Today’s jobs report sends mixed messages on whether jobs are increasing or decreasing. There is a major problem with job numbers.

by Robert Genetski

The Week That Was

Today’s February jobs report shows a strong gain of 223,000 private payroll jobs for the month. Total payroll employment increased by 275,000 in February and a million jobs over the past three months.

In contrast, an alternative (household) job measure reported the opposite. It shows a loss of 184,000 jobs in February and a loss of a million jobs over the past three months. There is obviously a major problem with one of these approaches to measuring employment.

Yesterday’s news also shows layoffs in February were at 84,638, up 3 percent from January and 9 percent from a year ago. February also had the highest layoffs for any February since the depth of the financial crisis in 2009. At that time there were 186,350 layoffs.

Some potential weakness in manufacturing also was apparent in the government’s report on January shipments and orders. Shipments were down 1 percent and new orders were down 3.6 percent (not annual rates). Major changes in large items, such as aircraft and defense orders, can distort these data. Excluding these items shows new orders have been unchanged for an extended period.

Aside from the conflict in the number of jobs, most other reports point to business expanding at a moderate rate. S&P and ISM February surveys show strong performance in the service sector with readings 52 to 53. These readings are consistent with real growth rates of 2 percent.

Things to Come

The Cleveland Fed expects Tuesday’s CPI report to be up only 0.43 percent for the total and up 0.32 percent for core inflation. If these numbers are accurate, the monthly inflation rates would be 5.3 percent and 3.9 percent, respectively. On a year-over-year basis, inflation would be 3.2 percent and 3.7 percent. Without inflation numbers close to its target, it is difficult for the Fed to do anything except double down on its intent to get inflation down.

On Thursday, February retail sales reports should show at least a moderate rebound following the sharp decline in January. However, a weak February sales report, it will begin to raise concerns over stagflation—slower growth with ongoing inflation.

Market Forces

The stock market bulls are still running as the S&P500 and Nasdaq 100 surge to new all-time highs.

Stock prices and interest rates seem hostage to the economic news. Although Chairman Powell told Congress nothing new, headlines focused on Powell’s belief interest rate would likely be heading lower in the latter half of this year.

Stock prices and interest rates seem hostage to the economic news. Although Chairman Powell told Congress nothing new, headlines focused on Powell’s belief interest rate would likely be heading lower in the latter half of this year.

Upcoming reports on the economy and inflation are not expected to be pretty. The upcoming CPI and retail sales numbers can present the Fed with a new set of challenges.

The CPI will likely show inflation remains a problem, making it difficult for the Fed to highlight potential interest rate cuts.

It will also be difficult for the Fed to consider easing monetary policy when the Atlanta Fed and business surveys show the economy remains relatively strong with inflation still in the area of 3 percent to 4 percent range.

In addition to signs of strong growth, the stock market’s technical indicators remain positive. As a result, there continues to be a bias for a further upward momentum in stocks despite stocks being close to 30 percent overvalued.

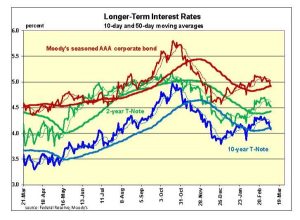

The chart above also shows there is still a slight propensity toward further interest rate hikes. The recent downward move in rates can easily reverse direction pending next week’s inflation news.

The chart above also shows there is still a slight propensity toward further interest rate hikes. The recent downward move in rates can easily reverse direction pending next week’s inflation news.

Outlook

Economic Fundamentals: positive

Stock Valuation: S&P 500 overvalued by 29 percent

Monetary Policy: restrictive

For more analyses by Robert Genetski.

For more great content from Budget & Tax News.

For more from The Heartland Institute.