Wyoming and North Dakota) have balanced-budget requirements, but there are loopholes in most cases, and in some states the courts have used creative interpretations to ensure that the government can run a deficit any time it wants.

As Paul notes, in 2020 the Fed opened the door to state and local bailouts by buying that debt, and it allocated a terrifying half a trillion dollars to the program, The Bond Buyer reported (hyperlink is to non-paywall republication at Fidelity Investments):

The Fed launched the [Municipal Liquidity Facility, or MLF] in April 2020 as part of the CARES Act, the first of three rounds of federal rescue aid packages. The emergency program was aimed at bolstering cash-strapped issuers who might have a tough time entering a volatile market that had seen base municipal bond index yields rise by more than 225 basis points in nine trading days.

The MLF was able to purchase up to $500 billion of three-year notes from states, counties with a population of at least 500,000 residents, and U.S. cities with a population of at least 250,000 residents.

Only Illinois and New York’s Metropolitan Transportation Authority ended up tapping the program, with Illinois borrowing $3.2 billion in two installments and the MTA borrowing $3.5 billion in two installments.

As Paul noted on the Senate floor, the MLF program set the stage for possible future bailouts to be undertaken without explicit agreement from Congress. The Bond Buyer reports:

The MLF expired in December 2020, although former U.S. Treasury Secretary Steven Mnuchin said at the time that the facilities could be reestablished by “having the Federal Reserve request approval from the Secretary of the Treasury and, upon approval, the facilities can be funded with Core ESF (Exchange Stabilization) funds, to the extent permitted by law, or additional funds appropriated by Congress.”

Rand’s amendment would prohibit the central bank from establishing “any emergency lending program or facility that purchases or sells any security issued by a state or a municipality, including a bond, note, draft or bill of exchange,” and block the bank from buying or selling any of the same securities.

Few people were aware of this potential for momentous bailouts, former federal Office of Management and Budget Director and two-term governor of Indiana Mitch Daniels noted in an op-ed in The Washington Post three days before Paul offered his amendment on the Senate floor:

Alarmingly, though, among its several precedents, the pandemic panic gave birth to a little-noticed action that could open a back door to the bailout vault. In April 2020, for the first time, the Federal Reserve announced it was willing to buy the debt of state and local governments. Among the multitude of “emergency” measures being launched at the time, the action attracted little notice. Even some of the veteran Fed watchers whom I consulted about the topic were unaware that this line had been crossed.

Several states are in sufficiently unstable fiscal quicksand that they can be expected to push Congress for a bailout, which they will not get, Daniels argues. They will then seek relief from the Fed, which loves to accommodate government overspending (though even the ever-accommodating Ben Bernanke told Congress the Fed would not go that far in 2011), Daniels notes:

There was some $1.2 trillion of state debt outstanding, as of 2021. Almost half was in six states, led by New York’s $170 billion and California’s $144 billion, rivaled on a per capita basis by Connecticut, Hawaii, Illinois, Massachusetts and New Jersey. Illinois already has nearly achieved junk bond ratings, but others are contending for that distinction.

These borrowings were run up to cover operating deficits and capital spending; the massively underfunded pension promises that these jurisdictions have made to their past and present employees are a separate, even less manageable problem. The day will come when, assuming a congressional bailout looks like a nonstarter, they muster their power elites and government union cronies to pressure the Fed to buy new bonds at a price the market will not pay.

If 40 or more states are taking reasonable measures to live within their means, and a few are not, legislators from the sensible states would provide a big barrier to a congressional bailout for the reckless spenders: “It’s hard today to imagine senators from the 40 more sensibly managed states voting to take the spendthrifts off the hook for years of excess and pandering to government unions,” Daniels notes.

If the Fed can bail out those states and circumvent Congress, however, it will invite even more irresponsibility among state and local governments. Daniels argues that keeping Congress in the loop is essential:

The situation calls for an intervention. Congress should enact a prohibition on the Fed buying state and municipal bonds now—before the supplicants begin banging on the bank’s door.

The Fed might privately welcome the handcuffs on a “stop us before we kill again” basis. It might prove a needless precaution, but the pandemic reminded us of the virtue of vaccination. Let’s request a booster.

Daniels may be underestimating the Fed’s predilection for innovative ways of creating disasters. As The Bond Buyer reports,

Paul’s comments on the Senate floor were “hyperbolic” as well as “curious and disturbing,” said Kent Hiteshew, former deputy associate director of the Fed’s Division of Financial Stability.

“The Fed has used its emergency statutory authorities to make loans to municipal governments only twice in its more than 100-year history—both back-stopped by Congressional appropriations during COVID,” Hiteshew said, noting that both loans were repaid on or before their due dates.

“In my view, it is doubtful that the Fed would use such powers again in the future absent similar existential threats to the economy and capital markets,” he said. “Nevertheless having such authority and independence would be crucial in such circumstances.”

It may be “doubtful” that the Fed would do something so reckless, irrational, and unfair, but it is certainly not beyond imagining, which Hiteshew’s comments unwittingly confirm.

Paul’s amendment would remove an enormous potential source of moral hazard and unfairness in state and local government spending. Paul should keep offering his amendment (or a separate bill, or both) until the senators from the 40 less-irrational states realize that their constituents are in danger of being punished severely for a few crazy states’ fiscal sins.

Sources: Sen. Rand Paul; YouTube; Politico; Sen. Rand Paul; Fidelity Investments; The Washington Post (behind paywall)

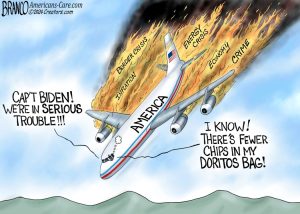

Cartoon

via Comically Incorrect

For more great content from Budget & Tax News. For more Rights, Justice, and Culture News.

For more from The Heartland Institute.