Not that many Americans expect politicians to be truthful, but for the sake of naïfs walking among us at this late date, let’s point out that, when President Joe Biden rails against giveaways to big business, it means a lot of money is on its way to favored corporations. To the extent the president is serious about the anti-business animus in his speeches, it’s directed only at private enterprises that go their own way; entities that follow government direction are recipients of all sorts of privileges and largesse.

Corporate Subsidies Are Bad Except When They’re Good

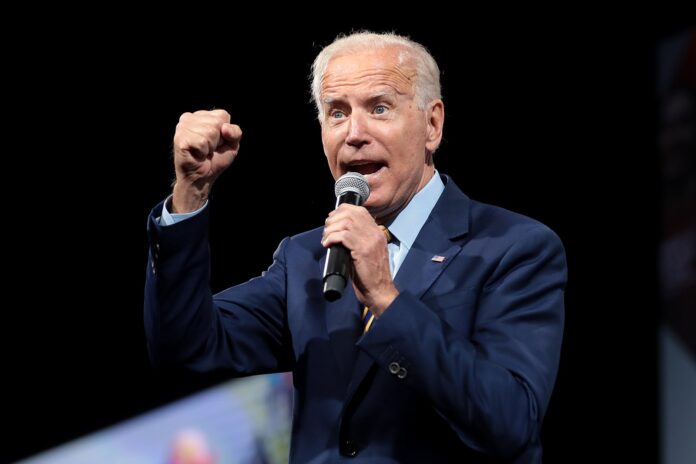

“I want to talk about the future of possibilities that we can build together — a future where the days of trickle-down economics are over and the wealthy and the biggest corporations no longer get the — all the tax breaks,” President Biden huffed during this year’s State of the Union address.

The president’s speech was marked by the usual theatrics that accompany these monarchical spectacles, including applause from his supporters, scowls from his opponents, and the occasional protest. It also continued the time-honored political tradition of being laden with bullshit.

Biden “is a hypocrite,” points out Cato Institute budget expert Chris Edwards. “He signed into law three massive bills handing out hundreds of billions of dollars of narrow tax breaks and spending subsidies to big corporations. It is the biggest gusher of corporate welfare ever.”

Biden barely broke stride in moving on from ranting against tax breaks for big corporations to handing huge sums of taxpayer money to giant businesses who, we might suspect, are perfectly capable of investing in projects they expect to generate profits.

“My CHIPS and Science Act led to partnership with companies, investing billions and billions of dollars across the country, bringing semiconductor manufacturing back to America — jobs of the future back to America,” Biden boasted just two weeks after the State of the Union speech, during a stop in Chandler, Arizona at the site of an Intel chip-making plant.

Specifically, Intel is on the receiving end of $8.5 billion from the federal government to help fund its expansion. Biden himself pointed out that the taxpayer funds are “being paired with over $100 billion from Intel” that the company is putting into its own project, so it’s clear that Intel is perfectly capable of making business decisions and investments on its own. But a purely private project wouldn’t provide a photo-op for politicians. Unfortunately for us all, those photo-ops are expensive.

Corporate Subsidies Are Wildly Expensive

“Taxpayers will pony up over $283,000 per job created—and that’s counting only the $8.5 billion in direct payments to the company,” Reason‘s Eric Boehm recently wrote about the Intel subsidies.

Of course, if private industry is left to its own devices, it may not invest in precisely the way government officials want to invest—for example, in a purple state considered crucial to the 2024 presidential contest. Taiwan Semiconductor Manufacturing Company (TSMC), an Intel competitor, asked the federal government for billions of dollars in support before it would continue with a planned Arizona expansion, which involves higher costs than existing operations in Taiwan.

And the flow of money doesn’t end there.

“Rather than trickle‐down economics, this is a Niagara Falls of subsidies flooding from Washington to the president’s favored industries and corporations,” Cato’s Edwards writes of the Biden administration’s efforts to encourage economic development the White House likes, in places that provide political benefit. “Biden signed the Infrastructure Investment and Jobs Act of 2021, which increased federal subsidies by $548 billion. Tens of billions of dollars were handed out to railroads, electric utilities, broadband companies, the EV industry, and others.”

Biden also approved tens of billions of dollars in subsidies through the CHIPs and Science Act of 2022, and $868 billion in energy subsidies in the badly misnamed Inflation Reduction Act of 2022.

“The US government could spend more than $1.8 trillion over ten years on energy tax subsidies,” Edwards’s colleague Adam N. Michel, a tax policy expert, recently noted.

The Return of Industrial Policy

This is all part of a return to the bad old days of industrial policy, under which government officials openly poke and prod private businesses to develop and grow in ways that politicians prefer, whether or not they make economic sense. The Biden administration makes no bones about favoring this approach.

“A modern American industrial strategy identifies specific sectors that are foundational to economic growth, strategic from a national security perspective, and where private industry on its own isn’t poised to make the investments needed to secure our national ambitions,” National Security Advisor Jake Sullivan insisted last April.

Sullivan spoke a month after the Harvard Kennedy School’s Ruchir Agarwal wrote for the International Monetary Fund that “industrial policy is gaining momentum in many countries, with some economists pointing to China’s model as a success.”

Most observers think China is in serious, self-inflicted economic distress, so it’s difficult to know just what “success” inspires others to adopt industrial policy—unless it’s control for its own sake. But even many “conservatives” from formerly market-oriented circles embrace state-guided economies.

“Market economies do not automatically allocate resources well across sectors,” Oren Cass, now executive director of American Compass, insisted in 2019. “While the policies produced by our political system will be far from ideal, efforts at sensible industrial policy can improve upon our status quo.”

Sensible industrial policy apparently involves paying Intel billions of dollars for projects to which it’s already committed, while paying billions more to TSMC to motivate the construction of economically uncompetitive chip plants. It also involves additional fortunes to subsidize electric vehicles for which drivers show limited enthusiasm. Industrial policy seems to rest on the assumption that, if you build what politicians want, consumers will come. There’s little evidence to support that claim.

Though maybe subsidies will win political favor. In November, we’ll have to see how the Niagara Falls of taxpayer funding breaks down in cost per vote.

Originally published by the Reason Foundation. Republished with permission.

For more from Budget & Tax News.

For more public policy from The Heartland Institute.